1

Introduction

1.1

This Supervisory Statement (SS) provides an overview of how the Prudential Regulation Authority’s (PRA)’s supervisory expectations of ‘new[1] and growing[2]’non-systemic[3] UK-incorporated banks[4],[5] (collectively referred to as ‘banks’), evolve as they grow from the point of authorisation to being regarded as fully established banks.

- Chapter 2 provides background on progress to date with new bank authorisations; common issues of new and growing banks; and an overview of how the PRA’s supervisory approach evolves as banks grow and develop.

- Chapter 3 provides further detail on supervisory expectations of new and growing banks with a focus on common issues including business model, governance, risk management and controls.

- Chapter 4 sets out the PRA’s expectations for capital management in new and growing banks, and includes a revision and simplification of the PRA methodology for calibrating the PRA buffer for these banks.

- Chapter 5 sets out the PRA’s expectations on new and growing banks to make preparations for recovery planning, solvent exit planning, and resolution.

- Chapter 6 sets out the PRA’s supervisory approach once banks become established.

Footnotes

- 1. New banks refers to firms that are in the ‘mobilisation stage’ (authorisation with restrictions) and those that have received authorisation without restrictions within the past 12 months (e.g. exited mobilisation or authorised without using the mobilisation period).

- 2. Growing banks refers to banks that are typically between one and five years post authorisation without restrictions. These banks often share many of these characteristics: rapid growth; loss making; reliant on regular capital injections; significant and rapid changes in strategy and business model; and immature controls.

- 3. Non-systemic banks are those which are not designated as systemically important through the O-SIIs (other systemically important institutions) Identification process. These banks are mainly category 2-4 UK incorporated deposit takers, whose size, interconnectedness, complexity, and business type give them the capacity to cause some (category 2), minor (category 3) and almost no capacity individually (category 4) to cause disruption to the UK financial system by failing, or by carrying on their business in an unsafe manner, but where difficulties across a whole sector or subsector have the potential to generate disruption.

- 4. https://www.bankofengland.co.uk/prudential-regulation/authorisations/which-firms-does-the-pra-regulate.

- 5. UK bank means of a UK undertaking that has permission under Part 4A of the Financial Services and Markets Act 2000 (FSMA) to carry on the regulated activity of accepting deposits and is a credit institution, but is not a credit union, friendly society or a building society.

- 01/10/2025

1.2

This SS is primarily relevant to new and growing non-systemic UK banks, though not all, as some banks in this category will have sufficient experience and resources to be able to move quickly to the standard expected of most established banks. This determination will depend on a number of factors, notably on whether the bank is; (i) part of an established domestic or international banking group; (ii) the size and complexity of its activities; and (iii) the extent of its available financial and non-financial resources. The PRA would consider each case on its merits and apply supervisory judgement to ensure that the policy is applied appropriately. See Box 1 ‘Supervision of UK bank subsidiaries of international groups’ for relevant examples.

- 15/04/2021

1.3

This SS is relevant to the following types of banks:

- banks in their first few years of being authorised by the PRA as a deposit-taker (typically less than five years post-authorisation); and

- prospective banks interested in and currently applying for authorisation as a deposit-taker (UK applicant banks).

- 15/04/2021

1.4

Chapter 6 of the SS is relevant to non-systemic UK banks that are ‘established’ (typically beyond five years post–authorisation, and in the ‘without restrictions’ stage of their lifecycle).

- 15/04/2021

1.5

There are a number of types of banks and other PRA-authorised firms that are not covered in this SS. These include:

- banks incorporated outside of the UK authorised to accept deposits through a branch in the UK;[6]

- systemically important firms, referring to firms that are designated under the other systemically important institutions (O-SII) identification process;[7] [8]

- building societies;[9]

- credit unions; and

- UK designated investment firms.

Footnotes

- 6. June 2019: CP25/18 ‘The Bank of England’s approach to amending financial services legislation under the European Union (Withdrawal) Act 2018’ (October 2018) with near final policy in PS 5/19 of the same name.

- 7. PRA SoP ‘The PRA’s approach to identifying other systemically important institutions (O-SIIs)’, December 2020: https://www.bankofengland.co.uk/prudential-regulation/publication/2016/the-pras-approach-to-identifying-other-systemically-important-institutions-o-siis-sop

- 8. The most significant deposit-takers or designated investment firms whose size, interconnectedness, complexity, and business type give them the capacity to cause very significant disruption to the UK financial system (and through that to economic activity more widely) by failing, or by carrying on their business in an unsafe manner (Approach document page 12)

- 9. Building societies are subject to different legislation. However, the authorisation of new building societies would include the option of mobilisation, and the expectation for solvent exit planning would apply.

- 01/10/2025

1.6

While this SS is not directly relevant to these firms it may be of interest to them. This SS also does not propose changes to the change in control process for buying an existing bank.[10] Firms are encouraged to speak with their normal supervisory contact if further clarity is required.

- 15/04/2021

1.7

This SS should be read in conjunction with:

- the PRA’s approach to banking supervision;[11]

- the following joint Bank / Financial Services Authority (FSA)[12] publications: ‘A review of requirements for banks entering into or expanding in the banking sector (the 2013 report)’;[13] and ‘A review of requirements for banks entering into or banks expanding in the banking sector: one year on (the 2013 report plus one year)’;[14]

- SS31/15‘The Internal Capital Adequacy Assessment Process (ICAAP) and the Supervisory Review and Evaluation Process (SREP)’;[15]

- the Pillar 2 Statement of Policy (SoP) ‘The PRA’s methodologies for setting Pillar 2 capital’;[16] and

- SS2/24 – ‘Solvent exit planning for non-systemic banks and building societies’.[17]

Footnotes

- 11. October 2018: https://www.bankofengland.co.uk/prudential-regulation/publication/pras-approach-to-supervision-of-the-banking-and-insurance-sectors

- 12. The FSA was the predecessor organisation to the PRA and Financial Conduct Authority (FCA).

- 13. Available at: https://www.fca.org.uk/publication/archive/barriers-to-entry.pdf.

- 14. Available at: https://www.fca.org.uk/publication/thematic-reviews/barriers-to-entry-review-one-year-on.pdf.

- 15. May 2023: https://www.bankofengland.co.uk/prudential-regulation/publication/2013/the-internal-capital-adequacy-assessment-and-supervisory-review-ss.

- 16. October 2021: https://www.bankofengland.co.uk/prudential-regulation/publication/2015/the-pras-methodologies-for-setting-pillar-2-capital.

- 17. https://www.bankofengland.co.uk/prudential-regulation/publication/2024/march/solvent-exit-planning-for-non-systemic-banks-and-building-societies-ss

- 01/10/2025

1.8

- 01/10/2025

1.9

The Financial Conduct Authority (FCA) is the conduct regulator for all firms operating in the UK. The policy in this SS does not affect the application of the FCA’s rules or requirements.

- 15/04/2021

Table 1: Non-exhaustive list of materials[20] to be read alongside SS3/21 ‘Non-systemic UK banks: the Prudential Regulation Authority’s approach to new and growing banks’

| General approach |

| The PRA’s approach to banking supervision[21] |

| Fundamental Rules[22] |

| A review of requirements for banks entering into or expanding in the banking sector[23] |

| A review of requirements for banks entering into or banks expanding in the banking sector: one year on[24] |

| Governance and risk management |

| The General Organisational Requirements Part of the PRA Rulebook The Senior Management Functions Part of the PRA Rulebook The Skills, Knowledge and Expertise Part of the PRA Rulebook The Fitness and Propriety Part of the PRA Rulebook The Risk Control Part of the PRA Rulebook The Allocation of Responsibilities Part of the PRA Rulebook The Market Risk Part of the PRA Rulebook The Group Risk Systems Part of the PRA Rulebook |

|

SS5/16 ‘Corporate Governance: Board responsibilities’[25] |

| Operational Continuity Part of the Rulebook The Outsourcing Part of the PRA Rulebook SS2/21 ‘Outsourcing and third party risk management’[29] Operational Resilience Part of the PRA Rulebook SS1/21 ‘Operational resilience: Impact tolerances for important business services’[30] SS9/16 ‘Ensuring operational continuity in resolution’[31] |

