3

Assessing the risks from equity release mortgages

3.1

This chapter sets out the PRA’s approach to assessing the risks to which insurers that invest in ERMs are, directly or indirectly, exposed. The assessment primarily covers the appropriateness of the amount of MA benefit arising from restructured ERM notes. The same principles apply in the exceptional case where a firm can justify including un-restructured ERMs in the MA portfolio under the limited proportion of assets with highly predictable cash flows, when assessing the appropriateness of the MA benefit (taking the FS addition in respect of these assets into account). In this case, the ‘Effective Value' of the un-restructured ERMs would simply be the sum of value of the un-restructured ERMs on the balance sheet and the MA benefit, and the economic value would be calculated based on the un-restructured ERMs in the same way as described in the rest of this chapter.

- 30/06/2024

Assessing the size of MA benefit from restructured ERM notes

3.1A

The size of the MA benefit arising from restructured ERM notes depends on the:

- contractually-agreed cash flows of the notes and the value placed on those notes, which will determine their spread; and

- FS assigned to the notes. The FS must reflect the risks that the firm retains in relation to the cash flows of the notes, including default and downgrade risk. These, in turn, will be driven by the risks presented by the underlying assets.

- 30/06/2024

3.2

ERMs are complex assets that often have embedded features such as a ‘no negative equity guarantee’ (NNEG) and no fixed maturity date. Restructuring them to produce MA-eligible notes with fixed cash flows adds a further layer of complexity. Also there are typically no CRA ratings or observable market prices for restructured notes on which firms and the PRA could place reliance.

- 30/06/2024

3.3

As with any securitisation, there is a risk that the valuation and/or credit assessment of the MA-eligible notes is not aligned with their true risk profile, leading to a spread that is too high or an FS that does not reflect all of the risks retained by the firm. As noted in paragraph 2.7 of this SS, the PRA will apply a higher supervisory intensity where it considers that there is a risk that the internal credit assessments on internally-rated assets, and hence the basic FS, may be inappropriate. The PRA also expect firms to pay particular regard to internally-rated assets when comparing their risk profile to the assumptions underlying the MA, when considering whether FS additions may be appropriate, as noted in paragraph 1.3A of this SS; this could also be subject to review by the PRA. For restructured ERM notes, this increased oversight will include both an assessment of the quality of the firm’s internal credit assessments (see paragraphs 2.10 to 2.17 of this SS), and a verification that the risks retained by the firm as a result of the embedded NNEGs have been appropriately allowed for, as described below.

- 30/06/2024

3.3A

Where a firm holds all of the tranches of a securitisation, the economic substance of its aggregate exposure remains the same regardless of the form of the securitisation. Understanding the risks posed to a firm by holding ERMs, in particular the NNEG, and how these risks have been distributed between the various tranches of restructured notes (for example in the FS of MA-eligible notes and the spread or valuation of the junior and senior notes), is an important part of ensuring that the MA does not arise from risks retained by the firm.

- 30/06/2024

3.3B

The approach to assessing NNEG risk set out under the heading ‘The Effective Value Test’ (the ‘EVT’) (below) is not the only method that could be used for these purposes, but it is consistent with principles (ii) to (iv) in paragraph 3.8 below and firms using this approach to demonstrate that they are not taking an inappropriately large MA benefit from restructured ERM cash flows will meet the PRA’s expectations for this assessment. Any alternative approaches that calculate property forward prices assuming property growth in excess of the risk-free rate while simultaneously discounting at the risk-free rate, without also making a sufficient allowance for the risk in the assumed property growth (as envisaged by principle (iv) in paragraph 3.8 below), are equivalent to assuming a negative deferment rate and would not meet principle (iii).

- 30/06/2024

Assessing the NNEG risk

3.4

The NNEG guarantees that the amount repayable by the borrower under the ERM need never exceed the market value of the property collateralising the loan at the repayment date. As such it is an important source of risk for an ERM. As part of the review of the amount of MA benefit being claimed by a firm, the PRA will assess the extent to which the contractual terms, value and rating of restructured notes properly reflect the underlying NNEG risks and the extent to which these underlying risks flow through to the notes held within the firm’s MA portfolio (and as such are effectively retained by the firm for these purposes).[14] Compensation for these NNEG risks should not lead to an increase in the MA benefit. For example, assuming future house price growth in excess of risk-free rates should not lead to a lower valuation of the NNEG and hence higher MA, because firms are fully exposed to the risk that the excess house price growth will not be achieved.

