9

Interest Risk Arising from Non-Trading Book Activities

General requirements

9.1

A firm must implement systems to identify, evaluate and manage the risk arising from potential changes in interest rates that affect a firm’s non-trading activities including the risks of such changes impacting either or both of the following:

- (1) the economic value of the firm's non-trading activities;

- (2) the earnings in respect of the firm's non-trading activities.

[Note: Art 84 of the CRD]

- 31/12/2021

9.1A

A firm must in addition implement systems to monitor and assess credit spread risk in respect of its non-trading activities.

- 31/12/2021

9.1B

As an alternative to implementing internal systems under 9.1(1), and only where appropriate to its nature, size and complexity as well as business activities and overall risk profile, a firm may elect to implement the standardised framework set out in 9.13 to 9.43 to identify, evaluate and manage the risk arising from potential changes in interest rates that affect the economic value of the firm’s non-trading activities.

- 31/12/2021

9.1C

- 31/12/2021

9.2

- 31/12/2021

9.3

- 31/12/2021

9.4

[Deleted.]

- 31/12/2021

9.4A

A firm must regularly carry out an evaluation in respect of the interest rate shock scenarios in 9.7 and immediately notify the PRA if any evaluation under this rule indicates that, as a result of the application of the interest rate scenarios in 9.7, the EVE would decline by more than 15% of the sum of its common equity tier one capital and its additional tier one capital.

- 31/12/2021

9.5

A firm must carry out the evaluation under 9.2 as frequently as necessary for it to be reasonably satisfied that it has at all times a sufficient understanding of the degree to which it is exposed to the risks referred to in 9.2 and the nature of that exposure. In any case it must carry out those evaluations no less frequently than once a year.

[Note: Art 98(5) of the CRD]

- 01/01/2014

9.6

A firm’s management body must oversee and approve the firm’s risk appetite and risk management framework for managing interest rate risk from non-trading book activities.

- 31/12/2021

Interest rate shock scenarios

9.7

For the purposes of the evaluation in 9.4A, a firm must apply the following prescribed interest rate scenarios to all material currencies as determined in 9.8:

scenario 0: current interest rates;

scenario 1: parallel shock up;

scenario 2: parallel shock down;

scenario 3: steepener shock (short rates down and long rates up);

scenario 4: flattener shock (short rates up and long rates down);

scenario 5: short rates shock up; and

scenario 6: short rates shock down.

- 31/12/2021

9.8

For the purposes of 9.7 and 9.15, a firm shall determine which currencies are material currencies using the following tests:

- (1) each currency that has non-trading book assets in that currency more than 5% of total non-trading book assets shall be a material currency;

- (2) where the sum of non-trading book assets in material currencies as identified under (1) does not exceed 90% of total non-trading book assets, a firm must select additional currencies to be deemed material currencies such that the sum of non-trading book assets in material currencies as identified under (1) and (2) is at least 90% of total nontrading book assets;

- (3) each currency that has non-trading book liabilities in that currency more than 5% of total non-trading book liabilities shall be a material currency; and

- (4) where the sum of non-trading book liabilities in material currencies as identified under (3) does not exceed 90% of total non-trading book liabilities, a firm must select additional currencies to be deemed material currencies such that the sum of nontrading book liabilities in material currencies as identified under (3) and (4) is at least 90% of total non-trading book liabilities.

- 31/12/2021

9.9

For the interest rate scenarios specified in 9.7, a firm shall determine the change to interest rates in accordance with the following formulae:

| for scenario 0: | ΔRc(tk) | = | 0 |

| for scenario 1: | ΔRc(tk) | = | + |

| for scenario 2: | ΔRc(tk) | = | — |

| for scenario 3: | ΔRc(tk) | = | —0.65 . |ΔRshort,c(tk)| + 0.9 . |ΔRlong,c(tk)| |

| for scenario 4: | ΔRc(tk) | = | +0.8 . |ΔRshort,c(tk)| — 0.6 . |ΔRlong,c(tk)| |

| for scenario 5: | ΔRc(tk) | = | +ΔRshort,c(tk) |

| for scenario 6: | ΔRc(tk) | = | —ΔRshort,c(tk) |

Where:

c = the index that denotes currency;

k = the index that denotes the buckets in accordance with Table 2 in 9.17 below;

tk = the bucket midpoint of bucket k, measured in years;