| Capital |

| The Internal Capital Adequacy Assessment Part of the PRA Rulebook |

| The Definition of Capital Part of the PRA Rulebook |

| The Capital Buffers Part of the PRA Rulebook |

| SS31/15 ‘The Internal Capital Adequacy Assessment Process (ICAAP) and the Supervisory Review and Evaluation Process (SREP)’[32] |

| Statement of Policy ‘The PRA’s methodologies for setting Pillar 2 capital’[33] |

| Liquidity |

| The Internal Liquidity Adequacy Assessment Part of the PRA Rulebook |

| SS24/15 ‘The PRA’s approach to supervising liquidity and funding risks’[34] |

| Recovery and resolution planning |

| SS9/17 ‘Recovery Planning’[35] SS2/24 – ‘Solvent exit planning for non-systemic banks and building societies’[36] SS4/19 ‘Resolution assessment and public disclosure by firms on Recovery Planning’[37] |

| The Bank of England’s Resolvability Assessment Framework[38] |

| The Bank of England’s Approach to Resolution[39] The Resolution Assessment Part of the PRA Rulebook The Recovery Plans Part of the PRA Rulebook The Depositor Protection Part of the PRA Rulebook SS 18/15 ‘Depositor and dormant account protection’[40] |

| Disclosure |

| The Regulatory Reporting Part of the PRA Rulebook |

| The Disclosure Part of the PRA Rulebook |

Footnotes

- 20. This may be a complete list now but may be superseded by future publications.

- 21. July 2023: https://www.bankofengland.co.uk/prudential-regulation/publication/pras-approach-to-supervision-of-the-banking-and-insurance-sectors.

- 22. Available at: https://www.bankofengland.co.uk/-/media/boe/files/prudential-regulation/new-bank/Fundamentalruleprinciples.

- 23. Available at: https://www.fca.org.uk/publication/archive/barriers-to-entry.pdf.

- 24. Available at: https://www.fca.org.uk/publication/thematic-reviews/barriers-to-entry-review-one-year-on.pdf.

- 25. 4 July 2020: https://www.bankofengland.co.uk/prudential-regulation/publication/2016/corporate-governance-board-responsibilities-ss.

- 26. April 2017: https://www.bankofengland.co.uk/prudential-regulation/publication/2015/internal-governance-ss.

- 27. Available at: https://www.eba.europa.eu/activities/single-rulebook/regulatory-activities/internal-governance/guidelines-internal-governance?version=2021#activity-versions.

- 28. December 2020: https://www.bankofengland.co.uk/prudential-regulation/publication/2015/strengthening-individual-accountability-in-banking-ss.

- 29. March 2021: https://www.bankofengland.co.uk/prudential-regulation/publication/2021/march/outsourcing-and-third-party-risk-management-ss.

- 30. March 2021: https://www.bankofengland.co.uk/prudential-regulation/publication/2021/march/operational-resilience-impact-tolerances-for-important-business-services-ss

- 31. July 2016: https://www.bankofengland.co.uk/prudential-regulation/publication/2016/ensuring-operational-continuity-in-resolution-ss

- 32. December 2020: https://www.bankofengland.co.uk/prudential-regulation/publication/2013/the-internal-capital-adequacy-assessment-process-and-supervisory-review-ss.

- 33. December 2020: https://www.bankofengland.co.uk/prudential-regulation/publication/2015/the-pras-methodologies-for-setting-pillar-2-capital.

- 34. September 2020: https://www.bankofengland.co.uk/prudential-regulation/publication/2015/the-pras-approach-to-supervising-liquidity-and-funding-risks-ss

- 35. https://www.bankofengland.co.uk/prudential-regulation/publication/2017/recovery-planning-ss.

- 36. https://www.bankofengland.co.uk/prudential-regulation/publication/2024/march/solvent-exit-planning-for-non-systemic-banks-and-building-societies-ss

- 37. July 2019: https://www.bankofengland.co.uk/prudential-regulation/publication/2019/resolution-assessment-and-public-disclosure-by-firms-ss

- 38. Available at: https://www.bankofengland.co.uk/financial-stability/resolution/resolvability-assessment-framework

- 39. December 2023: https://www.bankofengland.co.uk/paper/2017/the-bank-of-england-approach-to-resolution.

- 40. June 2023: https://www.bankofengland.co.uk/prudential-regulation/publication/2015/depositor-and-dormant-account-protection-ss.

- 01/10/2025

2

Overview of the PRA’s supervisory approach for new and growing banks

2.1

The PRA’s primary aim is to promote the safety and soundness of the firms it regulates. In doing so it recognises the importance of competition in the banking sector and, since 2013, the PRA has aimed to be proportionate in the requirements for new banks in order to facilitate greater competition, in line with the PRA’s secondary competition objective. The guidance published in the 2013 report is clear that applicant banks must meet the PRA’s Threshold Conditions[41] in order to be authorised as a deposit-taker. The PRA’s assessment is proportionate to the size and complexity of the bank. It also takes into account that new banks are unlikely to meet all the expectations the PRA has of an established bank from inception, and in many cases new banks will require time to build, and demonstrate capabilities.

Footnotes

- 41. Sections 55B to 55D and Schedule 6 of the Financial Services and Markets Act 2000: https://www.legislation.gov.uk/ukpga/2000/8/contents.

- 01/10/2025

2.2

The PRA’s approach has been successful in supporting the authorisation of a number of banks. However new and growing banks have often underestimated the work involved post-authorisation to become a successful, and established bank that is able to exit the market in an orderly way in the event the firm becomes non-viable. In recognition that authorisation is the start of the journey for a bank, this SS sets out the PRA’s expectations of how banks should progress from being a new and growing bank to becoming an established bank. In addition to ensuring they can complete a solvent exit of their business, firms must also be able to show at all times how the preferred resolution strategy set for them (either via the Bank Insolvency Procedure or use of resolution tools where justified by the supply of transactional accounts or other critical functions at sufficient scale) could be carried out in an orderly way.

- 01/10/2025

2.3

Competitive markets involve firms being able to enter and exit. The PRA’s objective is not to ensure no firm exits the market, but instead to make sure that firms are able to exit the market in an orderly manner, such as via resolution if all other reasonable options have failed or are, in the Bank’s view, likely to fail. While firms may fail at any stage of their maturity, the likelihood of failure may be higher during the early stages of a firm’s development.[42]

Footnotes

- 42. This is common across industries, see for example: Geroski, P.A. (1995) ‘What do we know about entry?’ International Journal of Industrial Organisation, 13 421–441; or Kücher, A. et al. (2020) ‘Firm age dynamics and causes of corporate bankruptcy: age dependent explanations for business failure’, Review of Managerial Science, 14: 633–661.

- 15/04/2021

Progress to date

2.4

The PRA has placed emphasis on promoting competition in the banking sector over the last few years. The 2013 report articulated how this would be achieved including, for example, proposals to reduce a number of prudential requirements that had often been applied at the point of authorisation, including the removal of automatic capital ‘add-ons’ or ‘scalars’ simply because a bank was new.

- 15/04/2021

2.5

The 2013 report also introduced improvements to the authorisation process. This included a significant expansion of support during the pre-application stage of the process,[43] designed to support banks in progressing towards authorisation as quickly as possible. Along with this, it introduced the option for banks to be initially authorised with restrictions (‘mobilisation’). This option recognised that banks often need the certainty of being authorised in order to raise capital and the time to set up the necessary infrastructure.

Footnotes

- 43. Previously there had been one pre-application meeting.

- 15/04/2021

2.6

Figure 1 illustrates the journey of a bank from pre-authorisation to established bank.

- 15/04/2021

Figure 1: the journey from pre-authorisation to established bank

- 15/04/2021

Common issues for new and growing banks and how the PRA’s approach evolves

2.7

While there has been progress in supporting competition in the banking sector, it is clear that new banks typically face considerable challenges upon authorisation. Often banks are focused on the ambition of becoming authorised and lose the longer term focus of becoming sustainable businesses or fail to appreciate the ongoing need to invest in systems and controls to ensure they remain commensurate with the evolving needs of the business. There is also insufficient focus on planning for downside scenarios, including the ability to effect an orderly exit, which should be of particular focus given the greater likelihood of being non-viable in the early years of operation.