Footnotes

- 14. The focus on the NNEG should not be taken to imply that other risks (eg prepayment risk) are not considered material by the PRA and indeed Chapter 2 of this SS is clear that these other risks should all be considered in the internal credit assessment.

- 30/06/2024

3.5

Assets such as ERMs generally do not have directly observable market prices, and so nor do they have directly observable spreads. Instead a spread must be derived, having first determined both a fair value for the ERM using alternative valuation methods as well as assumptions about cash flows.

- 30/06/2024

3.6

The presence of an NNEG will increase the derived spread on an ERM versus an equivalent loan without such a guarantee. It will also increase the amount of spread that should properly be attributed to risks retained by the firm.

- 30/06/2024

3.7

When determining the fair value of an asset for the purposes of deriving its spread, it is important that any embedded guarantees are valued consistently with the rest of the asset (ie on fair value principles).[15] Otherwise, the component of the asset’s spread that is assumed to represent compensation for the risks arising from the guarantee may be underestimated. Further, it is not sufficient simply to ensure that the value placed on the asset as a whole represents a fair value, since there could still be an incorrect attribution of value between the NNEG and the other components driving the valuation.

Footnotes

- 15. The PRA’s rules on valuation are set out in 2.1 of the Valuation Part of the PRA Rulebook.

- 30/06/2024

3.8

The PRA will assess the allowance made for the NNEG risk against its view of the underlying risks retained by the firm. This assessment will include the following four principles, which are explained in more detail below:

- (i) securitisations where firms hold all tranches do not result in a reduction of risk to the firm;

- (ii) the economic value of ERM cash flows cannot be greater than either the value of an equivalent loan without an NNEG or the present value of deferred possession of the property providing collateral;

- (iii) the present value of deferred possession of property should be less than the value of immediate possession; and

- (iv) the compensation for the risks retained by a firm as a result of the NNEG must comprise more than the best estimate cost of the NNEG.

- 30/06/2024

3.9

[Deleted]

- 30/06/2024

(I) Securitisations where a firm holds all tranches do not result in a reduction of risk to the firm

3.10

Where a firm holds all of the tranches of a securitisation (as is generally the case for correctly restructured ERM portfolios), the economic substance of its aggregate exposure remains the same regardless of the form of the securitisation. Understanding the risks posed to a firm by the NNEG, and how these risks have been distributed between the various tranches of restructured notes, is an important part of ensuring that the FS appropriately reflects all of the NNEG risks that are retained by the firm in relation to the cash flows on the MA-eligible notes.

- 30/06/2024

3.11

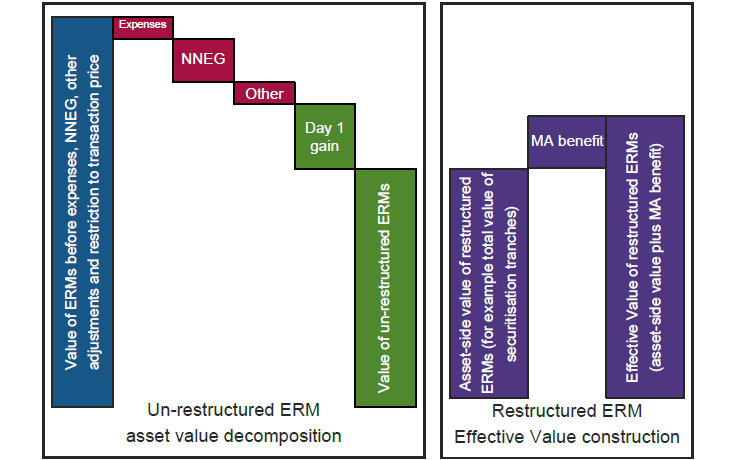

Some of the exposure to the risks posed by the NNEG will remain in the junior tranches outside of the MA portfolio. Nevertheless it is important to verify that the combination of the spread on the junior tranche and the FS of the MA-eligible tranche(s) have appropriately covered all of the risks retained by a firm that holds the ERMs until maturity, including those that arise from the NNEG. For this reason the PRA will assess the overall ‘Effective Value’ of the restructured ERM against the components of the value of the un-restructured ERM (the ‘economic value decomposition’), as described below and illustrated in Figure 1 below.

