GENPRU 1

Application

GENPRU 1.1

Application

- 31/12/2006

GENPRU 1.1.1

See Notes

GENPRU 1.1.2

See Notes

GENPRU 1.1.2A

See Notes

Scope

GENPRU 1.1.3

See Notes

GENPRU 1.2

Adequacy of financial resources

- 31/12/2006

Application

GENPRU 1.2.1

See Notes

GENPRU 1.2.2A

See Notes

GENPRU 1.2.3A

See Notes

GENPRU 1.2.6

See Notes

GENPRU 1.2.7

See Notes

GENPRU 1.2.10

See Notes

GENPRU 1.2.11

See Notes

Purpose

GENPRU 1.2.12

See Notes

GENPRU 1.2.13

See Notes

GENPRU 1.2.14

See Notes

GENPRU 1.2.15

See Notes

GENPRU 1.2.16

See Notes

GENPRU 1.2.17

See Notes

Outline of other related provisions

GENPRU 1.2.18

See Notes

GENPRU 1.2.19

See Notes

GENPRU 1.2.20

See Notes

GENPRU 1.2.21

See Notes

GENPRU 1.2.22

See Notes

GENPRU 1.2.23

See Notes

GENPRU 1.2.24

See Notes

GENPRU 1.2.25

See Notes

Requirement to have adequate financial resources

GENPRU 1.2.26

See Notes

GENPRU 1.2.26A

See Notes

GENPRU 1.2.27

See Notes

GENPRU 1.2.28

See Notes

GENPRU 1.2.29

See Notes

Systems, strategies, processes and reviews

GENPRU 1.2.30

See Notes

GENPRU 1.2.31

See Notes

GENPRU 1.2.32

See Notes

GENPRU 1.2.33

See Notes

GENPRU 1.2.34

See Notes

GENPRU 1.2.35

See Notes

GENPRU 1.2.36

See Notes

GENPRU 1.2.37

See Notes

GENPRU 1.2.38

See Notes

GENPRU 1.2.39

See Notes

GENPRU 1.2.40

See Notes

GENPRU 1.2.41

See Notes

Stress and scenario tests

GENPRU 1.2.42

See Notes

GENPRU 1.2.42A

See Notes

GENPRU 1.2.42B

See Notes

GENPRU 1.2.42C

See Notes

GENPRU 1.2.42D

See Notes

GENPRU 1.2.42E

See Notes

GENPRU 1.2.42F

See Notes

GENPRU 1.2.43

See Notes

Application of this section on a solo and consolidated basis: General

GENPRU 1.2.44

See Notes

Application of this section on a solo and consolidated basis: Processes and tests

GENPRU 1.2.45

See Notes

GENPRU 1.2.46

See Notes

GENPRU 1.2.47

See Notes

GENPRU 1.2.48

See Notes

GENPRU 1.2.49

See Notes

GENPRU 1.2.50

See Notes

GENPRU 1.2.51

See Notes

GENPRU 1.2.52

See Notes

GENPRU 1.2.53

See Notes

GENPRU 1.2.54

See Notes

GENPRU 1.2.55

See Notes

GENPRU 1.2.56

See Notes

Application of this section on a solo and consolidated basis: Adequacy of resources

GENPRU 1.2.57

See Notes

GENPRU 1.2.58

See Notes

GENPRU 1.2.59

See Notes

Documentation of risk assessments

GENPRU 1.2.60

See Notes

GENPRU 1.2.61

See Notes

GENPRU 1.2.62

See Notes

Additional guidance on stress tests and scenario analyses

GENPRU 1.2.63

See Notes

GENPRU 1.2.64

See Notes

GENPRU 1.2.65

See Notes

GENPRU 1.2.66

See Notes

GENPRU 1.2.68

See Notes

GENPRU 1.2.69

See Notes

GENPRU 1.2.70

See Notes

GENPRU 1.2.71

See Notes

GENPRU 1.2.72

See Notes

Capital planning

GENPRU 1.2.73A

See Notes

GENPRU 1.2.73B

See Notes

GENPRU 1.2.73C

See Notes

- 01/04/2013

GENPRU 1.2.74

See Notes

GENPRU 1.2.75

See Notes

GENPRU 1.2.76

See Notes

GENPRU 1.2.77

See Notes

GENPRU 1.2.78

See Notes

Pension obligation risk

GENPRU 1.2.79

See Notes

GENPRU 1.2.80

See Notes

GENPRU 1.2.81

See Notes

GENPRU 1.2.82

See Notes

GENPRU 1.2.83A

See Notes

GENPRU 1.2.84

See Notes

GENPRU 1.2.85

See Notes

GENPRU 1.2.86

See Notes

Group risk

GENPRU 1.2.87

See Notes

GENPRU 1.2.88

See Notes

GENPRU 1.2.89

See Notes

GENPRU 1.2.90

See Notes

GENPRU 1.2.91

See Notes

GENPRU 1.3

Valuation

- 31/12/2006

Application

GENPRU 1.3.1

See Notes

Purpose

GENPRU 1.3.2

See Notes

GENPRU 1.3.3

See Notes

General requirements: Accounting principles to be applied

GENPRU 1.3.4

See Notes

GENPRU 1.3.5

See Notes

GENPRU 1.3.6

See Notes

GENPRU 1.3.7

See Notes

GENPRU 1.3.8

See Notes

General requirements: Adjustments to accounting values

GENPRU 1.3.9

See Notes

GENPRU 1.3.10

See Notes

GENPRU 1.3.11

See Notes

GENPRU 1.3.12

See Notes

General requirements: Methods of valuation and systems and controls

GENPRU 1.3.13

See Notes

General requirements: Marking to market

GENPRU 1.3.14

See Notes

GENPRU 1.3.15

See Notes

GENPRU 1.3.16

See Notes

General requirements: Marking to model

GENPRU 1.3.17

See Notes

GENPRU 1.3.18

See Notes

GENPRU 1.3.19

See Notes

GENPRU 1.3.20

See Notes

GENPRU 1.3.21

See Notes

GENPRU 1.3.22

See Notes

GENPRU 1.3.23

See Notes

GENPRU 1.3.24

See Notes

GENPRU 1.3.25

See Notes

General requirements: Independent price verification

GENPRU 1.3.26

See Notes

GENPRU 1.3.27

See Notes

GENPRU 1.3.28

See Notes

General requirements: Valuation adjustments or, in the case of an insurer or a UK ISPV, valuation adjustments or reserves