- 15/04/2021

2.8

New banks’ business models, risk management, and governance are untested at the point of authorisation, and are unlikely to meet PRA expectations of established banks. This proportionate approach for new banks is regarded as appropriate given that orderly exit of a bank at an early stage in its life is likely to have no or minimal impact on financial stability and is a natural part of a competitive economy. However, if a new bank is to become a successful, established bank, it needs to mature rapidly across all aspects of its business. New and growing banks should expect to invest significantly in developing governance, controls and capabilities in their early years of operation.

- 15/04/2021

2.9

The table overleaf shows how the PRA’s expectations of banks increase as the bank matures. This focuses on the common areas where the PRA has seen new and growing banks struggle as they seek to become established banks: business model, governance, risk management, and capital. These areas of focus will be elaborated on in subsequent chapters. New and growing banks should ensure they also understand PRA expectations and requirements on topics not covered in this SS, including liquidity, credit risk management, operational risk, and resilience. In addition, Table 2 only covers the five years following exit from mobilisation (or upon authorisation if a firm does not follow the mobilisation route). The PRA expects banks to continue to develop across all these areas beyond this point, in line with the growth of the business, where appropriate.

- 15/04/2021

Table 2: The PRA’s expectations of banks as they mature

| Year 0[44] | Year 3 | Year 5 | |

| Business model | Untested business model, most banks loss making |

Business model refined based on experience Forecasts are more accurate Credible strategy to achieve profitability |

Settled business model Either profitable or a credible strategy to achieve profitability with definite capital support to achieve that Realistic forecasts |

| Governance |

Appropriate number of independent non-executive directors. Established good practice is at least two Chair must not perform an executive function and there is a strong expectation that they should be independent[45] |

Appropriate number of independent non-executive directors. Established good practice is at least three, including the chair[46] |

Appropriate number of independent non-executive directors. Established good practice is at least a majority independent board |

| Risk management |

Framework and policies in place Untested as firm has not yet operated as a bank |

Bank is testing and refining framework and policies in light of experience Risk management is fit for purpose, with a focus on developing risk management and controls for the most material risks |

Mature control environment Fully embedded risk management framework linked into stable business model Framework provides forward looking view across all risk types Continuous improvement to ensure framework remains fit for purpose given business and regulatory developments |

| Capital |

PRA buffer set on new bank basis (six months forward operating expenses) In addition to buffers, hold enough capital to meet business plan while remaining above buffers for 12 months Internal Capital Adequacy Assessment Process (ICAAP) meets minimum standards but untested, and is fit for purpose |

PRA buffer set on new bank basis (6 months forward operating expenses)[47] Undertaking advanced stress testing and a clear plan for transitioning to stress test buffer Forward looking view of capital to ensure buffers are not used in the usual course of business ICAAP meets minimum standards and is fit for purpose |

PRA buffer set on stress test basis Sophisticated capital management with credible capital models ICAAP is a robust document which is an integral part of the firm’s management process and decision making |

| Liquidity | Internal Liquidity Adequacy Assessment Process (ILAAP) meets minimum standards but untested, and is fit for purpose |

ILAAP meets minimum standards and is fit for purpose. |

ILAAP is a robust document which is an integral part of the firm’s management process and decision making |

| Operational resilience | Design operational resilience into business processes and controls from the outset, and follow all relevant policies. |

||

| Recovery and Resolvability |

Credible recovery plans in place - sufficiently detailed and practical to ensure they reflect the complexity and size of the firm and would be useable in a stress. Preparations for solvent exit approved by the Board. Undertake a forward-looking, realistic assessment of how its preparations for resolution would enable the bank to achieve the outcomes for resolvability. Meet the PRA rules on depositor protection. |

||

Footnotes

- 44. At authorisation / exit from mobilisation.

- 45. The optimal board composition will depend on the complexity, organisation structure and size of the firm at each stage. For instance a greater or smaller number of INEDs than those outlined in Table 2 might be appropriate for different firms at the same stage of development.

- 46. The optimal board composition will depend on the complexity, organisational structure and size of the firm at each stage. For instance a greater or smaller number of independent non-executive directors than those outlined in Table 2 might be appropriate for different firms at the same stage of development.

- 47. Although the PRA buffer could be set on a stress test basis by this point if the bank has reached profitability (see paragraph 4.8).

- 01/10/2025

Box 1 – Supervision of UK bank subsidiaries of international groups

The expectations set out in this statement will be tailored for banks that are subsidiaries of international groups.

In its role as host supervisor for international banks, the PRA considers the degree of equivalence of the home state regulatory and supervisory regime, and the degree of cooperation with the home state supervisor.

For subsidiaries of international groups, the PRA applies the same regulatory requirements and follows the same supervisory framework as for a UK headquartered firm but its supervisory approach takes into account the links between the subsidiary and the rest of the group of which it forms part. The PRA will adapt its supervisory approach according to the nature, scale and complexity of a firm’s UK operations and the potential impact on financial stability in the UK. Accordingly, the PRA’s expectations of subsidiaries may well differ in some areas from those of UK headquartered firms.[48]

Board composition is one example of where the PRA’s expectations differ from those set out in paragraph 3.11. The extent to which the PRA believes the boards of significant regulated subsidiaries need to be independent will be influenced by a number of factors, including the size, scope and nature of the subsidiary’s business, its business model, and the degree of strategic and operational dependence between the subsidiary and the wider group. The local board structure will need to recognise that connectivity. The objective is to ensure that the governance of the subsidiary is effective and that its board is capable of taking decisions in the interests of the safety and soundness of that firm.[49]

Other matters where there may be a difference of approach for subsidiaries of international firms include, but are not limited to, profitability, governance, recovery, resolution and solvent exit.

The PRA will discuss its expectations with firms during the authorisation process and through the ongoing supervisory dialogue. Firms should speak with their normal supervisory contact if further clarity is required.

Footnotes

- 48. 2023 Approach documents (para 154 – 160), July 2023: https://www.bankofengland.co.uk/prudential-regulation/publication/pras-approach-to-supervision-of-the-banking-and-insurance-sectors and SS5/21 (International banks: The PRA’s approach to branch and subsidiary supervision): July 2021: https://www.bankofengland.co.uk/prudential-regulation/publication/2021/july/pra-approach-to-branch-and-subsidiary-supervision-ss

- 49. SS5/16, July 2018: https://www.bankofengland.co.uk/prudential-regulation/publication/2016/corporate-governance-board-responsibilities-ss.

- 01/10/2025

3

Expectations of new and growing banks

3.1

The initial years following authorisation involve significant change and development, as banks test and refine their business models and develop the governance and controls to support their growth ambitions. In order to facilitate competition, at authorisation new banks do not have to meet all PRA expectations of established banks. However, this is acceptable only for a limited period. As banks grow and develop in the years following authorisation, the PRA’s expectations increase correspondingly. While there are no time limits, the PRA would typically expect banks to have a mature control environment within five years of authorisation.

- 15/04/2021

3.2

New and growing banks do not always seem aware of the importance of keeping their control environment in line with the size or complexity of their business. The PRA has observed a theme of banks outgrowing their control environment and having to retrospectively invest in control functions. This is not an appropriate way to develop the business and in the long run can be more expensive, as banks then have to undertake extensive remediation activity. The governance and controls which are appropriate at authorisation are unlikely to remain appropriate as the bank grows, and consequently banks should expect to make significant investment in controls in their early years of operation.

- 15/04/2021

3.3

It is important that new and growing banks understand all applicable rules, policies and regulatory expectations that come with being an authorised bank, and demonstrate this in the way they conduct their business and interact with regulators. The PRA provides support to prospective banks as they go through the pre-application process, but authorised banks must operate independently and have a mature and constructive relationship with their supervision team, in accordance with the PRA’s Fundamental Rules.