- 30/06/2024

3.12

The ‘Effective Value’ of restructured ERMs is the total value of all tranches of the restructured ERMs on the asset side of the balance sheet, plus the MA benefit arising from the restructured ERMs on the liability side of the balance sheet. The right-hand side of Figure 1 illustrates the construction of Effective Value, alongside an illustration of one way in which the value of un-restructured ERMs can be made up. The total value of the securitisation tranches is illustrated as being somewhat lower than the value of the un-restructured ERMs, to reflect the frictional costs of restructuring, on the assumption that an equation of value holds.

- 30/06/2024

3.13

On the left-hand side of Figure 1, the value of un-restructured ERMs has been illustratively decomposed into:

- the value of expected ERM cash flows prior to deductions (ie as a risk-free loan on expected decrements) (in blue);

- expenses (in red);

- NNEG (in red);

- any other adjustments (for example to allow for pre-payment risk) (in red).

For the purposes of this SS, the remainder (in green) is referred to as the economic value of ERM cash flows. The PRA expects the Effective Value to be less than this amount.[16] Calculation of the economic value should use methods and calibrations that are consistent with the other three principles.

Footnotes

- 16. The economic value has been broken down into the value of un-restructured ERMs and the restriction on the value to a transaction price, (labelled as ‘Day 1 gain’ in Figure 1 for brevity). The MA benefit has been illustrated in Figure 1 as partially offsetting the elimination of the Day 1 gain.

- 30/06/2024

3.13A

Where the SPV holds assets other than ERMs, the PRA expects firms to take the value of these other assets into account when conducting the EVT only if they are held for a purpose that supports the restructuring of the ERMs, for example to improve the credit quality of the restructured ERM notes, or to assist with risk or liquidity management, subject to the following expectations:

- (i) Other than as noted in (v) below, the balance sheet value of the other assets should be calculated in accordance with the PRA Rulebook and any other relevant requirements. This value of the other assets should be added to the economic value of ERMs.

- (ii) When determining Effective Value, firms should allow for the balance sheet value of the other assets in valuing each tranche. In particular, firms should allow for the impact on the security of the senior tranches arising from the other assets, and ensure that the valuation, spread and mapped CQS of the senior tranches reflects the presence of the other assets in the SPV, having regard to paragraph 2.4 of this SS. The PRA considers it would be difficult to demonstrate that the presence of a material value of other assets had no effect on the value or credit quality of the senior tranches and hence does not consider that it would be credible to assume that the value of the other assets was allocated in full to the junior tranche. The PRA expects a firm to be able to justify any allocation to the junior tranche in relation to the design of its restructuring approach.

- (iii) Firms should allow for any basis and counterparty risk associated with the other assets, for example any derivative or reinsurance contracts based on a property index are exposed to the basis risk of idiosyncratic property movements, as well as counterparty risk.

- (iv) Firms should allow for relevant costs associated with the other assets, for example commitment fees associated with liquidity facilities used to support the credit ratings of the MA-eligible notes.

- (v) For some assets other than ERMs, the PRA recognises that it may in principle be appropriate to depart from a balance sheet value calculated in accordance with the PRA Rulebook for the purposes of conducting the EVT. In particular, the PRA considers this may in principle be appropriate for some assets held to (partially) hedge NNEG risk. Where either a firm or the PRA believes it is appropriate to adopt a bespoke valuation approach for assets other than ERMs for the purposes of conducting the EVT, the PRA expects the firm to discuss and agree an appropriate valuation approach with its supervisor. In such cases, the PRA expects the firm to justify the relationship between the value of the asset for the purposes of the EVT and the allowance for NNEG risk included in the calculation of economic value.

The PRA expects firms to be able to demonstrate that the value of other assets has been allowed for in economic value and Effective Value in accordance with (i) – (v) above.

- 30/06/2024

3.14

The EVT assessment will be carried out on a firm-by-firm basis to provide assurance that all of the risks to which the firm is exposed have been appropriately reflected, either in the value of the securitised assets or in the FS assigned to those assets in the MA portfolio.