ΔRc(tk) = the change in interest rate at the point tk for currency c;

= the prescribed parallel interest rate shock for currency c determined in accordance with column two of Table 1 in 9.11;

ΔRshort,c(tk) = the change in short interest rate at the point tk for currency c determined in accordance with the formulae in 9.10; and

ΔRlong,c(tk) = the change in long interest rate at the point tk for currency c determined in accordance with the formulae in 9.10.

- 31/12/2021

9.10

For the purposes of 9.9, a firm shall determine the value of ΔRshort(tk) and ΔRlong(tk) in accordance with the following formulae:

- (1) for ΔRshort,c(tk): ΔRshort,c(tk) = +Rshort,c_ . e

- (2) for ΔRlong,c(tk): ΔRlong,c(tk) = +Rlong,c . (1 – e

)

- Where:

- c = the index that denotes currency;

- k = the index that denotes the buckets in accordance with Table 2 in 9.17 below;

- e = the mathematical constant that is the base of the natural logarithm;

- x = 4;

- tk = the bucket midpoint of bucket k, measured in years;

- ΔRshort,c(tk) = the change in short interest rate at the point tk for currency c;

- ΔRlong,c(tk) = the change in long interest rate at the point tk for currency c;

= the prescribed short interest rate shock for currency c determined in accordance with column three of Table 1 in 9.11; and

= the prescribed long interest rate shock for currency c determined in accordance with column four of Table 1 in 9.11.

- 31/12/2021

9.11

For the purposes of 9.9, the interest rate shock scenarios for individual currencies are those in Table 1 below:

Table 1. Specified size of interest rate shocks for each currency (bps)