- 15/04/2021

Business model

3.4

New and growing banks are often loss making initially and rely on regular capital injections to maintain their capital adequacy. The PRA understands this is often a feature of new businesses, but it is of course not sustainable over the longer term and creates a vulnerability to capital not being available when needed. Banks should focus on reaching profitability and the ability to achieve organic capital generation within a reasonable time period following authorisation, recognising that the longer they are unprofitable, the more uncertainty there is about whether investor sentiment will remain positive. By around three years post-authorisation, the PRA expects banks to have more clarity over their path to profitability. By five years post-authorisation, banks should either be profitable or have a credible strategy to achieve profitability, with definite capital support to achieve this. If the firm is of a size to require minimum requirement for own funds and eligible liabilities (MREL) at greater than minimum capital requirements within this planning horizon, it needs to factor in those requirements (see paragraph 4.4). The PRA, however, recognises that a number of factors, including the nature of the business model, could impact the path to profitability, and will apply flexibility in exceptional circumstances where the path to profitability is credible and there is sufficient financial resources in place in advance to manage the risks around that path. At least until profitability is achieved, the PRA expects firms to have a credible capital plan which will ensure new capital is injected in good time to avoid capital requirements plus buffers being entered. There will be no delay in transitioning to the PRA buffer on a stress test basis (see Chapter 4) if there is a delay in achieving profitability.

- 15/04/2021

3.5

The PRA understands new and growing banks may make significant or frequent changes to their business plans to reflect their experience post-authorisation. Banks should keep the PRA informed of any material issues affecting their business plan, and inform the PRA in advance of making any significant change to it. Banks should ensure they fully assess the risks of any change to their business plan and have suitable controls in place. Banks should use their experience to produce more realistic business plans as they mature; the PRA expects banks to be able to produce more accurate forecasts by around two-three years post-authorisation and have realistic forecasts within five years of authorisation. Banks should ensure they factor investment in governance and controls into their financial projections.

- 15/04/2021

3.6

The PRA is open to novel and untested business models, but expects to apply a higher degree of scrutiny to these banks to ensure governance and controls are appropriate and the bank understands the risks it is taking on.

- 15/04/2021

Governance

3.7

Good governance is critical to delivering a sound and well-run business; poor governance has been a key factor in the major financial sector failures in recent years and is often a leading indicator of financial problems in firms. As such, the PRA promotes good governance across the financial sector and all firms it supervises. A strong and well-functioning board is central to good governance.

- 15/04/2021

3.8

PRA rules require banks to have robust and comprehensive governance arrangements which reflect the nature, scale and complexity of the risks inherent in the bank’s business model and activities.[50] SS5/16 sets out the PRA’s expectations of boards of all authorised firms. For new and growing banks, the board has a pivotal role in ensuring the bank is able to grow in a sustainable way and that it has the ability to effect an orderly exit if required. Boards should:

- proactively identify and address potential weaknesses in the business model or control environment, demonstrating self-awareness and a willingness to tackle issues early on;

- ensure the bank has a forward looking approach to capital management, with clear triggers for when actions need to be taken to enable the bank to continue to meet total capital requirements (TCR) plus buffers;

- ensure the risks of rapid growth, or new ventures and products, are appropriately controlled before embarking on these; and

- provide independent oversight and challenge and oversee the development of risk management and controls.

Footnotes

- 50. General Organisational Requirements part of the PRA Rulebook: http://www.prarulebook.co.uk/rulebook/Content/Part/214136 https://www.prarulebook.co.uk/rulebook/Content/Part/214136 (2.2).

- 01/10/2025

3.9

Boards of new and growing banks will need to evolve as the business grows. At authorisation, banks should have a clear plan for how the board will develop, and should keep this plan updated as the business grows. Banks should regularly review the skills and composition of their boards to ensure they remain appropriate for the changing business. The PRA requires boards to have adequate collective knowledge, skills and experience, to understand the bank’s activities, including the main risks.[51] In new and growing banks, the PRA expects boards to have adequate collective, relevant experience to understand the bank’s business model, key risks, and set its strategy. For instance, in a new retail bank, the PRA expects the board to have sufficient, collective retail banking experience.

Footnotes

- 51. General Organisational Requirements Part of the PRA Rulebook: https://www.prarulebook.co.uk/rulebook/Content/Part/214136 (5.2).

- 01/10/2025

3.10

Banks should maintain succession plans for all board members, recognising that the individuals who have the skills to launch and build the business in its early years may not be best suited to lead the business as it grows. Banks are required to maintain a management responsibilities map[52] which should be used to support succession planning.

Footnotes

- 52. Allocation of Responsibilities Part of the PRA Rulebook: https://www.prarulebook.co.uk/rulebook/Content/Part/212514 (7.1).

- 01/10/2025

Conflicts of interest and independence of mind

3.11

The PRA places weight on boards having sufficient independence, which helps ensure they can provide effective challenge to the business. Although the optimal board composition is assessed on a case-by-case basis bearing in mind the complexity, organisational structure, and size of the firm. Established good practice is for new banks to have two independent non-executive directors, and the PRA’s strong preference is for banks to have independent non-executive chairs at this point. As they grow, established good practice is for banks to have a minimum of three independent non-executive directors, including the chair, within three years of authorisation. Depending on the size and complexity of the business, it may be appropriate for the bank to meet good practice of having a majority independent board within five years of authorisation.

- 15/04/2021

3.12

Banks should implement appropriate measures to identify, monitor and manage potential conflicts of interest or other challenges that can arise at the board. For instance, certain directors may be at greater risk of having conflicts of interest, because they are either significant shareholders themselves, are appointed or nominated by a significant shareholder or are founders of the bank. These individuals can be highly influential and may have incentives to influence certain decisions to align with their own interests, or to pursue rapid growth and increased risk taking. This can lead to poorer outcomes for the bank.

- 15/04/2021

3.13

As members of the management body, all non-executive directors, whether independent or not, have a binding obligation to act with honesty, integrity and independence of mind[53] and are required under Rules 2.1-2.3 and 3.4 in the Conduct Rules Part of the Rulebook to act with integrity, due skill, care and diligence and to be open and co-operative with regulators[54]. Independence of mind is a pattern of behaviour, shown in particular during discussions and decision making at the board. All members of the board should be able to make their own sound, objective and independent decisions and judgements.[55] Banks should consider the appropriate number of non-executive directors who are significant shareholders or who are appointed or nominated by a significant shareholder.

Footnotes

- 53. Article 91(8) Capital Requirements Directive (2013/36/EU): https://www.legislation.gov.uk/eudr/2013/36/article/91.

- 54. Conduct Rules part of the PRA Rulebook: https://www.prarulebook.co.uk/rulebook/Content/Part/302382 (2.1-2.3).

- 55. Joint ESMA and EBA Guidelines on the assessment of suitability of members of the management body and key function holders (EBA-GL-2017-12): https://www.bankofengland.co.uk/-/media/boe/files/paper/2020/december/joint-esma-and-eba-guidelines-on-assessment-of-the-suitability-of-members-of-the-management-body.pdf.

- 01/10/2025

3.14

Where the chief executive (SMF1) of a bank is also one of its founders, the board should implement appropriate checks, balances, and measures to identify, monitor, and manage any potential conflicts of interest.

- 15/04/2021

Risk management and controls

3.15

For all firms it supervises, the PRA expects to see a fit for purpose risk management framework, which is demonstrably used across the business to guide and control all of the firm’s activities. Many firms adopt a three lines of defence model and within this the PRA would expect to see first line risk ownership, with effective oversight and challenge provided by an independent second and third line. This helps to ensure risks are articulated, understood and managed or mitigated appropriately.

- 15/04/2021

3.16

Firms should articulate and maintain a culture of risk awareness. PRA expectations in respect of governance including firms’ approach to risk culture are set out in SS5/16. Firms should also be aware of the requirements set out in the Risk Control, General Organisational Requirements, and the Remuneration Part of the PRA Rulebook.

- 15/04/2021

3.17

The control environment in new and growing banks is usually untested at the point of authorisation and often lags behind their business ambitions. Banks should ensure they regularly assess whether their controls remain fit for purpose in the context of changes to the business, and whether there is a clear framework for risk identification, management and mitigation. This should take into consideration: the adequacy of technical knowledge across all lines of defence; the ability of the second and third lines to provide independent challenge; whether stress testing and downside risk analysis have sufficient prominence in decision making and key management documents; and whether the business can produce accurate data and management information.