- 30/06/2024

Figure 1: Illustration of the construction of Effective Value

- 30/06/2024

(II) The economic value of ERM cash flows cannot be greater than either the value of an equivalent loan without an NNEG or the present value of deferred possession of the property providing collateral

3.15

This concept was introduced as the first proposition of paragraph 4.9 of discussion paper (DP) 1/16.[17] It is derived from the following considerations:

- (i) Given the choice between an ERM and an equivalent loan without an NNEG, a market participant would choose the latter, since either the guarantee is not exercised, in which case the ERM and the loan have the same payoff, or it is, in which case the ERM pays less.

- (ii) Similarly, a market participant would prefer future possession of the property on exit to an ERM, given that the property will be of greater value than the ERM if the guarantee is not exercised, or the same value if it is.

Footnotes

- 17. ‘Equity release mortgages’ March 2016: see page 3 of 3 at www.bankofengland.co.uk/prudential-regulation/publication/2016/equity-release-mortgages.

- 30/06/2024

(III) The present value of deferred possession of a property should be less than the value of immediate possession

3.16

This statement is equivalent to the assertion that the deferment rate[18] for a property is positive. The rationale can be seen by comparing the value of two contracts, one giving immediate possession of the property, the other giving possession (‘deferred possession’) whenever the exit occurs. The only difference between these contracts is the value of foregone rights (eg to income or use of the property) during the deferment period. This value should be positive for the residential properties used as collateral for ERMs.

Footnotes

- 18. By deferment rate, the PRA means a discount rate that applies to the spot price of an asset resulting in the deferment price. The deferment price is the price that would be agreed and settled today to take ownership of the asset at some point in the future; it differs from the forward price of an asset in that the forward price is also agreed today, but is settled in the future.

- 30/06/2024

3.17

It is important to note that views on future property growth play no role in preferring one contract over the other. Investors in both contracts will receive the benefit of future property growth (or suffer any property depreciation) because they will own the property at the end of the deferment period. Hence expectations of future property growth are irrelevant for this statement.

- 30/06/2024

(IV) The compensation for the risks retained by a firm as a result of the NNEG must comprise more than the best estimate cost of the NNEG

3.18

- 30/06/2024

3.19

[Deleted]

- 30/06/2024

The Effective Value Test (the ‘EVT’)

3.20

Firms can demonstrate that the Effective Value is less than the economic value of ERM cash flows (taking into account other assets held by the SPV in accordance with paragraph 3.13A above) using the following approach for calculating NNEG risk. Firms should calculate the allowance for NNEG risk for the portfolio of loans as the sum of a series of allowances for each ERM for each annual period during which ERM cash flows could mature, each allowance being multiplied by an exit probability appropriate to the annual period determined using best estimate assumptions for mortality, morbidity and pre-payment. Firms should calculate the allowance for each loan and period using the Black-Scholes option pricing formula shown below with the specified assumptions:

\[e^{-rT}\left [ KN\left ( -d_{2} \right ) -Se^{\left ( r-q \right )T}N\left ( -d_{1} \right )\right ]\]

\[\textrm{where}\: d_{1}= \frac{1}{\sigma \sqrt{T}}\ \left [ ln\left ( \frac{S}{K} \right ) +\left ( r-q+\frac{1}{2}\sigma ^{2}\right )T\right ] \textrm{and}\: d_{2}= d_{1}-\sigma \sqrt{T}\]

and N() is the standard Normal cumulative distribution function

- S = Current reasonable estimate at the balance sheet date of the value of the property providing collateral against the ERM;

- T = term to maturity as described above;

- K = loan principal and expected accrued interest at time T, calculated in accordance with the principles in paragraph 3.20A below;

- r = published Solvency II basic risk-free interest rate for maturity T, adjusted for use on a continuously-compounded basis;

- 𝜎 = published volatility parameter; and

- q = published deferment rate parameter

- 30/06/2024

3.20A

For ERM loans where the value of K at time T is dependent on borrower behaviour relating to principal or interest, the PRA expects firms to follow the principles below:

- (i) K should not include principal or the interest accruing thereon that is (a) projected to be lent after the date at which the EVT is conducted and (b) where the amount and timing of principal is at the borrower’s discretion or otherwise not known in advance by the lender.

