5

Application of the Net Stable Funding Requirement to Small Domestic Deposit Takers and SDDT Consolidation Entities

5.1

This chapter applies only to SDDTs and SDDT consolidation entities.

- 01/07/2024

5.2

An SDDT must comply with this chapter on an individual basis.

- 01/07/2024

5.3

An SDDT consolidation entity must comply with this chapter on the basis of its consolidated situation and for that purpose the term firm shall be read as including an SDDT consolidation entity (if it would not otherwise be included).

- 01/07/2024

5.4

The NSFR provisions do not apply to a firm where the retail deposit ratio condition in 5.5 is met.

- 01/07/2024

5.5

The retail deposit ratio condition is where a firm’s four quarter moving average of its retail deposit ratio was greater than or equal to 50% on:

- (1) the most recent quarterly reporting reference date in respect of which the quarterly reporting remittance date has occurred; and

- (2) on each of the three quarterly reporting reference dates preceding the quarterly reporting reference date in (1).

- 01/07/2024

5.6

Where a firm ceases to meet the retail deposit ratio condition in 5.5 the NSFR provisions do not apply for a period of one year beginning with the day after the remittance date on which the firm ceased to meet the retail deposit ratio condition.

- 01/07/2024

5.7

- 01/07/2024

5.8

For the purpose of this chapter:

- (1) The quarterly reporting reference date for each quarterly reporting period is the date specified in Article 2 of the Reporting (CRR) Part for template C 68.00 at 6.277 of Annex XVIII.

- (2) The quarterly reporting remittance date for each quarterly reporting period is the date specified in Article 3 of the Reporting (CRR) Part for template C 68.00 at 6.277 of Annex XVIII.

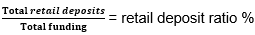

- (3) The retail deposit ratio is the ratio of the firm’s total retail deposits to its total funding and shall be expressed as a percentage in accordance with the following formula:

- where total funding means the sum of the firm’s:

- total retail deposits;

- unsecured wholesale funding as required to be reported in row 110 column 010 of template C 68.00 at 6.277 of Annex XVIII of the Reporting (CRR) Part; and

- secured wholesale funding as required to be reported in row 150 column 010 of template C 68.00 at 6.277 of Annex XVIII of the Reporting (CRR) Part.

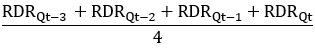

- (4) The four quarter moving average of a firm’s retail deposit ratio equals:

- where:

- RDR is the retail deposit ratio for a quarterly reporting reference date;

- Qt is the quarterly reporting reference date to which the calculation relates;

- Qt-1 is the quarterly reporting reference date immediately preceding that in Qt;

- Qt-2 is the quarterly reporting reference date immediately preceding that in Qt-1; and

- Qt-3 is the quarterly reporting reference date immediately preceding that in Qt-2.

- 01/07/2024