- 15/04/2021

3.18

By around three years post-authorisation, the PRA expects that banks will still be testing and refining their risk management framework, but that it is fit for purpose. Banks should prioritise developing controls for their most material risks. The PRA expects banks to have a mature control environment by five years post-authorisation, which includes a fully embedded risk management framework linked to a stable business model, which provides a forward looking view across all risk types. By this stage, the Internal Liquidity Adequacy Assessment Process (ILAAP), Internal Capital Adequacy Assessment Process (ICAAP), recovery plan and other significant regulatory and business documents should be robust documents which are an integral part of the firm’s business processes and decision making, with evidence of input and challenge from across the business.

- 15/04/2021

3.19

Different business models have different risk profiles and as such the PRA’s expectations of a bank’s control environment will vary depending on the extent and type of business and the risk to which that bank is exposed. Banks should ensure their risk management framework is tailored to the institution’s risk profile and that it takes into account the PRA’s rules and expectations, including those relating to liquidity, operational risk and outsourcing.

- 15/04/2021

Outsourcing

3.20

New and growing banks frequently tend to rely more extensively on outsourcing and third-party products and services given the benefits they can bring in terms of lower barriers to entry, cost savings, and in some cases increased operational resilience. The PRA’s existing requirements and expectations on outsourcing and related areas such as business continuity, as well as SS2/21 ‘Outsourcing and third party risk management’,[56] are therefore of particular relevance to new and growing banks.

- 01/10/2025

3.21

In particular, any banks whose business model relies extensively on outsourced service providers and other third-parties should demonstrate, at the point of authorisation and on an ongoing basis thereafter, that they will retain an appropriate governance and internal control framework and adequate non-financial resources, and will not operate as ‘empty shells’. In addition, where a bank relies extensively on outsourcing and other third-party arrangements, the PRA will place increased emphasis on ensuring that its risk management function has appropriate and sufficient skilled resources to manage the risks in these arrangements, and that effective governance arrangements are in place to ensure appropriate oversight.

- 15/04/2021

4

Capital expectations of new and growing banks

4.1

Poor capital management is a common theme across new and growing banks, with such banks often leaving it to the last minute before securing the investment needed to continue operating without entering capital buffers. This can result in banks entering their capital buffers in the usual course of business, which is not in line with PRA policy, or the need to seek additional capital investment under challenging circumstances, which can act as a significant distraction for management.

- 15/04/2021

4.2

The PRA’s expectations in relation to all UK incorporated firms, including new and growing banks, are that firms should maintain appropriate capital resources, both in terms of quantity and quality, consistent with their safety and soundness and taking into account the risks to which they are exposed. Having enough capital of sufficiently high quality reduces the risk of a firm becoming unable to meet the claims of its creditors, and is crucial for maintaining depositor confidence.

- 15/04/2021

4.3

The PRA recognises that new and growing banks need time to become profitable and that, consequently, new banks are typically dependent on external capital support to meet required growth targets and to help absorb early losses. A bank should prudently consider potential headwinds and ensure that it has sufficient capital to withstand these, including the possibility that profitability takes longer to achieve than expected. The loss or delay of external capital support is a frequent contributor to new bank business models becoming distressed and growth targets being missed.

- 15/04/2021

4.4

As first articulated in the 2013 report, new banks should also hold sufficient capital resources to meet Pillar 1 (P1), Pillar 2A (P2A), and buffers for at least the 12 months following exit from mobilisation (or upon authorisation if a firm does not follow the mobilisation route). This is in addition to meeting actual capital requirements, buffers and, if applicable (subject to the resolution strategy) any MREL above TCR. This is intended to avoid the significant management distraction involved in seeking external capital support in a bank’s first year of operation, recognising these banks are likely to have few recovery options and a high rate of capital erosion.

- 15/04/2021

4.5

Beyond this, banks should continue to manage their capital position on a sufficiently forward looking basis to avoid the need for emergency actions in order to prevent capital requirements plus buffers from being entered. Banks should set a clear risk tolerance for delays to capital raising plans, including consideration of Board approved triggers for the implementation of management actions designed to preserve capital headroom. Where a bank’s access to external capital is exposed to enhanced risk (i.e. because there are limited sources of capital or because investors demand capital instruments with complex features), banks should consider building additional contingencies and management actions into their capital plans in order to mitigate these risks. If the PRA observes evidence of ineffective capital planning, supervisory intensity will increase including consideration of whether further action is required (see paragraph 4.13). If the issue persists, the PRA’s focus will ultimately shift towards ensuring the business can exit the market in an orderly manner (see Chapter 5).

- 15/04/2021

Calculation of the New Bank PRA buffer

4.6

The PRA buffer (also referred to as Pillar 2B) is an amount of capital banks should maintain in addition to their TCR and the combined buffers. The PRA buffer for established banks is calculated based on the amount of capital needed to remain above TCR under a severe but plausible stress scenario.[57] For new and growing banks, the amount of capital needed to survive such a scenario would generally be very large, as it would need to cover: ongoing losses; Risk Weighted Assets (RWA) growth associated with continued business expansion; additional losses arising from the stress scenario; and limited access to external capital because of the adverse market conditions. This could give rise to a disproportionate level of capital relative to the financial stability risks posed by new banks, as these banks should be able to exit the market easily if required.

Footnotes

- 57. See Chapter 9 of PRA SoP ‘the PRA’s methodologies for setting Pillar 2 capital’: October 2021: https://www.bankofengland.co.uk/prudential-regulation/publication/2015/the-pras-methodologies-for-setting-pillar-2-capital.

- 01/10/2025

4.7

In recognition of this, an alternative approach to calculating the PRA buffer for new banks was first introduced in 2013 based on the bank’s estimate of wind down costs. Banks have taken different approaches to calculating this so the PRA has clarified the purpose of the buffer and adopted a simpler approach to its calculation. The PRA buffer for new and growing banks is calibrated to allow banks time to find alternative sources of capital or make business model adjustments, in the event of a loss of investor support. The PRA is of the view that a reasonable amount of time to allow for banks to pursue alternative options is around six months. Therefore banks are expected to calibrate their PRA buffer to be equal to six months projected operating expenses, defined as those expenses associated with the day to day running of the business.

For the purposes of the PRA buffer, the calculation of operating expenses should include:

administrative expenses (comprising staff and other administrative expenses), depreciation (of property, plant and equipment), and depreciation of investment properties, other operating expenses and expenses of share capital repayable on demand.

- 15/04/2021

Table 3: Expense category and FINREP 2 line item

| Expense category | FINREP 2 line item |

|---|---|

| Expenses on share capital repayable on demand |

150 |

| Other operating expenses |

350 |

| Staff expenses |

370 |

| Other administrative expenses |

380 |

| Depreciation: Property, Plant and Equipment |

400 |

| Depreciation: Investment Properties |

410 |

- 15/04/2021

4.8

The operating expenses methodology for calibrating the PRA buffer is applicable to banks which have:

- been operating for five years or less since being authorised without restriction; and

- yet to achieve a profit over a full year of trading.

- 15/04/2021

4.9

The buffer calculation should appear within the bank’s ICAAP with the projection covering the six months after the ICAAP reference date.[58] These projections should align with the bank’s business plan and may be subject to challenge by the PRA.

Footnotes

- 58. To clarify, after the first 12 months of operation, the ICAAP Pillar 2A assessment should be based on an actual balance sheet. The assessment should be forward looking and should consider risks that may emerge over a 12 month horizon, but the TCR assessment should be calculated based on an actual balance sheet.

- 01/10/2025

4.10

Interaction between the PRA buffer and the Capital Conservation buffer (CCoB) remains the same. To avoid double counting between the buffers, the component of the PRA buffer that relates to operating expenses is calculated as the excess amount of capital required over and above the CCoB. The Countercyclical Capital buffer is not part of this calculation.