- (ii) K should incorporate the principal and interest arising from a regular series of additional lending taking place after the date at which the EVT is conducted (a) where the amount and timing is known and certain in advance (other than any option to cease borrowing regular additional principal), and provided (b) that a best estimate of the rate at which borrowers cease to take additional borrowing is used.

- (iii) In the case of loans where borrowers pay some or all of the interest due as it accrues, K should reflect the expected accrual of interest at time T, allowing on a best estimate basis for the rate at which borrowers take up options to cease or reduce the interest they pay.

- (iv) Notwithstanding (i) above, the assessment of NNEG risk on existing lending should take account of any additional risk arising from future additional principal or interest arising from a pre-agreed lending facility, on a best estimate basis, having regard to the legal mechanisms by which future additional principal is expected to be incorporated into existing or additional restructured ERM notes. The purpose of this expectation is to reflect the risk to existing lending arising from future lending, and not the risks to which future lending would be exposed in itself. This is a potentially complex area and the PRA encourages firms to discuss their approach with their supervisor. In determining its best estimates of future lending, a firm should not take account of contractual variation terms that purport to allow the firm to curtail future lending in certain circumstances unless it can:

- a) justify that relying on such terms is consistent with its business plans with due consideration given to the franchise risk that could arise from such actions; and

- b) demonstrate it has considered carefully any legal and conduct requirements and expectations, including how a court might view these terms.

However, for the purposes of the EVT the PRA does not expect a firm to allow for risks to existing lending arising from future lending that is at the firm’s sole discretion (‘discretionary future advances’) and does not form part of a pre-agreed lending facility, subject to the firm demonstrating that this treatment of discretionary future advances for the purpose of the EVT has also had appropriate regard to relevant legal and conduct requirements and expectations.

- (v) Where the value of K is uncertain in a way not otherwise covered by the principles above, the PRA expects a firm to agree an appropriate approach to the calculation of K with its supervisor.

The PRA expects firms to be able to demonstrate that their calculation of K has been performed on a basis that is at least as prudent as that embodied in these principles. The PRA recognises that firms could adopt a range of methods that would meet these principles.

- 30/06/2024

3.21

The PRA expects firms to conduct the EVT with a minimum of the published value of q.

- 30/06/2024

3.21A

The values of q and 𝜎 will be published on the PRA’s website.[19] The PRA expects to review the value of q twice a year and to publish an updated value, or to confirm the prior value, by the end of March and September each year. The PRA expects to review and update or confirm the volatility parameter once per year, by the end of September. The PRA may publish updated values more frequently and at other times of the year when it considers it is appropriate to do so, taking into account market conditions. When reviewing the values of q and 𝜎 the PRA will use the following framework:

- The PRA will use its judgement informed by a range of analysis to inform its decision on the values, rather than a purely mechanistic approach.

- For q, the PRA will have regard to movements in long-term real risk-free interest rates, measured using a range of swaps-based data sources, at a range of tenors from 10 to 30 years. In general, material increases in long-term real risk-free interest rates will lead to an increase in q, and conversely material reductions in long-term real risk-free interest rates will lead to a reduction in q, subject to the value of q remaining positive in line with principle (iii) of paragraph 3.8 above.

- For 𝜎, the PRA will update its analyses to take account of any additional data on property price returns and relevant advances in techniques for estimating volatility.

- To avoid spurious precision, in general the PRA does not expect to publish an updated value of q or 𝜎 that results in an absolute change of under 0.5 percentage points or 1.0 percentage points respectively.

- The PRA will set out a summary of its rationale for updating the parameters (or confirming their prior values) at the time of publication.

- The PRA will consult further in the event that it wishes to make substantive changes to this framework.

Footnotes

- 30/06/2024

3.22

Where firms are unable to meet the EVT using the above approach and cannot offer appropriate and credible explanations (or alternatives that are consistent with principles (ii) to (iv) of paragraph 3.8 above, as explained in paragraph 3.3B above) this will be an indication that they may be deriving an inappropriately large MA benefit from restructured ERMs. This could be because some or all of the contractual terms of the ERM re-structure, valuation and spread of the restructured ERM notes, the rating (and hence CQS mapping), and the FS of the restructured ERM notes, do not adequately reflect the risk profile of the ERM cash flows that underpin the restructure. In such circumstances, firms will need to consider whether to adjust one or more of those components in order to properly reflect that risk profile.