GENPRU 1.3.29

See Notes

GENPRU 1.3.30

See Notes

GENPRU 1.3.31

See Notes

GENPRU 1.3.32

See Notes

GENPRU 1.3.33

See Notes

GENPRU 1.3.34

See Notes

GENPRU 1.3.35

See Notes

GENPRU 1.3.35A

See Notes

Specific requirements: BIPRU firms

GENPRU 1.3.36

See Notes

GENPRU 1.3.37

See Notes

Trading book and other fair-valued positions, and revaluations

GENPRU 1.3.38

See Notes

GENPRU 1.3.39

See Notes

GENPRU 1.3.40

See Notes

Investments, derivatives and quasi-derivatives

GENPRU 1.3.41

See Notes

Shares in and debts due from related undertakings

GENPRU 1.3.42

See Notes

GENPRU 1.3.43

See Notes

GENPRU 1.3.44

See Notes

GENPRU 1.3.45

See Notes

GENPRU 1.3.46

See Notes

GENPRU 1.3.47

See Notes

GENPRU 1.3.48

See Notes

GENPRU 1.3.49

See Notes

GENPRU 1.3.50

See Notes

GENPRU 1.3.51

See Notes

GENPRU 1.3.52

See Notes

GENPRU 1.3.53

See Notes

GENPRU 1.3.54

See Notes

Insurance Special Purpose Vehicles

GENPRU 1.3.55

See Notes

GENPRU 1.3.56

See Notes

General insurance business: Community co-insurance operations -

GENPRU 1.3.57

See Notes

GENPRU 1.5

Application of GENPRU 1 to Lloyd's

- 31/12/2006

Application of GENPRU 1.2

GENPRU 1.5.1

See Notes

GENPRU 1.5.2

See Notes

Insurance market direction

GENPRU 1.5.3

See Notes

GENPRU 1.5.4

See Notes

GENPRU 1.5.5

See Notes

GENPRU 1.5.6

See Notes

Members' obligation to maintain adequate financial resources

GENPRU 1.5.7

See Notes

GENPRU 1.5.8

See Notes

GENPRU 1.5.9

See Notes

Application of GENPRU 1.3

GENPRU 1.5.10

See Notes

Amounts receivable but not yet received

GENPRU 1.5.11

See Notes

Letters of credit, guarantees and life assurance policies

GENPRU 1.5.12

See Notes

GENPRU 1.5.13

See Notes

GENPRU 1.5.14

See Notes

GENPRU 1.5.15

See Notes

GENPRU 1.5.16

See Notes

The Society's callable contributions

GENPRU 1.5.17

See Notes

GENPRU 1.5.18

See Notes

GENPRU 1.5.19

See Notes

GENPRU 1.5.20

See Notes

Liabilities

GENPRU 1.5.21

See Notes

GENPRU 1.5.22

See Notes

GENPRU 1.5.23

See Notes

GENPRU 1.5.24

See Notes

GENPRU 1.5.25

See Notes

GENPRU 1.5.26

See Notes

GENPRU 2

Capital

GENPRU 2.1

Calculation of capital resources requirements

- 31/12/2006

Application

GENPRU 2.1.1

See Notes

GENPRU 2.1.2

See Notes

GENPRU 2.1.3

See Notes

GENPRU 2.1.4

See Notes

GENPRU 2.1.5

See Notes

Purpose

GENPRU 2.1.6

See Notes

GENPRU 2.1.7

See Notes

GENPRU 2.1.8

See Notes

Monitoring requirements

GENPRU 2.1.9

See Notes

GENPRU 2.1.10

See Notes

GENPRU 2.1.11

See Notes

Additional capital requirements

GENPRU 2.1.12

See Notes

Main requirement: Insurers

GENPRU 2.1.13

See Notes

GENPRU 2.1.14

See Notes

GENPRU 2.1.15

See Notes

GENPRU 2.1.16

See Notes

Calculation of the CRR for an insurer

GENPRU 2.1.17

See Notes

GENPRU 2.1.18

See Notes

GENPRU 2.1.19

See Notes

GENPRU 2.1.20

See Notes

GENPRU 2.1.21

See Notes

GENPRU 2.1.22

See Notes

GENPRU 2.1.23

See Notes

Calculation of the MCR (Insurer only)

GENPRU 2.1.24

See Notes

GENPRU 2.1.24A

See Notes

GENPRU 2.1.25

See Notes

GENPRU 2.1.26

See Notes

GENPRU 2.1.27

See Notes

GENPRU 2.1.28

See Notes

Calculation of the base capital resources requirement for an insurer

GENPRU 2.1.29

See Notes

Table: Base capital resources requirement for an insurer

GENPRU 2.1.30

See Notes

This table belongs to GENPRU 2.1.29 R

| Firm category | Amount: Currency equivalent of | |

| General insurance business | ||

| Liability insurer (classes 10-15) | Directive mutual | €2.775 million |

| Non-directive insurer | €350,000 | |

| Other (including mixed insurer but excluding pure reinsurer) | €3.7 million | |

| Other insurer | Directive mutual | €1.875 million |

| Non-directive insurer (classes 1 to 8, 16 or 18) | €260,000 | |

| Non-directive insurer (classes 9 or 17) | €175,000 | |

| Mixed insurer | €3.7 million | |

| Other (excluding pure reinsurer) | €2.5 million | |

| Long-term insurance business | ||

| Mutual | Directive | €2.775 million |

| Non-directive mutual | €700,000 | |

| Any other insurer (including mixed insurer but excluding pure reinsurer) | €3.7 million | |

| All business (general insurance business and long-term insurance business) | ||

| Pure reinsurer excluding captive reinsurer | €3.7 million | |

| Captive reinsurer | €1.2 million | |

GENPRU 2.1.31

See Notes

GENPRU 2.1.32

See Notes

GENPRU 2.1.33

See Notes

Calculation of the general insurance capital requirement (Insurer only)

GENPRU 2.1.34

See Notes

GENPRU 2.1.35

See Notes

Calculation of the long-term insurance capital requirement (Insurer only)

GENPRU 2.1.36

See Notes

GENPRU 2.1.37

See Notes

Calculation of the ECR (Insurer only)

GENPRU 2.1.38

See Notes

GENPRU 2.1.39

See Notes

Main requirement: BIPRU firms

GENPRU 2.1.40

See Notes

GENPRU 2.1.41

See Notes

GENPRU 2.1.42

See Notes

GENPRU 2.1.43

See Notes

GENPRU 2.1.44

See Notes

Calculation of the base capital resources requirement for a BIPRU firm

GENPRU 2.1.47

See Notes

Table: Base capital resources requirement for a BIPRU firm

GENPRU 2.1.48

See Notes

This table belongs to GENPRU 2.1.47 R

| Firm category | Amount: Currency equivalent of |

| Bank | €5 million |

| Building society | The higher of €1 million and £1 million |

| BIPRU 730K firm | €730,000 |

| BIPRU 125K firm | €125,000 |

| BIPRU 50K firm | €50,000 |

| Collective portfolio management investment firm | €125,000 |

Definition of BIPRU 730K firm, BIPRU 125K firm and BIPRU 50K firm

GENPRU 2.1.49

See Notes

Table: Definition of BIPRU 730K firm, BIPRU 125K firm and BIPRU 50K firm

GENPRU 2.1.50

See Notes

This table belongs to GENPRU 2.1.49 G

| Category of BIPRU investment firm | Definition | ||

| BIPRU 50K firm | (1) | it does not deal in any financial instruments for its own account or underwrite issues of financial instruments on a firm commitment basis; | |

| (2) | it offers one or more of the following services: | ||

| (a) | reception and transmission of investors' orders for financial instruments; or | ||

| (b) | the execution of investors' orders for financial instruments; or | ||

| (c) | the management of individual portfolios of investments in financial instruments; and | ||

| (3) | it does not hold clients' money and/or securities and it is not authorised to do so (it should have a limitation or requirement prohibiting the holding of client money and its permission should not include safeguarding and administering investments). | ||

| BIPRU 125K firm | (1) | it does not deal in any financial instruments for its own account or underwrite issues of financial instruments on a firm commitment basis; | |

| (2) | it offers one or more of the following services: | ||

| (a) | reception and transmission of investors' orders for financial instruments; or | ||

| (b) | the execution of investors' orders for financial instruments; or | ||

| (c) | the management of individual portfolios of investments in financial instruments; and | ||

| (3) | it holds clients' money and/or securities or it is authorised to do so. | ||

| BIPRU 730K firm | is subject to the Capital Adequacy Directive and is neither a BIPRU 50K firm nor a BIPRU 125K firm. | ||

Calculation of the credit risk capital requirement (BIPRU firm only)

GENPRU 2.1.51

See Notes

Calculation of the market risk capital requirement (BIPRU firm only)

GENPRU 2.1.52

See Notes

Calculation of base capital resources requirement for banks authorised before 1993