| Currency | Parallel | Short | Long |

| ARS | 400 | 500 | 300 |

| AUD | 300 | 450 | 200 |

| BRL | 400 | 500 | 300 |

| CAD | 200 | 300 | 150 |

| CHF | 100 | 150 | 100 |

| CNY | 250 | 300 | 150 |

| EUR | 200 | 250 | 100 |

| GBP | 250 | 300 | 150 |

| HKD | 200 | 250 | 100 |

| IDR | 400 | 500 | 350 |

| INR | 400 | 500 | 300 |

| JPY | 100 | 100 | 100 |

| KRW | 300 | 400 | 200 |

| MXN | 400 | 500 | 300 |

| RUB | 400 | 500 | 300 |

| SAR | 200 | 300 | 150 |

| SEK | 200 | 300 | 150 |

| SGD | 150 | 200 | 100 |

| TRY | 400 | 500 | 300 |

| USD | 200 | 300 | 150 |

| ZAR | 400 | 500 | 300 |

- 31/12/2021

9.12

- 31/12/2021

Standardised Framework

Calculating Loss in Economic Value

9.13

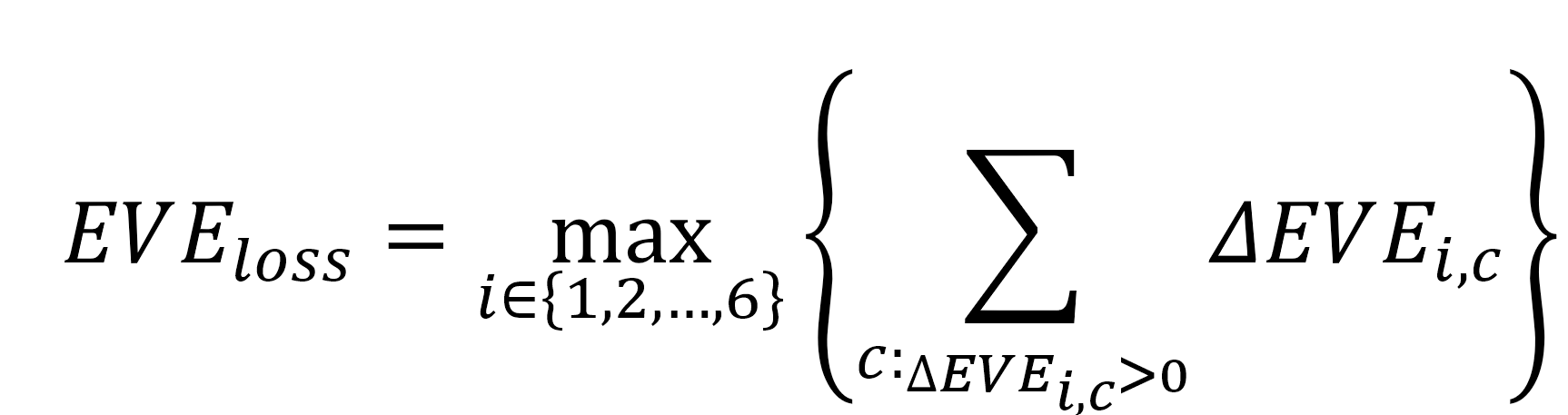

Using the standardised framework, a firm shall carry out the evaluation in 9.1(1) by calculating the loss in EVE (EV Eloss) in accordance with the following formula:

Where:

i = the index that denotes the interest rate shock scenarios in accordance with 9.15;

c = the index that denotes the material currencies in accordance with 9.15; and

ΔEV Ei,c = the change in economic value in currency c for interest rate scenario i as calculated in accordance with 9.14.

- 31/12/2021

9.14

For the purposes of 9.13, a firm must calculate the change in economic value in a given currency for a given interest rate scenario in accordance with the following formula:

ΔEV Ei,c = NA0i,c + KA0i,c

Where:

i = the index that denotes the interest rate shock scenarios in accordance with 9.15;

c = the index that denotes the material currencies in accordance with 9.15;

ΔEV Ei,c = the change in economic value in currency c for interest rate scenario i;

NA0i,c = the non-automatic option risk in currency c for interest rate scenario i as calculated in accordance with 9.16; and

KA0i,c = the automatic option risk in currency c for interest rate scenario i as calculated in accordance with 9.41.

- 31/12/2021

9.15

- 31/12/2021

9.16

For the purposes of 9.14, a firm must calculate the non-automatic option risk in currency c for interest rate scenario i (NA0i,c) in accordance with the following formula:

Where:

i = the index that denotes the interest rate shock scenarios in accordance with 9.15;

c = the index that denotes the material currencies in accordance with 9.15;

k = the index that denotes the buckets in accordance with Table 2 in 9.17;

DFi,c(tk) (respectively DF0,c(tk)) = the discount factor for bucket k in currency c for interest rate scenario i (respectively for interest rate scenario 0), calculated in accordance with 9.18; and

CFi,c(k) (respectively CF0,c(k)) = the net repricing cash flow for bucket k in currency c for interest rate scenario i (respectively for interest rate scenario 0), calculated in accordance with 9.19 to 9.40.

- 31/12/2021

9.17

For the calculation of discount factors and notional repricing cash flows in 9.18 and 9.19, a firm must project all notional repricing cashflows on to the following bucket intervals or bucket midpoints:

Table 2

| Time bucket intervals and mid points (M = months, Y = years) | |||

| Bucket number (k) | Bucket interval | Bucket midpoint | |

| Short-term rates | 1 | Overnight | 0.0028Y |

| 2 | > Overnight and <= 1M | 0.0147Y | |

| 3 | > 1M and <= 3M | 0.1667Y | |

| 4 | > 3M and <= 6M | 0.375Y | |

| 5 | > 6M and <= 9M | 0.625Y | |

| 6 | > 9M and <= 1Y | 0.875Y | |

| 7 | > 1Y and <= 1.5Y | 1.25Y | |

| 8 | > 1.5Y and <= 2 Y | 1.75Y | |

Medium-term rates |

9 | >2 Y and <= 3Y | 2.5Y |

| 10 | > 3Y and <= 4Y | 3.5Y | |

| 11 | > 4Y and <= 5Y | 4.5Y | |

| 12 | > 5Y and <= 6Y | 5.5Y | |

| 13 | > 6Y and <= 7Y | 6.5Y | |

Long-term rates |

14 | > 7Y and <= 8Y | 7.5Y |

| 15 | > 8Y and <= 9Y | 8.5Y | |

| 16 | >9 Y and <= 10Y | 9.5Y | |

| 17 | > 10Y and <= 15Y | 12.5Y | |

| 18 | > 15Y and <= 20Y | 17.5Y | |

| 19 | 20Y | 25Y | |

- 31/12/2021

9.18

- (1) For the purposes of 9.16, a firm must calculate the discount factor for bucket k in currency c for interest rate scenario i (DFi,c(tk)) in accordance with the following formula:

- Where:

- i = the index that denotes the interest rate shock scenarios in accordance with 9.15;

- c = the index that denotes the material currencies in accordance with 9.15;

- k = the index that denotes the buckets in accordance with Table 2 in 9.17;

- e = the mathematical constant that is the base of the natural logarithm;

- tk = the bucket midpoint of bucket k in accordance with Table 2 in 9.17; and

- Ri,c(tk)= subject to (2), the risk-free zero coupon rate at bucket midpoint tk in currency c for interest rate scenario i, including any commercial margin and other spread components.

- (2) A firm may elect to use the risk-free zero coupon rate Ri,c(tk) excluding commercial margin and other spread components, provided the firm either (i) implements a prudent and transparent methodology for deducting commercial margins and other spread components from the initial repricing cash flows CFα in 9.26 or (ii) determines that the effect of deducting commercial margins and other spread components is not material.

- 31/12/2021

9.19

In accordance with 9.21, 9.22, 9.23 and 9.24, a firm must assign each interest rate risk position arising from non-trading activities to one of the following categories:

category 1: automatic interest rate options;

category 2: non-maturing deposits;

category 3: fixed rate loans with retail borrowers that are subject to prepayment risk;

category 4: term deposits by retail depositors subject to early redemption risk; and

category 5: other positions.

- 31/12/2021

9.20

A firm must perform the allocation in 9.19 for all interest rate-sensitive non-trading book:

- (1) assets, excluding assets that are:

- (a) deducted from common equity tier one capital;

- (b) fixed assets, including real estate and intangible assets; or

- (c) equity exposures in the non-trading book;

- (2) liabilities, including all non-remunerated deposits and excluding common equity tier one capital; and

- (3) off-balance sheet items.

- 31/12/2021

9.21

Under 9.19, term deposits that satisfy either of the following conditions may be treated as other positions in 9.19:

- (1) the depositor has no legal right to withdraw the deposit; or

- (2) an early withdrawal results in a significant penalty that at least compensates for the loss of interest between the date of withdrawal and the contractual maturity date and the economic cost of breaking the contract.

- 31/12/2021

9.22

- 31/12/2021

9.23

- 31/12/2021

9.24

- 31/12/2021

9.25

- 31/12/2021

9.26

For each position, a firm must determine a set of initial repricing cash flows CFα as:

- (1) any repayment of principal;

- (2) any repricing of principal; and

- (3) any interest payment on a tranche of principal that has not yet been repaid or repriced.

- 31/12/2021

9.27

A firm must determine the set of initial repricing cash flows CFα for floating rate positions as:

- (1) a series of coupon payments until the next repricing; and

- (2) a par notional cash flow at the point of the next repricing.

- 31/12/2021

9.28

In accordance with 9.32 to 9.40 for each material currency c identified in accordance with 9.15 and for interest rate scenario i, a firm must allocate each notional repricing cash flow CFi,c to one of the buckets in Table 2 in 9.17 based on the repricing date, where repricing date means the date of each repayment, repricing or interest payment.