- 30/06/2024

3.23

Figure 1 shows an allowance for ‘other’ risks in the decomposition of economic value of ERM cash flows. The PRA will not assess each firm’s allowance for other risks using a single specified approach, because the size and nature of the allowance is likely to depend on the specific contractual terms and risk profile of each firm’s ERM cash flows. However, the PRA will expect firms to demonstrate that they have made a realistic and credible allowance for other risks when assessing the economic value of ERM cash flows. In particular, the PRA expects firms to include an allowance for the likelihood and potential impact of early pre-payment of ERMs, and a further allowance for the uncertainties discussed in paragraph 3.20A above.

- 30/06/2024

3.24

The PRA expects firms to conduct the EVT in the following circumstances:

- (i) when restructured ERM notes are established or amended;

- (ii) regularly in support of the Supervisory Review Process[20]: this should be at least annually at firms’ financial year end dates. For a firm where exposures to restructured ERMs (as a proportion of total assets in the MA portfolio) are more material, or if the PRA judges there to be an increased risk of the firm taking an inappropriately large MA benefit from restructured ERMs, the firm may be expected to assess more frequently, as agreed with supervisors;

- (iii) when recalculating the transitional measure on technical provisions, whether at a regular two-year recalculation point, or as a result of a relevant change in risk profile;

- (iv) where a firm has reason to believe that the result of the EVT would show that the test would no longer be met; and

- (v) on request by their supervisor.

Firms may wish to conduct the EVT for their own purposes at any time.

Footnotes

- 20. See ‘The PRA’s approach to insurance supervision’ available at www.bankofengland.co.uk/prudential-regulation/publication/pras-approach-to-supervision-of-the-banking-and-insurance-sectors.

- 30/06/2024

3.25

The PRA expects a firm to communicate the results and calculation of the EVT to its supervisor promptly, and as soon as possible in the event that the EVT result indicates that an inappropriately large amount of MA benefit may be derived from restructured ERMs. The results and calculation of the EVT should consist of a written statement setting out, for each separate securitisation, the following:

- (i) the effective date at which the test has been conducted;

- (ii) the value of q and 𝜎 used when conducting the test;

- (iii) economic value, as a total broken down into the major elements in Figure 1 above;

- (iv) Effective Value, as a total broken down into the fair value for each tranche of the restructuring, and the MA benefit arising from each eligible tranche; and

- (v) the result of the test (whether or not it has been met) together with any commentary that the firm considers to be relevant.

- 30/06/2024

3.25A

Where a firm chooses to use the EVT for attestation purposes, the PRA expects it to engage with the principles underlying the EVT and use its own assumptions that are judged to be appropriate when attesting that the MA can be earned with a high degree of confidence from the assets held in the relevant portfolio of assets (Matching Adjustment 9.1(1)(b)). These assumptions should not fall below the PRA’s published minimum parameters where applicable, with additional consideration given to any retained risks other than the NNEG that are not assessed by the EVT.

- 30/06/2024

Assessing the internal model SCR for restructured ERMs

3.26

The PRA reminds firms of the PRA’s expectations for modelling MA in stress in SS8/18 (Solvency II: Internal models – modelling of the matching adjustment) [21], in particular the expectations relating to using a different technique to the primary methodology when validating internal models for MA in paragraph 6.8 of SS8/18.

Footnotes

- 21. ‘Solvency II: Internal models – modelling of the matching adjustment’, June 2024: www.bankofengland.co.uk/prudential-regulation/publication/2018/solvency-2-internal-models-modelling-of-the-matching-adjustment-ss.

- 30/06/2024

3.27

The PRA considers that assessing the EVT in stressed scenarios could be a relevant validation technique in relation to paragraph 6.8 of SS8/18. Specifically, assessing the EVT in stress entails considering:

- (i) the stressed economic value of ERMs;

- (ii) the stressed value of other assets held by the SPV;

- (iii) the stressed Effective Value of restructured ERMs (derived from the stressed value and mapped CQS of the restructured ERM notes); and

- (iv) the relationship between stressed economic value and Effective Value.