GENPRU 2.1.60

See Notes

GENPRU 2.1.61

See Notes

GENPRU 2.1.62

See Notes

GENPRU 2.2

Capital resources

- 31/12/2006

Application

GENPRU 2.2.1

See Notes

Purpose

GENPRU 2.2.2

See Notes

GENPRU 2.2.3

See Notes

GENPRU 2.2.4

See Notes

Contents guide

GENPRU 2.2.5

See Notes

Table: Arrangement of GENPRU 2.2

GENPRU 2.2.6

See Notes

This table belongs to GENPRU 2.2.5 G

Simple capital issuers

GENPRU 2.2.7

See Notes

Principles underlying the definition of capital resources

GENPRU 2.2.8

See Notes

Tier one capital

GENPRU 2.2.9

See Notes

GENPRU 2.2.10

See Notes

Upper and lower tier two capital

GENPRU 2.2.11

See Notes

Tier three capital

GENPRU 2.2.12

See Notes

Non-standard capital instruments

GENPRU 2.2.13

See Notes

Deductions from capital

GENPRU 2.2.14

See Notes

GENPRU 2.2.15

See Notes

GENPRU 2.2.16

See Notes

Which method of calculating capital resources applies to which type of firm

GENPRU 2.2.17

See Notes

GENPRU 2.2.18

See Notes

Table: Applicable capital resources calculation

GENPRU 2.2.19

See Notes

This table belongs to GENPRU 2.2.17 R

| Type of firm | Location of rules | Remarks |

| Insurer | GENPRU 2 Annex 1 | |

| Bank | GENPRU 2 Annex 2 | |

| Building society | GENPRU 2 Annex 3 | |

| BIPRU investment firm without an investment firm consolidation waiver | GENPRU 2 Annex 4 (Deducts material holdings) | Applies to a BIPRU investment firm not using GENPRU 2 Annex 5 or GENPRU 2 Annex 6 |

| BIPRU investment firm without an investment firm consolidation waiver | GENPRU 2 Annex 5 (Deducts illiquid assets) | A BIPRU investment firm must give one Month's prior notice to the appropriate regulator before starting to use or stopping using this method |

| BIPRU investment firm with an investment firm consolidation waiver | GENPRU 2 Annex 6 (Deducts illiquid assets and material holdings) | A firm with an investment firm consolidation waiver must use this method. No other BIPRU investment firm may use it. |

Calculation of capital resources: Which rules apply to BIPRU investmentfirms

GENPRU 2.2.20

See Notes

GENPRU 2.2.21

See Notes

Calculation of capital resources: Insurers

GENPRU 2.2.22

See Notes

Table: Approaches to calculating capital resources

GENPRU 2.2.23

See Notes

This table belongs to GENPRU 2.2.22 G

| Liabilities | Assets | ||

| Borrowings | 100 | Admissible assets | 350 |

| Ordinary shares | 200 | Intangible assets | 100 |

| Profit and loss account and other reserves | 100 | Other inadmissible assets | 100 |

| Perpetual subordinated debt | 150 | ||

| Total | 550 | Total | 550 |

| Calculation of capital resources: eligible assets less foreseeable liabilities | |||

| Total assets | 550 | ||

| less intangible assets | (100) | ||

| less inadmissible assets | (100) | ||

| less liabilities (borrowings) | (100) | ||

| Capital resources | 250 | ||

| Calculation of capital resources: components of capital | |||

| Ordinary shares | 200 | ||

| Profit and loss account and other reserves | 100 | ||

| Perpetual subordinated debt | 150 | ||

| less intangible assets | (100) | ||

| less inadmissible assets | (100) | ||

| Capital resources | 250 | ||

Limits on the use of different forms of capital: General

GENPRU 2.2.24

See Notes

Limits on the use of different forms of capital: Use of higher tier capital in lower tiers

GENPRU 2.2.25

See Notes

GENPRU 2.2.26

See Notes

GENPRU 2.2.26A

See Notes

GENPRU 2.2.28

See Notes

Limits on the use of different forms of capital: Limits relating to tier one capital applicable to insurers

GENPRU 2.2.29

See Notes

GENPRU 2.2.30

See Notes

Limits on the use of different forms of capital: Limits relating to tier one capital applicable to BIPRU firms

GENPRU 2.2.30A

See Notes

Limits on the use of different forms of capital: Limits relating to tier one capital: Purpose of the requirements

GENPRU 2.2.31

See Notes

Limits on the use of different forms of capital: Insurers

GENPRU 2.2.32

See Notes

GENPRU 2.2.33

See Notes

GENPRU 2.2.34

See Notes

GENPRU 2.2.34A

See Notes

GENPRU 2.2.35

See Notes

GENPRU 2.2.36

See Notes

GENPRU 2.2.37

See Notes

GENPRU 2.2.38

See Notes

GENPRU 2.2.39

See Notes

GENPRU 2.2.40

See Notes

GENPRU 2.2.41

See Notes

Limits on the use of different kinds of capital: Purposes for which tier three capital may not be used (BIPRU firm only)

GENPRU 2.2.44

See Notes

GENPRU 2.2.45

See Notes

Limits on the use of different kinds of capital: Tier two limits (BIPRU firm only)

GENPRU 2.2.46

See Notes

Limits on the use of different kinds of capital: Purposes for which tier three capital may be used (BIPRU firm only)

GENPRU 2.2.47

See Notes

GENPRU 2.2.48

See Notes

Limits on the use of different kinds of capital: Combined tier two and tier three limits (BIPRU firm only)

GENPRU 2.2.49

See Notes

GENPRU 2.2.50

See Notes

Example of how the capital resources calculation for BIPRU firms works

GENPRU 2.2.51

See Notes

Table: Example of the calculation of the capital resources of a BIPRU firm

GENPRU 2.2.52

See Notes

This table belongs to GENPRU 2.2.51 G

| Description of the stage of the capital resources calculation | Stage in the capital resources table | Amount (£) |

| Total tier one capital after deductions | Stage F | 80 |

| Total tier two capital | Stage K | 80 |

| Deductions | Stage M | (20) |

| Total tier one capital and tier two capital after deductions | Stage N | 140 |

| Upper tier three capital (this example assumes the firm has no lower tier three capital (trading book profits)) | Stage Q | 50 |

| Total capital resources | Stage T | 190 |

GENPRU 2.2.54

See Notes

GENPRU 2.2.55

See Notes

Table: Example of how capital resources of a BIPRU firm are measured against its capital resources requirement

GENPRU 2.2.56

See Notes

This table belongs to GENPRU 2.2.55 G

| Description of the stage of the capital resources calculation | Stage in the capital resources table | Amount (£) |

| Total tier one capital and tier two capital after deductions | Stage N | 140 |

| Credit, operational, and counterparty risk requirement | (100) | |

| Tier one capital and tier two capital available to meet market risk requirement | 40 | |

| Tier three capital | Stage Q | 50 |

| Total capital available to meet market risk requirement | 90 | |

| Market risk requirement | (90) | |

| Market risk requirement met subject to meeting gearing limit set out in GENPRU 2.2.49 R - see GENPRU 2.2.57 G |

GENPRU 2.2.57

See Notes

GENPRU 2.2.58

See Notes

In order to calculate the relevant tier one capital for the upper tier three gearing limit in accordance with GENPRU 2.2.49 R it is first necessary to allocate tier one capital and tier two capital to the individual credit, operational and counterparty risk requirements. This allocation process underlies the calculation of the overall amount referred to in GENPRU 2.2.48 R. The calculation in GENPRU 2.2.49R (3) and GENPRU 2.2.49R (4) then focuses on the tier one element of this earlier calculation.