- 31/12/2021

9.29

- 31/12/2021

9.30

Where a firm chooses to apply the methodology in 9.29, that firm must:

- (1) split each initial repricing cash flow determined in 9.25, CFα such that:

- (a) the sum of the resulting two cash flows is equal to the initial repricing cash flow, CFα; and

- (b) the weighted average maturity of the resulting two cash flows equals the initial repricing cash flows’ maturity; and

- (2) document the methodology that the firm implements to split cash flows.

- 31/12/2021

9.31

- 31/12/2021

Non-maturing deposits

9.32

- 31/12/2021

9.33

For the purposes of 9.32(1) deposits made by small businesses, legal entities, sole proprietorships or partnerships managed as retail exposures provided the total aggregated liabilities are less than £877,000 may also be treated as retail deposits.

- 31/12/2021

9.34

For each category in 9.32, a firm must allocate each position to the following categories:

- (1) the core portion, consisting of deposits that are found to remain undrawn with a high degree of likelihood using data history of an appropriate length, and unlikely to reprice even under significant changes in the interest rate environment; and

- (2) the non-core portion, consisting of deposits not allocated to the core portion.

- 31/12/2021

9.35

For non-maturing deposits as determined in 9.34, the notional repricing cash flows in currency c for each interest rate scenario i, CFi,c, must be:

- (1) for the core portion, the initial notional repricing cash flows

in currency c for interest rate scenario i with the firm’s own estimates of tenors; and

- (2) for the non-core portion, the initial notional repricing cash flows

in currency c for interest rate scenario i with an overnight tenor.

- 31/12/2021

9.36

For the allocation in 9.34 and the calculation of CFi in 9.35, a firm must ensure that the proportion and average repricing date of core deposits is no greater than the caps in Table 3:

Table 3: Caps on core deposits

| Cap on proportion of core deposits (%) | Cap on average repricing date of core deposits (years) | |

| Transactional retail deposits (as referred to in 9.32(1)) | 90 | 5 |

| Other retail deposits (as referred to in 9.32(2)) | 70 | 4.5 |

| Other deposits (as referred to in 9.32(3)) | 50 | 4 |

- 31/12/2021

Fixed Rate Loans

9.37

For fixed rate loans with borrowers that are subject to prepayment risk as determined in 9.19, a firm must:

- (1) allocate each position to a single portfolio of homogeneous positions p denominated in a single currency c;

- (2) for each portfolio of homogeneous positions, determine and notify the PRA a baseline monthly conditional prepayment rate (

) in currency c under the current term structure of interest rates;

- (3) for each portfolio of homogeneous positions, determine the conditional prepayment rate in currency c for interest rate scenario i, (CPRi,c) in accordance with the following formula:

- where γi refers to the prescribed scalar multiplier for each interest rate shock scenarios given in Table 4 below.

Table 4

| Scenario number i | Interest rate shock scenarios | γi (scenario multiplier) |

| 0 | Current interest rates | 1 |

| 1 | Parallel up | 0.8 |

| 2 | Parallel down | 1.2 |

| 3 | Steepener | 0.8 |

| 4 | Flattener | 1.2 |

| 5 | Short rate up | 0.8 |

| 6 | Short rate down | 1.2 |

- (4) for each portfolio of homogeneous positions, determine the notional repricing cash flows CFi,c allocated to bucket 1 in accordance with Table 2 in 9.17, CFi,c(1), in accordance with the following formula:

- Where:

(1) = the initial repricing cash flows CFα for interest rate scenario i with tenor that corresponds to bucket 1 in accordance with Table 2 in 9.17; and

- Ni(0)= the notional currently outstanding before any repayments.

