SUP App 1

Prudential categories and sub-categories

SUP App 1.1

Application

- 01/12/2004

SUP App 1.1.1

See Notes

- 21/06/2001

SUP App 1.2

Purpose

- 01/12/2004

SUP App 1.2.1

See Notes

- 21/06/2001

SUP App 1.2.2

See Notes

- 21/06/2001

SUP App 1.2.3

See Notes

- 21/06/2001

SUP App 1.3

Prudential categories and sub-categories

- 01/12/2004

SUP App 1.3.1

See Notes

Prudential categories and sub-categories used in the InterimPrudential sourcebooks and the Supervision manual

| Prudential categories (Note 1) | Applicable prudential requirements (Note 2) | Prudential sub-categories |

| Authorised professional firm* | IPRU(INV) 1 and 2 | |

| Bank* | IPRU(BANK) | EEA bank Overseas bank UK bank |

| Building society* | IPRU(BSOC) | |

| Credit union | CRED 7, 8, 9, and 10 |

Version 1 credit union

Version 2 credit union |

| ELMI | ELM | |

| Friendly society | IPRU(FSOC) |

Directive friendly society

Incorporated friendly society Non-directive friendly society Registered friendly society Flat rate benefits business friendly society |

| ICVC* | None, but see COLL and CIS | |

| Incoming EEA firm | None (unless another prudential category applies) | |

| Incoming Treaty firm | None (unless another prudential category applies) | |

| Insurer* | IPRU(INS) or IPRU(FSOC) |

Long term insurer

General insurer Friendly society (see above) |

| Investment management firm* | IPRU(INV) 1 and 5 | OPS firm Non-OPS life office Non-OPS local authority Individuals admitted to authorisation collectively Individual whose sole investment business is giving investment advice to institutional or corporate investors Other |

| Lead regulated firm | None (unless another prudential category applies) | |

| Media firm* | None | |

| Members' adviser | IPRU(INV) 1 and 4 | |

| Personal investment firm* | IPRU(INV) 1 and 13 | Category A firm Category A1 firm Category A2 firm Category A3 firm Category B firm Category B1 firm Category B2 firm Category B3 firm Low resource firm Network Small personal investment firm |

| Securities and futures firm* |

IPRU(INV) 1 and either 3 or 10 There is a special transitional regime for ex-section 43 lead regulated firms - see transitional rules to IPRU(INV). |

IPRU(INV) 3: Adviser Arranger Broad scope firm Corporate finance advisory firm Dematerialised instruction transmitter Derivative fund manager Energy market participant Local Oil market participant Venture capital firm Other IPRU(INV) 10: Category A Category B Category C Category D Category D - corporate finance advisory firm |

| Service company* | IPRU(INV) 1 and 6 | |

| Society of Lloyd's* | LLD | |

| UCITS management company* | IPRU(INV) 1, 5 and 7 |

UCITS firm

UCITS investment firm |

| UCITS qualifier | None (unless another prudential category applies) | |

| Underwriting agent | IPRU(INV) 1 and 4 |

Managing agent

Members' agent |

| Note 1 = It is possible for a firm to have more than one prudential category. But it cannot have more than one of the prudential categories marked with a '*'. Note 2 = Only the requirements in the Interim Prudential sourcebooks, LLD, and CRED are listed in the column. Requirements in other parts of the Handbook will also apply. | ||