In this worked example, if it is assumed that the counterparty risk requirement has been met by tier one capital, the relevant tier one capital for gearing is £50. This is because the deductions of £20 and the credit and operational risk requirementsof £90 have been met by tier two capital in the first instance. However, the total sum of deductions and credit and operational risk requirementsexceed the tier two capital amount of £80 by £30. Hence the £80 of tier one capital has been reduced by £30 to leave £50.

In practical terms, the same result is achieved for the relevant tier one capital for gearing by taking the amount carried forward to meet market risk of £40 and adding back the £10 in respect of the counterparty risk requirement. Again, there are other options as to the allocation to credit, operational, and counterparty risk of the constituent elements of Stage N of the capital resources table.

The outcome of these calculations can be summarised as follows:

GENPRU 2.2.59

See Notes

Capital used to meet the base capital resources requirement (BIPRU firm only)

GENPRU 2.2.60

See Notes

GENPRU 2.2.61

See Notes

Notification of issuance of capital instruments

GENPRU 2.2.61A

See Notes

GENPRU 2.2.61B

See Notes

GENPRU 2.2.61C

See Notes

GENPRU 2.2.61D

See Notes

GENPRU 2.2.61E

See Notes

GENPRU 2.2.61F

See Notes

GENPRU 2.2.61G

See Notes

GENPRU 2.2.61H

See Notes

Tier one capital: General

GENPRU 2.2.62

See Notes

GENPRU 2.2.63

See Notes

General conditions for eligibility as tier one capital

GENPRU 2.2.64

See Notes

GENPRU 2.2.65

See Notes

Guidance on certain of the general conditions for eligibility as tier one capital

GENPRU 2.2.66

See Notes

GENPRU 2.2.67

See Notes

GENPRU 2.2.67A

See Notes

GENPRU 2.2.68

See Notes

GENPRU 2.2.68A

See Notes

GENPRU 2.2.68B

See Notes

GENPRU 2.2.69

See Notes

Tier one capital: payment of coupons (BIPRU firm only)

GENPRU 2.2.69A

See Notes

GENPRU 2.2.69B

See Notes

GENPRU 2.2.69C

See Notes

GENPRU 2.2.69D

See Notes

GENPRU 2.2.69E

See Notes

GENPRU 2.2.69F

See Notes

Redemption of tier one instruments

GENPRU 2.2.70

See Notes

GENPRU 2.2.70A

See Notes

GENPRU 2.2.71

See Notes

GENPRU 2.2.72

See Notes

GENPRU 2.2.73

See Notes

GENPRU 2.2.74

See Notes

GENPRU 2.2.74A

See Notes

GENPRU 2.2.74B

See Notes

GENPRU 2.2.75

See Notes

Step-ups and redeemable tier one instruments: Insurer only

GENPRU 2.2.76

See Notes

Meaning of redemption

GENPRU 2.2.77

See Notes

GENPRU 2.2.78

See Notes

GENPRU 2.2.79

See Notes

Purchases of tier one instruments: BIPRU firm only

GENPRU 2.2.79A

See Notes

GENPRU 2.2.79B

See Notes

GENPRU 2.2.79C

See Notes

GENPRU 2.2.79D

See Notes

GENPRU 2.2.79E

See Notes

GENPRU 2.2.79F

See Notes

GENPRU 2.2.79G

See Notes

GENPRU 2.2.79H

See Notes

GENPRU 2.2.79I

See Notes

GENPRU 2.2.79J

See Notes

GENPRU 2.2.79K

See Notes

GENPRU 2.2.79L

See Notes

Loss absorption

GENPRU 2.2.80

See Notes

GENPRU 2.2.81

See Notes

GENPRU 2.2.82

See Notes

Core tier one capital: permanent share capital

GENPRU 2.2.83

See Notes

General conditions for eligibility of capital instruments as core tier one capital (BIPRU firm only)

GENPRU 2.2.83A

See Notes

GENPRU 2.2.83B

See Notes

GENPRU 2.2.83C

See Notes

GENPRU 2.2.83D

See Notes

Core tier one capital: exception to eligibility criteria (building societies only)

GENPRU 2.2.83E

See Notes

GENPRU 2.2.83F

See Notes

GENPRU 2.2.83G

See Notes

GENPRU 2.2.83H

See Notes

Core tier one capital: additional information

GENPRU 2.2.84

See Notes

GENPRU 2.2.84A

See Notes

Core tier one capital: profit and loss account and other reserves: Losses

GENPRU 2.2.85

See Notes

Core tier one capital: profit and loss account and other reserves: Losses arising from valuation adjustments (BIPRU firm only)

GENPRU 2.2.86

See Notes

Core tier one capital: profit and loss account and other reserves: Dividends

GENPRU 2.2.87

See Notes

GENPRU 2.2.87A

See Notes

Core tier one capital: profit and loss account and other reserves: Capital contributions

GENPRU 2.2.88

See Notes

GENPRU 2.2.89

See Notes

Core tier one capital: profit and loss account and other reserves: Securitisation (BIPRU firm only)

GENPRU 2.2.90

See Notes

Core tier one capital: profit and loss account and other reserves: Valuation

GENPRU 2.2.91

See Notes

Core tier one capital: profit and loss account and other reserves: Revaluation reserves (BIPRU firm only)

GENPRU 2.2.92

See Notes

Core tier one capital: partnership capital account (BIPRU firm only)

GENPRU 2.2.93

See Notes

Core tier one capital: Eligible LLP members' capital (BIPRU firm only)

GENPRU 2.2.94

See Notes

Core tier one capital: Eligible LLP members' and partnership capital accounts (BIPRU firm only)

GENPRU 2.2.95

See Notes

GENPRU 2.2.96

See Notes

Core tier one capital: Other capital items for limited liability partnerships and partnerships (BIPRU firm only)

GENPRU 2.2.97

See Notes

GENPRU 2.2.98

See Notes

GENPRU 2.2.99

See Notes

Core tier one capital: partnership and limited liability partnership excess drawings (BIPRU firm only)

GENPRU 2.2.100

See Notes

Core tier one capital: Share premium account

GENPRU 2.2.101

See Notes

Core tier one capital: externally verified interim net profits

GENPRU 2.2.102

See Notes

GENPRU 2.2.103

See Notes

Core tier one capital: valuation differences (insurer only)

GENPRU 2.2.104

See Notes

GENPRU 2.2.105

See Notes

GENPRU 2.2.106

See Notes

GENPRU 2.2.107

See Notes

Core tier one capital: fund for future appropriations (insurer only)

GENPRU 2.2.108

See Notes

Core tier one capital: deferred shares (building society only)

GENPRU 2.2.108A

See Notes

GENPRU 2.2.108B

See Notes

Other tier one capital: perpetual non-cumulative preference shares (insurer only)

GENPRU 2.2.109

See Notes

GENPRU 2.2.110

See Notes

Other tier one capital: innovative tier one capital: general (insurer only)

GENPRU 2.2.113

See Notes

Other tier one capital: innovative tier one capital: redemption (insurer only)

GENPRU 2.2.114

See Notes

GENPRU 2.2.115

See Notes

Other tier one capital: conditions for eligibility for hybrid capital to be included at the different stages B1, B2 and C of the calculation in the capital resources table (BIPRU firm only)

GENPRU 2.2.115A

See Notes

GENPRU 2.2.115B

See Notes

GENPRU 2.2.115C

See Notes

GENPRU 2.2.115D

See Notes

GENPRU 2.2.115E

See Notes

GENPRU 2.2.115F

See Notes

GENPRU 2.2.115G

See Notes

Other tier one capital: loss absorption

GENPRU 2.2.116

See Notes

GENPRU 2.2.116A

See Notes

GENPRU 2.2.117

See Notes

GENPRU 2.2.117A

See Notes

GENPRU 2.2.117B

See Notes

GENPRU 2.2.117C

See Notes

GENPRU 2.2.118

See Notes

GENPRU 2.2.118A

See Notes

GENPRU 2.2.119

See Notes

Other tier one capital: innovative tier one capital: coupons (insurer only)

