5

Situations where the quality of capital is undermined by a guarantee

5.1

Two situations where the quality of capital is undermined by a subordinated guarantee are set out below. They are designed to be illustrative of the issue which this statement addresses, but they are not the only possible examples.

- 30/09/2019

5.2

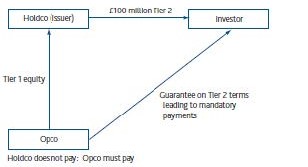

The first example describes a situation where a holding company (Holdco) issues a Tier 2 capital instrument to investors. Holdco owns an operating company (Opco) by virtue of holding 100% of its equity share capital (Figure A).

Figure A Simple structure where the quality of capital is undermined

- 30/09/2019

5.3

The issuer is purely a holding company and relies on the dividends of Opco to pay the coupons due to the holders of the Tier 2 subordinated debt instrument. Furthermore, the contract governing the debt instrument provides that Opco will guarantee the coupon payments and principal.

- 30/09/2019

5.4

The economic effect of the arrangement is that Opco is liable for the Tier 2 debt instrument. The quality of Opco’s capital is undermined as it has a potential liability to the investors in the capital instrument issued by Holdco.

- 30/09/2019

5.5

As such, in reporting its regulatory capital on a solo basis, Opco should disqualify £100 million of its Tier 1 capital. The amount may still count towards a lower tier of capital if the terms of the subordinated guarantee meet all of the relevant criteria.

- 30/09/2019

5.6

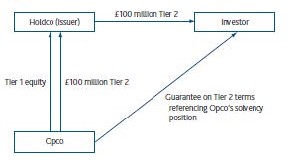

A more complicated example is illustrated in Figure B. The structure is broadly similar to Figure A, but there is an additional internal Tier 2 instrument issued by Opco to Holdco. The coupon payments on the internal instrument could be seen to support the coupon payments on the instrument issued by Holdco to the market.

Figure B Complex structure with internal instrument

- 30/09/2019

5.7

In this example, it will depend on the precise contractual arrangements of the internal instrument and the subordinated guarantee as to whether two sets of liabilities can be assumed by Opco.

- 30/09/2019

5.8

Disqualification of Opco’s Tier 1 capital is not required if, when the subordinated guarantee is called upon, the guarantee effectively extinguishes or replaces the existing subordinated liability arising from the internal Tier 2 instrument. The subordinated guarantee should possess the same, or better, features regarding quality of capital (eg loss absorbency and subordination) as the subordinated liability it is replacing.

- 30/09/2019

5.9

The above examples are not the only ones where the situation arises. This statement applies to any arrangement where a firm has guaranteed, on a subordinated basis, a regulatory capital instrument issued by another entity.

Table A Summary table of important actions and dates [deleted]

[Table A is deleted]

- 30/09/2019