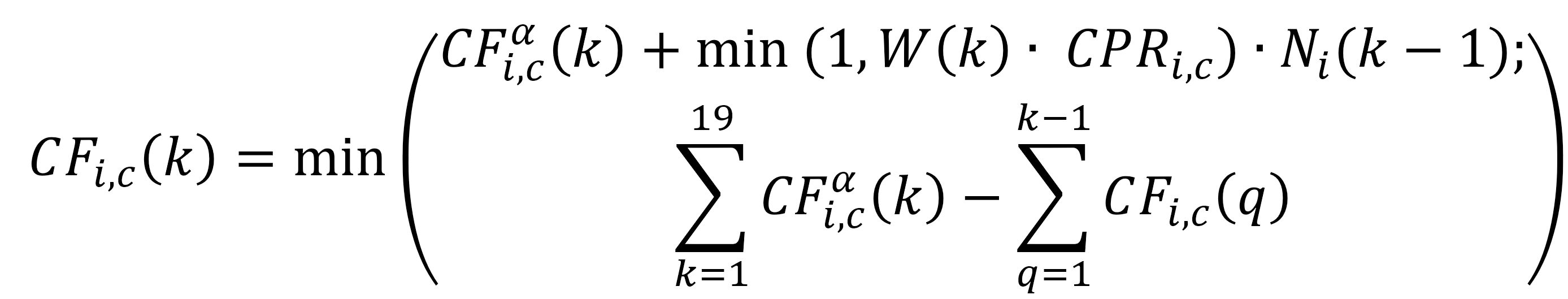

- (5) for each portfolio of homogeneous positions, determine the notional repricing cash flows CFi,c allocated to each bucket k in Table 2 where k > 1, CFi,c(k), in accordance with the following recursive formula:

- Where:

- k = the index that denotes the buckets in accordance with Table 2 in 9.17;

- W(k) = the width of bucket k measured in months and capped at 1200;

= the initial repricing cash flows CFα in currency c for interest rate scenario i with tenor that corresponds to bucket k;

- N(k – 1) = the notional outstanding after notional repricing cash flows in bucket k− 1 have transpired; and

= the sum of CFi determined for preceding buckets 1 to k − 1 .

- 31/12/2021

9.38

For the purpose of 9.37, firms may adjust the formulas in 9.37 (4) and (5) to reflect a base monthly conditional prepayment rate that varies over the life of each loan in the portfolio. In that case, it is denoted as for each time bucket k or time bucket midpoint tk in accordance with Table 2 in 9.17.

- 31/12/2021

Term Deposits Subject to Early Redemption Risk

9.39

For term deposits by depositors subject to early redemption risk as determined in 9.19, a firm must:

- (1) allocate each position to a single portfolio of homogeneous positions p denominated in each material currency c;

- (2) for each portfolio of homogeneous positions, determine and notify the PRA a baseline term deposit redemption ratio

in currency c under the current term structure of interest rates;

- (3) for each portfolio of homogeneous loans, determine the conditional term deposit redemption ratio in currency c for interest rate scenario i,

in accordance with the following formula:

- where ui refers to the prescribed scalar multiplier for each interest rate shock scenarios given in Table 5 below.

Table 5.

| Scenario number (i) | Interest rate shock scenarios | ui (scenario multiplier |

| 0 | Current interest rates | 1 |

| 1 | Parallel up | 1.2 |

| 2 | Parallel down | 0.8 |

| 3 | Steepener | 0.8 |

| 4 | Flattener | 1.2 |

| 5 | Short rate up | 1.2 |

| 6 | Short rate down | 0.8 |

- (4) for each portfolio of homogeneous positions, determine the notional repricing cash flows CFi,c allocated to bucket 1 in Table 2 in 9.17, CFi,c(1), in accordance with the following formula:

- Where:

-

= the initial repricing cash flows

in currency c for interest rate scenario i with tenor that corresponds to bucket 1 in accordance with Table 2 in 9.17; and

- TDc = the total term deposits subject to early redemption for currency c.

- (5) for each portfolio of homogeneous positions, determine the notional repricing cash flows CFi allocated to bucket k in Table 2 other than bucket CFi(k), in accordance with the following formula:

- Where:

- k = the index that denotes the buckets in accordance with Table 2 in 9.17; and

-

= the initial repricing cash flows

in currency c for interest rate scenario i with tenor that corresponds to bucket k.