GENPRU 2.2.120

See Notes

Other tier one capital: innovative tier one capital: step-ups (insurer only)

GENPRU 2.2.121

See Notes

GENPRU 2.2.122

See Notes

Other tier one capital: hybrid capital: indirectly issued tier one capital (BIPRU firm only)

GENPRU 2.2.123

See Notes

GENPRU 2.2.124

See Notes

GENPRU 2.2.125

See Notes

GENPRU 2.2.126

See Notes

GENPRU 2.2.127

See Notes

GENPRU 2.2.128

See Notes

GENPRU 2.2.128A

See Notes

GENPRU 2.2.128B

See Notes

GENPRU 2.2.129

See Notes

GENPRU 2.2.130

See Notes

GENPRU 2.2.131

See Notes

GENPRU 2.2.131A

See Notes

GENPRU 2.2.132

See Notes

GENPRU 2.2.133

See Notes

GENPRU 2.2.134

See Notes

GENPRU 2.2.135

See Notes

GENPRU 2.2.136

See Notes

GENPRU 2.2.137

See Notes

Tier one capital: Conversion ratio

GENPRU 2.2.138

See Notes

GENPRU 2.2.139

See Notes

GENPRU 2.2.140

See Notes

GENPRU 2.2.141

See Notes

GENPRU 2.2.142

See Notes

GENPRU 2.2.143

See Notes

GENPRU 2.2.144

See Notes

Tier one capital: Requirement to have sufficient unissued stock

GENPRU 2.2.145

See Notes

Step-ups: calculating the size of a step-up

GENPRU 2.2.146

See Notes

Step-ups: Limits on the amount of step-ups on tier one and two capital

GENPRU 2.2.147

See Notes

GENPRU 2.2.148

See Notes

GENPRU 2.2.149

See Notes

GENPRU 2.2.150

See Notes

GENPRU 2.2.151

See Notes

GENPRU 2.2.152

See Notes

GENPRU 2.2.153

See Notes

GENPRU 2.2.154

See Notes

Deductions from tier one: Intangible assets

GENPRU 2.2.155

See Notes

GENPRU 2.2.156

See Notes

Tier two capital: General

GENPRU 2.2.157

See Notes

GENPRU 2.2.158

See Notes

General conditions for eligibility as tier two capital instruments

GENPRU 2.2.159

See Notes

GENPRU 2.2.160

See Notes

General conditions for eligibility as tier two capital instruments: Additional remedies

GENPRU 2.2.161

See Notes

GENPRU 2.2.162

See Notes

General conditions for eligibility as tier two capital instruments: Alternative governing laws

GENPRU 2.2.163

See Notes

General conditions for eligibility as tier two capital instruments: Standard form documentation

GENPRU 2.2.164

See Notes

Guidance on the general conditions for eligibility as tier two capital instruments

GENPRU 2.2.165

See Notes

GENPRU 2.2.166

See Notes

GENPRU 2.2.167

See Notes

GENPRU 2.2.168

See Notes

Tier two capital instruments: Connected transactions

GENPRU 2.2.169

See Notes

GENPRU 2.2.170

See Notes

Amendment of tier two instruments

GENPRU 2.2.171

See Notes

Redemption of tier two instruments

GENPRU 2.2.172

See Notes

GENPRU 2.2.173

See Notes

GENPRU 2.2.174

See Notes

Tier two capital: step-ups

GENPRU 2.2.175

See Notes

Upper tier two capital: General

GENPRU 2.2.176

See Notes

GENPRU 2.2.177

See Notes

GENPRU 2.2.178

See Notes

GENPRU 2.2.179

See Notes

Upper tier two capital: Loss absorption

GENPRU 2.2.180

See Notes

Upper tier two capital: Legal opinions

GENPRU 2.2.181

See Notes

Upper tier two capital: Guidance

GENPRU 2.2.182

See Notes

GENPRU 2.2.183

See Notes

GENPRU 2.2.184

See Notes

Upper tier two capital: Revaluation reserves (BIPRU firm only)

GENPRU 2.2.185

See Notes

GENPRU 2.2.186

See Notes

Upper tier two capital: General/collective provisions (BIPRU firm only)

GENPRU 2.2.187

See Notes

GENPRU 2.2.188

See Notes

GENPRU 2.2.189

See Notes

Upper tier two capital: Surplus provisions (BIPRU firm only)

GENPRU 2.2.190

See Notes

GENPRU 2.2.191

See Notes

GENPRU 2.2.192

See Notes

GENPRU 2.2.193

See Notes

Lower tier two capital

GENPRU 2.2.194

See Notes

GENPRU 2.2.195

See Notes

GENPRU 2.2.196

See Notes

GENPRU 2.2.197

See Notes

The effect of swaps on debt capital

GENPRU 2.2.198

See Notes

GENPRU 2.2.199

See Notes

GENPRU 2.2.200

See Notes

GENPRU 2.2.201

See Notes

Deductions from tiers one and two: Qualifying holdings (bank or building society only)

GENPRU 2.2.202

See Notes

GENPRU 2.2.203

See Notes

GENPRU 2.2.204

See Notes

GENPRU 2.2.205

See Notes

GENPRU 2.2.206

See Notes

GENPRU 2.2.207

See Notes

Deductions from tiers one and two: Material holdings (BIPRU firm only)

GENPRU 2.2.208

See Notes

GENPRU 2.2.209

See Notes

GENPRU 2.2.210

See Notes

GENPRU 2.2.211

See Notes

GENPRU 2.2.212

See Notes

GENPRU 2.2.213

See Notes

GENPRU 2.2.214

See Notes

GENPRU 2.2.215

See Notes

GENPRU 2.2.216

See Notes

GENPRU 2.2.216A

See Notes

Deductions from tiers one and two: Reciprocal cross holdings (BIPRU firm only)

GENPRU 2.2.217

See Notes

GENPRU 2.2.218

See Notes

GENPRU 2.2.219

See Notes

GENPRU 2.2.220

See Notes

Deductions from tiers one and two: Connected lending of a capital nature (bank only)

GENPRU 2.2.221

See Notes

GENPRU 2.2.222

See Notes

GENPRU 2.2.223

See Notes

GENPRU 2.2.224

See Notes

GENPRU 2.2.225

See Notes

GENPRU 2.2.226

See Notes

GENPRU 2.2.227

See Notes

GENPRU 2.2.228

See Notes

GENPRU 2.2.229

See Notes

GENPRU 2.2.230

See Notes

GENPRU 2.2.231

See Notes

GENPRU 2.2.232

See Notes

GENPRU 2.2.233

See Notes

GENPRU 2.2.234

See Notes

GENPRU 2.2.235

See Notes

Deductions from tiers one and two: Expected losses and other negative amounts (BIPRU firm only)

GENPRU 2.2.236

See Notes

Deductions from tiers one and two: Securitisation positions (BIPRU firm only)

GENPRU 2.2.237

See Notes

Deductions from tiers one and two: Special treatment of material holdings and other items (BIPRU firm only)

GENPRU 2.2.238

See Notes

GENPRU 2.2.239

See Notes

GENPRU 2.2.240

See Notes

Tier three capital: upper tier three capital resources (BIPRU firm only)