- 01/04/2004

SUP App 1.4

Relevance of prudential categories

- 01/12/2004

SUP App 1.4.1

See Notes

- 21/06/2001

SUP App 1.4.2

See Notes

- 21/06/2001

SUP App 1.4.3

See Notes

- 21/06/2001

SUP App 1.5

Determining the prudential categories of a firm

- 01/12/2004

SUP App 1.5.1

See Notes

- 21/06/2001

SUP App 1.5.2

See Notes

- 21/06/2001

SUP App 1.5.3

See Notes

- 01/02/2006

SUP App 1.6

Changing prudential category after authorisation

- 01/12/2004

SUP App 1.6.1

See Notes

- 21/06/2001

SUP App 1.6.2

See Notes

- 21/06/2001

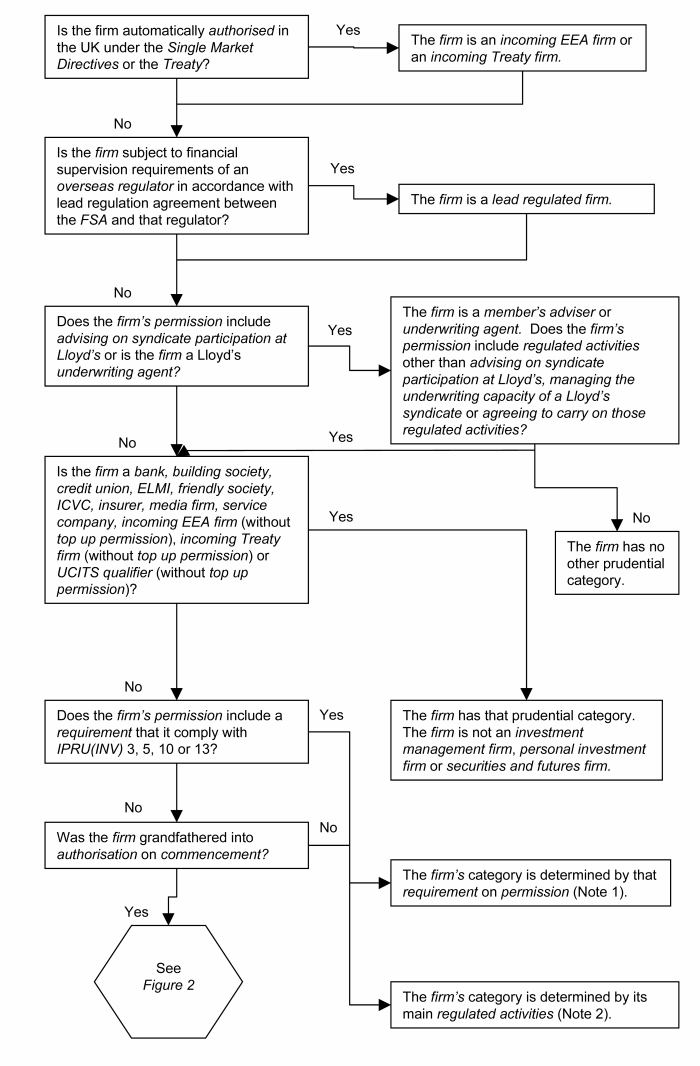

SUP App 1.7

Prudential categories and sub-categories

- 01/12/2004

SUP Fig App 1.7.1

See Notes

- 21/06/2001

SUP Fig App 1.7.2

See Notes

- 21/06/2001

SUP App 1.8

Notes to Figures 1 and 2

- 01/12/2004

SUP App 1.8.1

See Notes

Note 1

| Chapter of IPRU(INV) that requirement on permission requires the firm to comply with | Firm's prudential category |

| Chapter 3 | Securities and futures firm |

| Chapter 5 | Investment management firm |

| Chapter 10 | Securities and futures firm |

| Chapter 13 | Personal investment firm |

- 21/06/2001

SUP App 1.8.2

See Notes

Note 2

| The table below shows how a firm's main regulated activities determine its prudential category. A firm's 'main regulated activities' in this context are the regulated activities included in the firm's Part IV permission from which the firm derives or is expected to derive the most substantial part of its gross income, including commissions. The aggregate gross income from all of the activities listed against each prudential category should be considered to determine which source is the most substantial. | |

| The gross income is based on the business plan submitted as part of the firm's application for a Part IV permission (for a firm given a Part IV permission after commencement) or on the firm's financial year preceding its authorisation under the Act (for a firm authorised under section 25 of the Financial Services Act 1986 prior to commencement). | |

| If the firm's prudential categorisation is not clear, please consult the FSA for guidance. | |

| Activities from which the most substantial part of the firm's gross income, including commissions, from regulated activitiesis derived | Firm's prudential category |

| (i) Managing investments other than for private customers or if the assets managed are primarily derivatives; (ii) OPS activity; (iii) acting as the manager or trustee of an AUT; (iv) acting as the ACD or depository of an ICVC; (v) establishing, operating or winding up a collective investment scheme other than an AUT or ICVC; and (vi) safeguarding and administering investments. |

Investment management firm |

| (i) Advising on investments, or arranging (bringing about) deals in investments, in relation to packaged products; and (ii) managing investments for private customers. |

Personal investment firm |

| (i) An activity carried on as a member of an exchange; (ii) making a market in securities or derivatives; (iii) corporate finance business; (iv) dealing, or arranging (bringing about) deals in investments, in securities or derivatives; (v) the provision of clearing services as a clearing firm; (vi) managing investments where the assets managed are primarily derivatives; and (vi) activities relating to spread bets; |

Securities and futures firm |

- 21/06/2001

SUP App 1.8.3

See Notes

Note 3

| Single SRO membership | Firm's prudential category |

| IMRO | Investment management firm |

| PIA | Personal investment firm |

| SFA | Securities and futures firm |

- 21/06/2001

SUP App 1.8.4

See Notes

Note 4

| SRO to whose Financial Supervision requirements the firm was subject | Firm's prudential category |

| IMRO | Investment management firm |

| PIA | Personal investment firm |

| SFA | Securities and futures firm |

- 21/06/2001

SUP App 1.8.5

See Notes

Only a small number of firms are expected to be authorised under section 25 of the Financial Services Act 1986 immediately prior to commencement and not be a member of one of the SROs. These firms are directly regulated by the FSA under the Financial Services Act 1986.

- 21/06/2001