- 31/12/2021

Other positions

9.40

For other positions as determined in 9.19, a firm must determine the notional repricing cash flows CFi,c allocated to bucket k in Table 2 other than bucket 1, CFi(k), in accordance with the following formula:

Where:

k = the index that denotes the buckets in accordance with Table 2 in 9.17; and

= the initial repricing cash flows

in currency c for interest rate scenario i with tenor that corresponds to bucket k.

- 31/12/2021

Automatic interest rate options

9.41

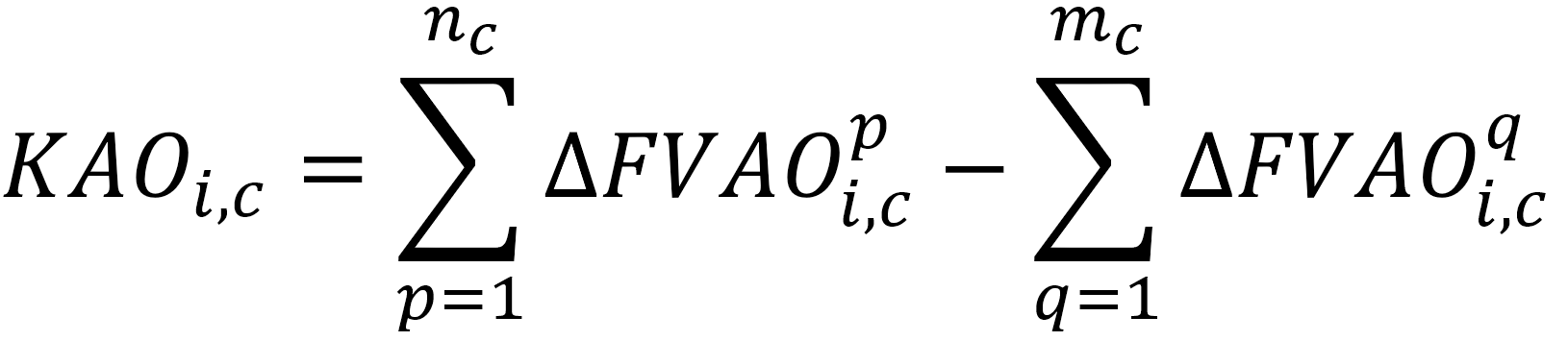

For 9.14, and subject to 9.42, a firm must determine the automatic option risk in currency c for interest rate scenario i (KA0i,c) for all automatic interest rate options as determined in 9.19 and 9.22 in accordance with the following formula:

Where:

nc = the index that denotes the number of all sold automatic options in currency c;

mc = the index that denotes the number of all bought automatic options in currency c;

= the change in value of sold automatic option p for interest rate scenario i, calculated in accordance with 9.43; and

= the change in value of bought automatic option q for interest rate scenario i, calculated in accordance with 9.43.

- 31/12/2021

9.42

A firm may choose to include in the calculation of only bought automatic options that are used for hedging sold automatic interest rate options, provided that the firm must add to KA0i,c in 9.41 the value of bought automatic options that are not for hedging sold automatic interest rate options that is included in the firm’s own funds.

- 31/12/2021

9.43

- (1) For 9.41, a firm must calculate the change in value of sold automatic option p (respectively bought automatic option q) for interest rate scenario i other than interest rate scenario

(respectively

), as the increase in value of the option to the option holder:

- (a) from the value of the option for interest rate scenario 0; and

- (b) to the value of the option for interest rate shock scenario i with a relative increase in implied volatility of 25%.

- (2) For 9.41, a firm must set the change in value of sold automatic option p (respectively bought automatic option q) for interest rate scenario

(respectively

), as 0.

- (3) A firm must notify the PRA of the methodology used to estimate the value of automatic options in (1).

- 31/12/2021