GENPRU 2.2.241

See Notes

GENPRU 2.2.242

See Notes

GENPRU 2.2.243

See Notes

GENPRU 2.2.244

See Notes

GENPRU 2.2.245

See Notes

This table belongs to GENPRU 2.2.244 R

| Tier two capital rule | Adjustment |

| GENPRU 2.2.159 R (General conditions for eligibility as tier two capital) | The references in GENPRU 2.2.159R (5) (Capital must not become repayable prior to stated maturity date except in specified circumstances) to repayment at the option of the holder are replaced by a reference to GENPRU 2.2.242R (1) (Upper tier three capital should have maturity or notice period of at least two years) The reference in GENPRU 2.2.159R (10) (Description of tier two capital in marketing documents) to GENPRU 2.2.271 R (Other requirements: insurers carrying on with-profits business (Insurer only)) does not apply |

| GENPRU 2.2.160 R (Holder of a non-deferred share of a building society to be treated as a senior creditor) | |

| GENPRU 2.2.161 R (Additional remedies) | |

| GENPRU 2.2.163 R (Legal opinion where debt subject to a law of a country outside the United Kingdom) | |

| GENPRU 2.2.169 R (Ineligibility as tier two capital owing to connected transactions) | The reference to GENPRU 2.2.177 R (General eligibility conditions for upper tier two capital) does not apply |

| GENPRU 2.2.171 R (Amendments to terms of the capital instrument) | |

| GENPRU 2.2.172 R to GENPRU 2.2.173 R (Redeemability at the option of the issuer) | |

| GENPRU 2.2.174 R (Notification of redemption) | |

| References in the rules in the first column to the fifth anniversary are amended so as to refer to the second anniversary. | |

Tier three capital: lower tier three capital resources (BIPRU firm only)

GENPRU 2.2.246

See Notes

GENPRU 2.2.247

See Notes

GENPRU 2.2.248

See Notes

GENPRU 2.2.249

See Notes

Deductions from total capital: Inadmissible assets (insurers only)

GENPRU 2.2.250

See Notes

GENPRU 2.2.251

See Notes

GENPRU 2.2.252

See Notes

GENPRU 2.2.253

See Notes

Deductions from total capital: Adjustments for related undertakings

GENPRU 2.2.254

See Notes

GENPRU 2.2.255

See Notes

GENPRU 2.2.256

See Notes

GENPRU 2.2.257

See Notes

GENPRU 2.2.258

See Notes

Deductions from total capital: Illiquid assets (BIPRU investment firm only)

GENPRU 2.2.259

See Notes

GENPRU 2.2.260

See Notes

GENPRU 2.2.261

See Notes

GENPRU 2.2.262

See Notes

Deductions from total capital: Excess trading book position (bank or building society only)

GENPRU 2.2.263

See Notes

GENPRU 2.2.264

See Notes

GENPRU 2.2.265

See Notes

Other capital resources: Unpaid share capital or initial funds and calls for supplementary contributions (Insurer only)

GENPRU 2.2.266

See Notes

GENPRU 2.2.267

See Notes

GENPRU 2.2.268

See Notes

GENPRU 2.2.269

See Notes

Other requirements: insurers carrying on with-profits business (Insurer only)

GENPRU 2.2.270

See Notes

GENPRU 2.2.270A

See Notes

- 01/04/2013

GENPRU 2.2.271

See Notes

GENPRU 2.2.272

See Notes

GENPRU 2.2.273

See Notes

GENPRU 2.2.274

See Notes

GENPRU 2.2.275

See Notes

Public sector guarantees

GENPRU 2.2.276

See Notes

GENPRU 2.3

Application of GENPRU 2 to Lloyd's

- 31/12/2006

Application of GENPRU 2.1

GENPRU 2.3.1

See Notes

GENPRU 2.3.2

See Notes

GENPRU 2.3.3

See Notes

GENPRU 2.3.4

See Notes

Calculation of the MCR

GENPRU 2.3.5

See Notes

GENPRU 2.3.6

See Notes

GENPRU 2.3.7

See Notes

GENPRU 2.3.8

See Notes

Calculation of the base capital resources requirement

GENPRU 2.3.9

See Notes

Calculation of the general insurance capital requirement

GENPRU 2.3.10

See Notes

GENPRU 2.3.11

See Notes

GENPRU 2.3.12

See Notes

GENPRU 2.3.13

See Notes

GENPRU 2.3.14

See Notes

GENPRU 2.3.15

See Notes

Application of GENPRU 2.2

GENPRU 2.3.16

See Notes

GENPRU 2.3.17

See Notes

GENPRU 2.3.18

See Notes

GENPRU 2.3.19

See Notes

GENPRU 2.3.20

See Notes

GENPRU 2.3.21

See Notes

Calculation of capital resources

GENPRU 2.3.22

See Notes

GENPRU 2.3.23

See Notes

GENPRU 2.3.24

See Notes

GENPRU 2.3.25

See Notes

GENPRU 2.3.26

See Notes

GENPRU 2.3.27

See Notes

GENPRU 2.3.28

See Notes

GENPRU 2.3.29

See Notes

GENPRU 2.3.30

See Notes

Characteristics of tier one capital

GENPRU 2.3.31

See Notes

Adjustments for related undertakings

GENPRU 2.3.32

See Notes

GENPRU 2.3.33

See Notes

Modification of GENPRU 2 Annex 7R for Lloyd's

GENPRU 2.3.34

See Notes

GENPRU 2.3.35

See Notes

GENPRU 2 Annex 1

Capital resources table for an insurer

- 31/12/2006

See Notes

| Capital resources calculation for an insurer | |||

| Type of capital | Related text | Stage | |

| Core tier one capital | (A) | ||

| Permanent share capital | GENPRU 2.2.83 R | ||

| Profit and loss account and other reserves (taking into account interim net losses) | GENPRU 2.2.85 R ; GENPRU 2.2.87 R to GENPRU 2.2.88 R | ||

| Share premium account | GENPRU 2.2.101 R | ||

| Externally verified interim net profits | GENPRU 2.2.102 R | ||

| Positive valuation differences | GENPRU 2.2.105 R | ||

| Fund for future appropriations | GENPRU 2.2.108 R | ||

| Perpetual non-cumulative preference shares | (B) | ||

| Perpetual non-cumulative preference shares | GENPRU 2.2.109 R | ||

| Innovative tier one capital | (C) | ||

| Innovative tier one instruments | GENPRU 2.2.113 R to GENPRU 2.2.121 R | ||

| Total tier one capital before deductions = A+B+C | (D) | ||

| Deductions from tier one capital | (E) | ||

| Investments in own shares | None | ||

| Intangible assets | GENPRU 2.2.155 R | ||

| Amounts deducted from technical provisions for discounting and other negative valuation differences | GENPRU 2.2.105 R to GENPRU 2.2.107 R | ||

| Total tier one capital after deductions = D-E | (F) | ||

| Upper tier two capital | (G) | ||

| Perpetual cumulative preference shares | GENPRU 2.2.159 R to GENPRU 2.2.181 R | ||

| Perpetual subordinated debt | See previous entry | ||

| Perpetual subordinated securities | See previous entry | ||

| Lower tier two capital | (H) | ||

| Fixed term preference shares | GENPRU 2.2.159 R to GENPRU 2.2.175 G; GENPRU 2.2.194 R to GENPRU 2.2.196 R | ||

| Long term subordinated debt | See previous entry | ||

| Fixed term subordinated securities | See previous entry | ||

| Total tier two capital = G+H | (I) | ||

| Positive adjustments for related undertakings | (J) | ||

| Related undertakings that are regulated related undertakings (other than insurance undertakings) | GENPRU 2.2.256 R | ||

| Total capital after positive adjustments for insurance undertakings but before deductions = F + I + J | (K) | ||

| Deductions from total capital | (L) | ||

| Inadmissible assets | GENPRU 2.2.250 R to GENPRU 2.2.251 R; GENPRU 2 Annex 7 | ||

| Assets in excess of market risk and counterparty limits | INSPRU 2.1.22 R | ||

| Related undertakings that are ancillary services undertakings | GENPRU 2.2.255 R | ||

| Negative adjustments for Related undertakings that are regulated related undertakings (other than insurance undertakings) | GENPRU 2.2.256 R | ||

| Total capital after deductions = K - L | (M) | ||

| Other capital resources* | (N) | ||

| Unpaid share capital or, in the case of a mutual, unpaid initial funds and calls for supplementary contributions | GENPRU 2.2.266 G to GENPRU 2.2.269 G | ||

| Implicit items | GENPRU 2 Annex 8 | ||

| Total capital resources after deductions = M + N | (O) | ||

| * Items in section (N) of the table can be included in capital resources if subject to a waiver under section 138A of the Act. | |||

| Note: Where the table refers to related text, it is necessary to refer to that text in order to understand fully what is included in the descriptions of capital items and deductions set out in the table. | |||