- 15/04/2021

4.11

As the buffer for new banks is not calibrated on the basis of a stress test, it does not necessarily provide sufficient capital for banks to survive a stress or execute a solvent exit. If a new or growing bank enters its buffer and is unable to restore its capital position or continues to erode capital, this may lead to the bank having to be resolved, subject to the statutory conditions being met. The boards of new and growing banks should be cognisant of this when setting their internal capital risk appetite.

- 01/10/2025

4.12

When exercising its supervisory judgement, the PRA may, in exceptional circumstances, diverge from the stated approach to calculating the PRA buffer for new and growing banks, for instance where the stated approach does not achieve the intended outcome of avoiding a disproportionate level of capital relative to financial stability risks. Such divergence could also include instances where the PRA identifies heightened risks to its objectives which justify an earlier transition to the PRA buffer in line with established banks.

- 15/04/2021

Capital Management

4.13

Banks should manage their capital position on a forward looking basis and, as outlined in SS31/15, should not use their PRA buffer in the normal course of business or enter into it as part of their base business plan. Where capital injections are needed, these should take place sufficiently in advance to avoid entering buffers. Responsibilities for the management of the bank’s capital position should be clearly defined in accordance with the Senior Managers Regime.

- 15/04/2021

4.14

Use of the PRA buffer is not in itself a breach of capital requirements or Threshold Conditions (see 5.33 of SS31/15). However given the speed of capital depletion that is often experienced by new and growing banks, if such banks expect to enter their PRA buffer, the board is expected to act quickly and decisively to address the problem, given the PRA buffer has not been calibrated to provide sufficient capital to survive a stress or execute a solvent exit.. A bank should notify the PRA as early as possible when it has identified it may need to use its capital buffer and explain how it plans to restore its buffer (see 5.34 and 5.35 of SS31/15).

- 01/10/2025

4.15

The PRA will undertake more intensive supervision if it becomes clear that a bank does not have a sufficiently forward looking approach to capital management and will consider whether further action should be taken. This may include the application of a risk management and governance scalar to reflect poor capital management; the use of a skilled person review under Section 166 FSMA; and restrictions being placed on the business.

- 15/04/2021

Transition Arrangements and Stress Testing

4.16

The PRA’s approach for setting the PRA buffer is designed to support new banks in their early years of operation, and as such is time-limited. Once either of the conditions set out above (paragraph 4.8) no longer apply, the bank’s PRA buffer will be calibrated using the bank’s stress testing assessments, in line with established banks. However, as stated in paragraph 4.12, such an approach could be introduced earlier where the PRA identifies heightened risks to its objectives.

- 15/04/2021

4.17

From the point of authorisation, new and growing banks should undertake stress testing as part of their ICAAP and business planning process. Banks should invest in developing their stress testing capabilities to ensure they have sufficient understanding of downside risks, can assess unexpected loss events and, in due course, transition smoothly to having a PRA buffer set on a stress test basis.

- 15/04/2021

4.18

The ICAAP stress testing work should be proportionate to the scale of the bank, but should be adequate to allow calibration of the PRA buffer on a stress test basis. This will be subject to review and challenge as part of the capital Supervisory Review and Evaluation Process (SREP). Weaknesses in stress testing may be indicative of limitations in the bank’s risk management and governance capability. The PRA may apply a risk management and governance scalar if it concludes there are weaknesses in a bank’s risk management and governance capabilities.

- 15/04/2021

4.19

As part of their ongoing capital management, new and growing banks should monitor their capital position against the PRA buffer calibrated on the basis of stress testing, to understand how this differs from their position against the PRA buffer being set based on operating expenses. Banks should plan for transitioning to the stress test buffer including building sufficient capital to be able to meet the stress test buffer at the point of transition. The PRA will engage with a bank well ahead of this transition to ensure this is the case.

- 15/04/2021

4.20

The move to setting the PRA buffer based on stress testing may result in a sizeable increase in the amount of capital that a bank needs to hold. A plan for transitioning onto the stress testing approach will therefore be determined by the PRA dependent upon the circumstances, but usually this will be phased over two years to provide an incremental increase in the size of the buffer. If a bank does not have sufficient capital to meet the PRA buffer at the point of transition, as outlined in paragraph 4.14, it should notify the PRA as early as possible and explain how it plans to restore its buffer.

- 15/04/2021

Loss Absorbing Capacity

4.21

The Bank, as resolution authority, sets MREL for each institution. Should new banks meet the criteria for MREL in the first five years, for example by meeting thresholds for transactional accounts or providing critical functions to a scale, they will be granted a transition period. Firms are expected to plan for their MREL needs and reflect this in their capital planning.

- 15/04/2021

4.22

Banks should expect the PRA to investigate whether any firm in breach or likely breach of its MREL is failing, or likely to fail, to satisfy the Threshold Conditions, with a view to taking further action as necessary. However, a breach or likely breach by a firm of its MREL does not automatically mean that the PRA will consider the firm is failing, or likely to fail, to satisfy Threshold Conditions.[59]

Footnotes

- 59. PRA SS 16/16: ‘The minimum requirement for own fund and eligible liabilities (MREL) – buffers and Threshold Conditions, December 2020: https://www.bankofengland.co.uk/prudential-regulation/publication/2016/the-minimum-requirement-for-own-funds-and-eligible-liabilities-mrel-ss (3.2)

- 01/10/2025

4.23

The PRA expects firms to meet both MREL and maintain an amount of Common Equity Tier 1 (CET 1) capital that reflects their risk-weighted capital and leverage buffers (if applicable). The PRA expects firms not to double count CET1 towards both MREL and the amount reflecting the risk-weighted capital and leverage buffers (if applicable). While firms can meet MREL with CET1, they do not have to meet it with CET1.

- 15/04/2021

Capital Quality

4.24

As set out in SS7/13 ‘CRD IV and capital’[60] the PRA’s preference is for firms to adopt simple, plain vanilla share structures consisting of only one class of share that is fully subordinated to all other capital and debt, and has full voting rights and equal rights across all shares with respect to dividends and rights in liquidation. The PRA expects firms to refrain from features that may be ineffective (or less effective) in absorbing losses. For example, the PRA would expect firms to refrain from complex share structures, including transactions involving several legs or side agreements, where the same prudential objective can be achieved more simply. Complex features and structures complicate the prudential assessment and may also undermine instruments’ loss-absorbing properties.

Footnotes

- 60. September 2022: https://www.bankofengland.co.uk/prudential-regulation/publication/2013/crdiv-and-capital-ss (2.4).

- 01/10/2025

5

Orderly exit: recovery, solvent exit and resolution

5.1

The PRA’s approach to new and growing bank supervision aims to facilitate competition, in support of its secondary competition objective. Competitive markets involve firms being able to enter and exit. The PRA’s aim is not to avoid all instances of failure, but instead to work with firms and the Bank as resolution authority to make sure that banks progress from being a new and growing bank to becoming an established bank that would be able, if necessary, to exit in an orderly manner. This means without disruption to the financial system, interruption to the provision of critical functions or exposing public funds to loss. The orderly failure of a new or growing bank at an early stage of its life is likely to have no or minimal impact on financial stability, and is a natural part of a competitive economy.

- 15/04/2021

5.2

The likelihood of failure is higher during the early years of a bank’s development.[61] Factors which may lead new and growing banks to fail include failure to obtain the required loss absorbing capacity or an inability to realise their business model. Many new and growing banks operate in highly competitive markets and many have novel and untested business plans; this facilitates innovation and competition but not all may prove to be viable. Coupled with this, new and growing banks may have fewer recovery options available to them than established banks, meaning it is crucial they make preparations to exit the market in an orderly way, if required.

Footnotes

- 61. This is common across industries, see for example P.A. Geroski, What do we know about entry?, International Journal of Industrial Organization 13 (1995) 421-441, or Kücher et al, Firm age dynamics and causes of corporate bankruptcy: age dependent explanations for business failure, Review of Managerial Science (2020) 14:633-661.

- 01/10/2025

5.3

[deleted]

- 01/10/2025

5.3A

A bank may discontinue its businesses (whether in part or in full) via the following routes:

- Recovery: a firm implements recovery options such as asset sales and disposal options to maintain or restore its viability or financial position following a significant deterioration of its financial situation.