The PRA considers reassessment of the EVT in stress, in particular the comparison of stressed economic value and Effective Value in (iv) above, to be a helpful validation exercise that could contribute to firms meeting the internal model requirements (see Chapter 14 of the Solvency Capital Requirement – Internal Models Part of the PRA Rulebook). When assessing internal model applications and firms’ continued compliance with the calibration standards[22] and internal model requirements[23] relevant for granting internal model permissions, the PRA will ask firms to apply a test based on the EVT in stress, to assist in providing assurance that the amount of MA in stress is not overstated. Firms may wish to consider adding an EVT in stress to their regular suite of validation tools.

Footnotes

- 22. See 3.3 and 3.4 of the Solvency Capital Requirement – General Provisions Part of the PRA Rulebook.

- 23. See Chapters 10 to 16 of Solvency Capital Requirement – Internal Models.

- 30/06/2024

3.28

Assessing the EVT in stress is not intended to replace firms’ existing primary approaches in their internal model methodologies for restructured ERMs. In particular, the PRA expects firms to follow the five-step framework set out in Chapter 3 of SS8/18, part of which entails re-valuing the MA portfolio assets and determining appropriate stressed FSs; this will require applying appropriate stresses to firms’ valuation methodologies and FS for restructured ERMs.

- 30/06/2024

3.29

Firms should apply a test based on the EVT in stress as a validation technique.

- 30/06/2024

3.30

Firms assessing the EVT in stressed scenarios should consider the following principles:

- (i) All the relevant inputs to the EVT should be stressed appropriately, including without limitation: the value of other assets; the opening property value, having regard to the risk that individual properties do not necessarily perform in line with a diversified index; the risk-free rate; mortality, morbidity and prepayment assumptions; best-estimate assumptions used in the calculation of the principal and interest; the deferment rate; and the volatility parameter. After allowing for appropriate diversification effects, the stresses should be consistent with the confidence level of 99.5% over a 1-year period for the SCR of the MA portfolio holding the restructured ERMs.

- (ii) The minimum deferment rate and volatility parameters for the EVT are set by the PRA using the framework in paragraph 3.21A above from time to time. These parameters are designed to inform a diagnostic test on the base balance sheet. The PRA expects firms to engage with the principles underlying the EVT and the framework for reviewing the parameters as set out earlier in this chapter, and to derive their own stresses to the deferment rate and volatility parameters. In doing so, firms may wish to consider adverse historical environments and prospective scenarios for property prices, both in the UK and internationally, as well as the framework for the parameters in paragraph 3.21A above.

- (iii) The deferment rate parameter of the EVT assessed on the base balance sheet has been set as a minimum view. Firms should therefore consider what the minimum view would be in stressed economic conditions, having regard to the levels of variables such as nominal and real interest rates, and property prices. A zero value for the deferment rate does not meet Principle III above, and so the PRA does not consider this to be a realistic or credible value when using the test to meet the intended purpose.

- (iv) Firms may wish to stress the inputs to the EVT in different ways depending on the design of their internal model. For example, firms could stress the risk-free rate r and the deferment rate q, or apply stresses to r and r-q. On the basis of the broad linkage between the deferment rate and real interest rates, firms may wish to consider changes in r-q as being broadly linked to implied inflation.

- (v) Firms should consider carefully the dependency structure among all risk drivers used in deriving stresses to the EVT parameters, in particular between r and q (or r and r-q), and ensure that the stressed scenarios used in the application of the EVT as a validation technique are economically realistic.

- (vi) Firms may wish to consider management actions to support the SPV under stress, for example injecting assets to support the credit quality of senior notes, or amending note cash flows. In respect of management actions, firms are reminded to consider carefully the relevant requirements as set out in Solvency Capital Requirement – Internal Models 11.8(3) and Article 236 of Commission Delegated Regulation (EU) 2015/35, and any implications for the MA eligibility of the restructured ERM notes or the MA portfolio as a whole.

- (vii) Firms should apply the EVT in a sufficiently wide range of scenarios to give reasonable assurance that the MA benefit in stress is not overstated. Where a firm’s internal model is based on Monte Carlo simulations, the firm could in principle limit the application of the EVT in stress to a key subset of the scenarios generated, provided they can demonstrate that the results of the test do not indicate that any material re-ranking of simulated scenarios would be required. The PRA considers that it would be good practice to apply the EVT in upside and downside scenarios.

- 30/06/2024