GENPRU 2 Annex 2

Capital resources table for a bank

- 31/12/2006

See Notes

| The capital resources calculation for a bank | |||

| Type of capital | Related text | Stage | |

| Core tier one capital | (A) | ||

| Permanent share capital | GENPRU 2.2.83 R | ||

| Profit and loss account and other reserves (taking into account interim net losses) | GENPRU 2.2.85 R to 2.2.90 | ||

| Eligible partnership capital | GENPRU 2.2.93 R; GENPRU 2.2.95 R | ||

| Eligible LLP members' capital | GENPRU 2.2.94 R; GENPRU 2.2.95 R | ||

| Share premium account | GENPRU 2.2.101 R | ||

| Externally verified interim net profits | GENPRU 2.2.102 R | ||

| Hybrid capital | |||

| Stage B1 | GENPRU 2.2.115A R to GENPRU 2.2.117B R | (B1) | |

| Stage B2 | GENPRU 2.2.115D R to GENPRU 2.2.117B R | (B2) | |

| Stage C | GENPRU 2.2.115F R to GENPRU 2.2.117B R | (C) | |

| Total tier one capital before deductions = A + B1 + B2 + C | (D) | ||

| Deductions from tier one capital | (E) | ||

| Investments in own shares | None | ||

| Intangible assets | GENPRU 2.2.155 R | ||

| Excess of drawings over profits for partnerships and limited liability partnerships | GENPRU 2.2.100 R | ||

| Net losses on equities held in the available-for-sale financial asset category | GENPRU 2.2.185 R | ||

| (For certain limited purposes only certain additional deductions are made here) | GENPRU 2.2.239R (2) to GENPRU 2.2.239R (4) | ||

| Total tier one capital after deductions = D-E | (F) | ||

| Upper tier two capital | (G) | ||

| Perpetual cumulative preference shares | GENPRU 2.2.159 R to GENPRU 2.2.181 R | ||

| Perpetual subordinated debt | See previous entry | ||

| Perpetual subordinated securities | See previous entry | ||

| Revaluation reserves | GENPRU 2.2.185 R | ||

| General/collective provisions | GENPRU 2.2.187 R to GENPRU 2.2.189 R | ||

| Surplus provisions | GENPRU 2.2.190 R to GENPRU 2.2.193 R | ||

| Lower tier two capital | (H) | ||

| Fixed term preference shares | GENPRU 2.2.159 R to GENPRU 2.2.174 R; GENPRU 2.2.194 R to GENPRU 2.2.196 R | ||

| Long term subordinated debt | See previous entry | ||

| Fixed term subordinated securities | See previous entry | ||

| Total tier two capital = G+H | (I) | ||

| Deductions from tier two capital | (J) | ||

| (For certain limited purposes only certain additional deductions are made here) | GENPRU 2.2.239R (2) to GENPRU 2.2.239R (4) | ||

| Total tier two capital after deductions = I - J | (K) | ||

| Total tier one capital plus tier two capital = F+K | (L) | ||

| Deductions from the totals of tier one and two | (M) | ||

| Qualifying holdings | GENPRU 2.2.202 R to GENPRU 2.2.207 R | (Part 1 of stage M) | |

| Material holdings | GENPRU 2.2.208 R to GENPRU 2.2.215 R | ||

| Expected loss amounts and other negative amounts | GENPRU 2.2.236 R | ||

| Securitisation positions | GENPRU 2.2.237 R | ||

| Reciprocal cross-holdings | GENPRU 2.2.217 R to GENPRU 2.2.220 R | ||

| Investments in subsidiary undertakings and participations excluding: (1) any amount which is already deducted as material holdings or qualifying holdings; and (2) any investment in a Venture Capital Investor or a Venture Capital Holding Company which has been ignored in accordance with GENPRU 2.2.209R (2) or (3) for the purposes of determining whether there is a material holding. | GENPRU 2.2.216A G | (Part 2 of stage M) | |

| Connected lending of a capital nature | GENPRU 2.2.221 R to GENPRU 2.2.233 R | ||

| Total tier one capital plus tier two capital after deductions = L-M | (N) | ||

|

In calculating whether a

bank's

capital resources

exceed its

capital resources requirement: (1)the credit risk capital component, theoperational risk capital requirementand thecounterparty risk capital component; or(2)the base capital resources requirement; as the case may be, must be deducted here. | |||

| Upper tier three | (O) | ||

| Short term subordinated debt | GENPRU 2.2.241 R to GENPRU 2.2.245 R | ||

| Lower tier three | (P) | ||

| Net interim trading book profit and loss | GENPRU 2.2.246 R to GENPRU 2.2.249 R | ||

| Total tier three capital=O+P | (Q) | ||

| Total capital before deductions = N+Q | (R) | ||

| Deductions from total capital | (S) | ||

| Excess trading book position | GENPRU 2.2.263 R to GENPRU 2.2.265 R | ||

| Free deliveries | BIPRU 14.4 | ||

| Total capital after deductions (R - S) | (T) | ||

| In calculating whether a bank's capital resources exceed its capital resources requirement, themarket risk capital requirementand theconcentration risk capital componentmust be deducted here. | |||

| Note (1): Where the table refers to related text, it is necessary to refer to that text in order to understand fully what is included in the descriptions of capital items and deductions set out in the table. |

| Note (2): If the amount calculated at: (a)stage N less the deductions in respect of the capital resources requirement made immediately following stage N; or(b)stage T less the deductions in respect of the capital resources requirement made immediately following stages N and T; is a negative number the bank'scapital resources are less than its capital resources requirement. |

- 01/04/2013

- Past version of Capital before 01/04/2013

GENPRU 2 Annex 3

Capital resources table for a building society

- 31/12/2006

See Notes

| The capital resources calculation for a building society | |||

| Type of capital | Related text | Stage | |

| Core tier one capital | (A) | ||

| Deferred shares | GENPRU 2.2.108A R | ||

| Profit and loss account and other reserves (taking into account interim net losses) | GENPRU 2.2.85 R to 2.2.90 | ||

| Externally verified interim net profits | GENPRU 2.2.102 R | ||

| Hybrid capital | |||

| Stage B1 | GENPRU 2.2.115A R to GENPRU 2.2.117B R | (B1) | |

| Stage B2 | GENPRU 2.2.115D R to GENPRU 2.2.117B R | (B2) | |

| Stage C | GENPRU 2.2.115F R to GENPRU 2.2.117B R | (C) | |

| Total tier one capital before deductions = A + B1 + B2 + C | (D) | ||

| Deductions from tier one capital | (E) | ||

| Investments in own shares | None | ||

| Intangible assets | GENPRU 2.2.155 R | ||

| Net losses on equities held in the available-for-sale financial asset category | GENPRU 2.2.185 R | ||