- Solvent exit: a firm ceases its PRA-regulated activities while remaining solvent. The firm should transfer or repay (or both) all deposits as part of its solvent exit.

- Resolution: a firm enters into the resolution regime.[62]

Footnotes

- 62. Entry into the resolution regime is triggered if a bank is judged by the PRA to be failing or likely to fail and by the Bank of England that it is not reasonably likely, having regard to timing and other circumstances, action will be taken that will result in the firm no longer failing or likely to fail.

- 01/10/2025

Recovery plans

5.4

New and growing banks should have credible recovery plans which are sufficiently detailed and practical to ensure they reflect the complexity and size of the firm and would be useable in a stress. Recovery plans are important for all firms; for new and growing banks which may have additional vulnerabilities to stress, a robust recovery plan ensures the bank is aware of the range of recovery options available, the impacts and limitations of these actions, and ensures that management actions can be undertaken in a timely manner. However, the PRA recognises new banks have a more limited range of recovery options.

- 15/04/2021

5.5

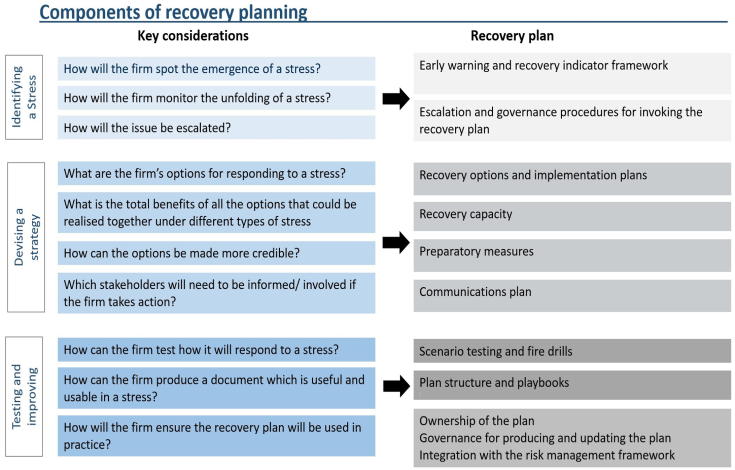

The PRA has observed that recovery plans produced by many new and growing banks can initially be unrealistic and would not be useful in a stress. Boards of new and growing banks should ensure the bank’s recovery plan is relevant, credible, and executable in a severe stress. Banks should consider the components of recovery planning shown in the chart below, and ensure these are covered in their recovery plan, as well as consulting PRA recovery planning Policy. [63]

Footnotes

- 63. See SS9/17 for more information on recovery planning: https://www.bankofengland.co.uk/prudential-regulation/publication/2017/recovery-planning-ss.

- 01/10/2025

Figure 2: Components of recovery planning

- 15/04/2021

Solvent exit planning

5.6

[deleted]

- 01/10/2025

5.7

[deleted]

- 01/10/2025

5.8

[deleted]

- 01/10/2025

5.9

[deleted]

- 01/10/2025

5.10

[deleted]

- 01/10/2025

5.6A

According to Chapter 7 of the Recovery Plans Part of the PRA Rulebook, a firm should prepare for solvent exit so that, if the need arises, it can effect a solvent exit in an orderly manner. As set out in SS2/24 – ‘Solvent exit planning for non-systemic banks and building societies’,[64] a firm should produce a ‘solvent exit analysis’ as part of its business-as-usual activities; and a ‘solvent exit execution plan’ when solvent exit becomes a reasonable prospect.

- 01/10/2025

5.7A

A new and growing bank should have in place clear governance arrangements for solvent exit preparations. The Board is expected to play a key role in the approval of solvent exit analysis decision-making to initiate a solvent exit and monitoring of its execution. The PRA expects banks to engage with their supervisor at an early stage on decisions to execute (or not to execute) solvent exit actions.

- 01/10/2025

5.8A

The PRA expects banks to have in place preparations for a solvent exit approved by the Board at the point of authorisation (or exit from mobilisation). A bank should review and update its solvent exit analysis to ensure it remains appropriate as the business develops.

- 01/10/2025

5.9A

A bank should refer to Chapter 2 of SS2/24 – ‘Solvent exit planning for non-systemic banks and building societies’, which sets out the PRA’s expectations for how a firm should prepare for a solvent exit. The level of detail in the solvent exit analysis should be proportionate to the nature, scale, and complexity of the firm. A firm may find it helpful to include the solvent exit analysis as a discrete section in its recovery plan. The firm can also decide to set out the solvent exit analysis separately if the firm finds it appropriate.

- 01/10/2025

Box 2 [deleted]

- 01/10/2025

Resolution

5.11

A series of conditions must be met before a bank may be placed into resolution (together, the resolution conditions). The first two resolution conditions are most relevant to new and growing banks. First, the bank must be deemed ‘failing or likely to fail’. This includes where a bank is failing or likely to fail to meet its threshold conditions in a manner that would justify the withdrawal or variations of authorisation.[65] This assessment is made by the PRA. The second condition is that it must not be reasonably likely that action will be taken – outside resolution – that will result in the bank no longer failing or being likely to fail. Such actions could include the bank’s recovery actions. This assessment is made by the Bank, as resolution authority, having consulted the PRA, FCA and HM Treasury. The conditions for entry into the regime are designed to strike a balance between, on the one hand, avoiding placing a bank into resolution before all realistic options for a private sector solution have been exhausted and, on the other, reducing the chances of an orderly resolution by waiting until it is technically insolvent.

Footnotes

- 65. The ‘threshold conditions’ include that the bank must have: adequate resources to satisfy applicable capital and liquidity requirements; appropriate resources to measure, monitor and manage risk; and fit and proper management who conduct business prudently – see Sections 55B-55D and Schedule 6 of the Financial Services and Markets Act 2000: https://www.legislation.gov.uk/ukpga/2000/8/contents.

- 01/10/2025

5.12

The Bank sets preferred resolution strategies for all banks. For smaller banks that do not supply transactional accounts or other critical functions to a scale likely to justify the use of resolution tools, the preferred resolution strategy is the applicable insolvency procedure. Usually, this is the Bank Insolvency Procedure (BIP).[66] Under this, the bank’s business and assets are sold or wound up after covered depositors have been paid by the Financial Service Compensation Scheme (FSCS) or had their account transferred by the liquidator to another institution using FSCS funds. BIP is likely to be the preferred resolution strategy for most new and growing banks.

Footnotes

- 66. Or other modified insolvency procedures depending on the type of firm, i.e. the building society insolvency procedure (BSIP) for building societies or the special administration regime (SAR) for investment firms. In some specific circumstances, and if a firm does not hold FSCS covered deposits, a corporate insolvency may be more appropriate.

- 01/10/2025

5.13

In order to support orderly resolution, banks must maintain a single customer view and exclusions file, [67] and are required to provide this to the PRA or FSCS within 24 hours of a request.[68] Banks’ systems must automatically identify the amount of covered deposits payable to each depositor and identify any portion of an eligible deposit that is over the specified coverage level.[69]

Footnotes

- 67. The exclusions file that firms are required to provide should include data on deposits which are not in the SCV including for example deposits held in client accounts and deposit aggregators.

- 68. Depositor Protection Part of the Rulebook: https://www.prarulebook.co.uk/rulebook/Content/Part/213751 (12.2).

- 69. Depositor Protection Part of the Rulebook: https://www.prarulebook.co.uk/rulebook/Content/Part/213751 (12.7).

- 01/10/2025

5.14

As a bank grows, the Bank can change its preferred resolution strategy to either a partial transfer or a bail-in resolution strategy. Banks should be aware of the PRA’s and the Bank’s Resolvability Assessment Framework (RAF) and, as part of their forward planning, anticipate when their preferred resolution strategy may change and when they will come into scope of different policies, for example the MREL[70] or operational continuity in resolution (OCIR).[71] [72] Banks should plan for this well in advance and consider how they will transition to meet these policies.

Footnotes

- 70. December 2021: https://www.bankofengland.co.uk/paper/2018/boes-approach-to-setting-mrel-2018.

- 71. SS4/21 May 2021: https://www.bankofengland.co.uk/prudential-regulation/publication/2016/ensuring-operational-continuity-in-resolution-ss.

- 72. Operational Continuity Part of the PRA Rulebook: http://www.prarulebook.co.uk/rulebook/Content/Part/320890.

- 01/10/2025

Box 3 [deleted]

- 01/10/2025

6

The PRA’s approach once banks become established

6.1

As banks move beyond five years of operation and transition out of the ‘growing’ phase and into ‘established’ bank status, the PRA expects banks to reach a level of maturity where they can confidently demonstrate that they have a settled business model, are profitable or have a credible strategy to achieve profitability supported by capital, a fully embedded risk management framework, and a well-developed governance structure.

- 15/04/2021

6.2

Many banks operate without meriting a change in supervisory or preferred resolution strategy by maintaining relatively static risk profiles. The PRA does not have a preference as to where a bank chooses to define its risk appetite. The PRA is primarily focussed on the potential impact a bank might have on financial stability along with its financial resources and its ability to maintain an appropriate governance and risk management framework to match its chosen risk appetite. At certain points in a bank’s growth, regulatory requirements increase and banks can expect to be captured by more policy thresholds including those listed in Table 4. It is the bank’s responsibility to monitor the various policy thresholds and ensure that the firm is able to meet those requirements.

- 15/04/2021

A path to further growth and positive regulatory engagement as an established bank (Five+ years)

6.3

Many banks choose to change their risk appetites and adjust their business models as they develop. The PRA is not averse to such business decisions and recognises the rationale for such moves. However, a key aspect to a positive regulatory relationship is being open with the PRA about intentions to adjust risk profiles. Any such changes should be well thought through and communicated to the PRA in a timely manner. Through this approach the PRA can provide feedback where appropriate and be aware of a bank’s anticipated change, adjusting its expectations and approach accordingly. Both parties benefit strongly from such an approach.

- 15/04/2021

6.4

It is in cases where banks have not been open with the regulators, have not anticipated the need to increase control requirements, and not demonstrated the capability to apply these controls that the PRA has needed to implement its enforcement or statutory supervisory powers.[73] This could include varying an authorised bank’s permissions or requiring a bank to undertake or stop an action.

- 01/10/2025

Plan for regulatory policy thresholds and associated requirements

6.5

The PRA has aimed to design its regulatory approach in a proportionate manner. Accordingly, as banks increase the scale and complexity of their operations, it is likely they will have greater impact on financial stability creating a greater regulatory responsibility.

- 15/04/2021

6.6

The PRA includes thresholds in policies which are designed to ensure that regulations are only applied to firms when necessary (table 3). It is important for banks to anticipate within their business plans when they expect to be captured by regulatory thresholds and measure the impact. When a material impact is projected this should be discussed with the PRA. This open dialogue benefits both the PRA and the banks it supervises through avoiding unnecessary surprises and unintended consequences. It is also in keeping with the PRA’s aim to be forward looking. As set out in the approach documents, when established banks increase their financial stability impact (which might be consistent with them being captured by an increasing number of regulatory thresholds) the PRA and the Bank will also consider proportionately increasing its respective supervisory and resolution planning intensity.

- 15/04/2021

6.7

In recognising the impact of some of these regulatory requirements, the PRA has taken action to ensure any transition is proportionate and not unduly burdensome. In addition, the PRA regularly considers the impact of regulatory policy, implementing adjustments where policies do not achieve their intended objective. For example the PRA has taken various steps, to mitigate aspects of the capital regime which have been regarded as disadvantageous for non-systemic banks. The PRA publishes an annual competition report where greater detail can be found regarding these initiatives.[74] Such actions have included:

- Introducing the updated P2A refined approach to Pillar 2A capital; and [75] [76]

- Implementing policies to facilitate internal rating based (IRB) model applications from smaller banks.[77] [78]

Footnotes

- 74. https://www.bankofengland.co.uk/prudential-regulation/secondary-competition-objective.

- 75. Policy Statement 22/17 ‘Refining the PRA’s Pillar 2A capital framework’, October 2017 https://www.bankofengland.co.uk/prudential-regulation/publication/2017/refining-the-pra-pillar-2a-capital-framework.

- 76. https://www.bankofengland.co.uk/prudential-regulation/publication/2020/pra-annual-report-2019-20.

- 77. Annual Competition Report 2019-20 (page 47): https://www.bankofengland.co.uk/prudential-regulation/publication/2020/pra-annual-report-2019-20.

- 78. October 2017: https://www.bankofengland.co.uk/prudential-regulation/publication/2017/internal-ratings-based-approach-clarifying-pra-expectations.

- 01/10/2025

Recognise challenge - open to solutions

6.8

The PRA is committed to executing its duties in line with its objectives. The PRA welcomes feedback regarding the impact of its policies and supervisory approach on banks. The PRA further welcomes proposals from banks regarding how the PRA can best achieve its objectives. While it is banks’ responsibility to navigate their own challenges, the PRA is committed to being open to working with banks to find solutions to overcome difficulties including being willing to adapt its supervisory approach where a solution is in line with its objectives.

- 15/04/2021

Table 4: A sample of PRA regulatory thresholds

| Size/Threshold value | Threshold measure | Threshold applies to | Reference |

|---|---|---|---|

| Is or exceeds £100 million |

Regulated mortgage contracts value per annum |

Housing – Application provision |

The Housing Part of the PRA Rulebook[79] |

| Exceeding £250 million |

Average total gross assets |

General Organisational requirements - Whistleblowing – Application provision |

The Whistleblowing Part of the PRA Rulebook[80] |

| Exceeds either £1 billion or 5% |

Exposure to ‘higher-risk’ sovereigns and institutions |

Exposures to ‘higher risk’ sovereigns and institutions (IRB) |

SS11/13 (IRB) approaches[81] |

| Greater than £5 billion |

Total assets |

Regulatory Reporting - Capital + reports – Application provision |

Capital+ Reports Part of the PRA Rulebook[82] |

| Equal to or in excess of £10 billion |

Business area or division gross total assets gross total assets |

Senior Management Functions – Executive – Application provision |

The Senior Management Functions – Executive Part of the PRA Rulebook[83] |

| Not exceeding £13 billion |

Average total assets |

Remuneration – proportionality level three |

SS2/17 Remuneration[84] |

| Exceeding £13 billion but not exceeding £50 billion |

Average total assets |

Remuneration - proportionality level two |

SS2/17 Remuneration |

| £25 billion |

Core deposits |

Ring-fenced bodies |

SS8/16 Ring-fenced bodies (RFBs)[85] |

| Equal to or greater than £50 billion |

Retail deposits |

Regulatory Reporting - Capital + reports - Application provision |

Capital + Reports Part of the PRA Rulebook[86] |

| Greater than £50 billion |

Total retail deposits |

Stress-testing (Annual Cyclical Scenario) |

The Bank’s approach to stress testing[87] |

| Balance sheet total |

Written auditors report to PRA |

The Auditors Part of the PRA Rulebook[88] |

|

| Exceeding £50 billion |

Average total assets |

Various remuneration requirements including proportionality level 1 |

The Remuneration Part of the PRA Rulebook,[8][9] SS2/17 Remuneration |

| Meets the Small Domestic Deposit Takers (SDDT) criteria and (if applicable) the SDDT consolidation entity criteria |

The measures contained in the SDDT criteria and SDDT consolidation entity criteria |

Prudential requirements for SDDTs |

SDDT Regime – General Application[90] |

Footnotes

- 79. http://www.prarulebook.co.uk/rulebook/Content/Part/211178 (1.7).

- 80. http://www.prarulebook.co.uk/rulebook/Content/Chapter/307285 (2A.1).

- 81. October 2017: https://www.bankofengland.co.uk/prudential-regulation/publication/2013/internal-ratings-based-approaches-ss (6.3).

- 82. http://www.prarulebook.co.uk/rulebook/Content/Chapter/331360 (20.10).

- 83. http://www.prarulebook.co.uk/rulebook/Content/Chapter/212478 (3.6A).