| (For certain limited purposes only certain additional deductions are made here) | GENPRU 2.2.239R (2) to GENPRU 2.2.239R (4) | ||

| Total tier one capital after deductions = D-E | (F) | ||

| Upper tier two capital | (G) | ||

| Perpetual subordinated debt | GENPRU 2.2.159 R to GENPRU 2.2.181 R | ||

| Perpetual subordinated securities | See previous entry | ||

| Revaluation reserves | GENPRU 2.2.185 R | ||

| General/collective provisions | GENPRU 2.2.187 R to GENPRU 2.2.189 R | ||

| Surplus provisions | GENPRU 2.2.190 R to GENPRU 2.2.193 R | ||

| Lower tier two capital | (H) | ||

| Long term subordinated debt | GENPRU 2.2.159 R to GENPRU 2.2.174 R; GENPRU 2.2.194 R to GENPRU 2.2.196 R | ||

| Fixed term subordinated securities | See previous entry | ||

| Total tier two capital = G+H | (I) | ||

| Deductions from tier two capital | (J) | ||

| (For certain limited purposes only certain additional deductions are made here) | GENPRU 2.2.239R (2) to GENPRU 2.2.239R (4) | ||

| Total tier two capital after deductions = I - J | (K) | ||

| Total tier one capital plus tier two capital = F+K | (L) | ||

| Deductions from the totals of tier one and two | (M) | ||

| Qualifying holdings | GENPRU 2.2.202 R to GENPRU 2.2.207 R | ||

| Material holdings | GENPRU 2.2.208 R to GENPRU 2.2.215 R | (Part 1 of stage M) | |

| Expected loss amounts and other negative amounts | GENPRU 2.2.236 R | ||

| Securitisation positions | GENPRU 2.2.237 R | ||

| Reciprocal cross-holdings | GENPRU 2.2.217 R to GENPRU 2.2.220 R | (Part 2 of stage M) | |

| Investments in subsidiary undertakings and participationsexcluding: (1) any amount which is already deducted as material holdings or qualifying holdings; and (2) any investment in a Venture Capital Investor or a Venture Capital Holding Company which has been ignored in accordance with GENPRU 2.2.209R (2) or (3) for the purposes of determining whether there is a material holding. | GENPRU 2.2.216A G | ||

| Total tier one capital plus tier two capital after deductions = L-M | (N) | ||

|

In calculating whether a

building society's

capital resources

exceed its

capital resources requirement: (1)the credit risk capital component, theoperational risk capital requirementand thecounterparty risk capital component; or(2)the base capital resources requirement; as the case may be, must be deducted here. | |||

| Upper tier three | (O) | ||

| Short term subordinated debt | GENPRU 2.2.241 R to GENPRU 2.2.245 R | ||

| Lower tier three | (P) | ||

| Net interim trading book profit and loss | GENPRU 2.2.246 R to GENPRU 2.2.249 R | ||

| Total tier three capital=O+P | (Q) | ||

| Total capital before deductions = N+Q | (R) | ||

| Deductions from total capital | (S) | ||

| Excess trading book position | GENPRU 2.2.263 R to GENPRU 2.2.265 R | ||

| Free deliveries | BIPRU 14.4 | ||

| Total capital after deductions (R - S) | (T) | ||

| In calculating whether a building society's capital resources exceed its capital resources requirement, themarket risk capital requirementand theconcentration risk capital componentmust be deducted here. | |||

| Note (1): Where the table refers to related text, it is necessary to refer to that text in order to understand fully what is included in the descriptions of capital items and deductions set out in the table. |

| Note (2): If the amount calculated at: (a)stage N less the deductions in respect of the capital resources requirement made immediately following stage N; or(b)stage T less the deductions in respect of the capital resources requirement made immediately following stages N and T; is a negative number the building society'scapital resources are less than its capital resources requirement. |

- 01/04/2013

- Past version of Capital before 01/04/2013

GENPRU 2 Annex 4

Capital resources table for a BIPRU investment firm deducting material holdings

- 31/12/2006

See Notes

| The capital resources calculation for an investment firm deducting material holdings | |||

| Type of capital | Related text | Stage | |

| Core tier one capital | (A) | ||

| Permanent share capital | GENPRU 2.2.83 R | ||

| Profit and loss account and other reserves (taking into account material interim net losses) | GENPRU 2.2.85 R to 2.2.90 | ||

| Eligible partnership capital | GENPRU 2.2.93 R; GENPRU 2.2.95 R | ||

| Eligible LLP members' capital | GENPRU 2.2.94 R; GENPRU 2.2.95 R | ||

| Sole trader capital | None | ||

| Share premium account | GENPRU 2.2.101 R | ||

| Externally verified interim net profits | GENPRU 2.2.102 R | ||

| Hybrid capital | |||

| Stage B1 | GENPRU 2.2.115A R to GENPRU 2.2.117B R | (B1) | |

| Stage B2 | GENPRU 2.2.115D R to GENPRU 2.2.117B R | (B2) | |

| Stage C | GENPRU 2.2.115F R to GENPRU 2.2.117B R | (C) | |

| Total tier one capital before deductions = A + B1 + B2 + C | (D) | ||

| Deductions from tier one capital | (E) | ||

| Investments in own shares | None | ||

| Intangible assets | GENPRU 2.2.155 R | ||

| Excess of drawings over profits for partnerships, limited liability partnerships and sole traders | GENPRU 2.2.100 R; there is no related text for sole traders | ||

| Net losses on equities held in the available-for-sale financial asset category | GENPRU 2.2.185 R | ||

| (For certain limited purposes only certain additional deductions are made here) | GENPRU 2.2.239R (2) to GENPRU 2.2.239R (4) | ||

| Total tier one capital after deductions = D-E | (F) | ||

| Upper tier two capital | (G) | ||

| Perpetual cumulative preference shares | GENPRU 2.2.159 R to GENPRU 2.2.181 R | ||

| Perpetual subordinated debt | See previous entry | ||

| Perpetual subordinated securities | See previous entry | ||

| Revaluation reserves | GENPRU 2.2.185 R | ||

| General/collective provisions | GENPRU 2.2.187 R to GENPRU 2.2.189 R | ||

| Surplus provisions | GENPRU 2.2.190 R to GENPRU 2.2.193 R | ||

| Lower tier two capital | (H) | ||

| Fixed term preference shares | GENPRU 2.2.159 R to GENPRU 2.2.174 R; GENPRU 2.2.194 R to GENPRU 2.2.196 R | ||

| Long term subordinated debt | See previous entry | ||

| Fixed term subordinated securities | See previous entry | ||

| Total tier two capital = G+H | (I) | ||

| Deductions from tier two capital | (J) | ||

| (For certain limited purposes only certain additional deductions are made here) | GENPRU 2.2.239R (2) to GENPRU 2.2.239R (4) | ||

| Total tier two capital after deductions = I - J | (K) | ||

| Total tier one capital plus tier two capital = F+K | (L) | ||

| Deductions from the totals of tier one and two | (M) | ||

| Material holdings | GENPRU 2.2.208 R to GENPRU 2.2.215 R | ||

| Expected loss amounts and other negative amounts | GENPRU 2.2.236 R | (Part 1 of stage M) | |

| Securitisation positions | GENPRU 2.2.237 R | ||

| Reciprocal cross-holdings | GENPRU 2.2.217 R to GENPRU 2.2.220 R | (Part 2 of stage M) | |

| Total tier one capital plus tier two capital after deductions = L-M | (N) | ||

| In calculating whether a firm'scapital resources exceed its capital resources requirement: (1)the credit risk capital component, the operational risk capital requirement (if applicable) and the counterparty risk capital component; or(2)the base capital resources requirement; as the case may be, must be deducted here. | |||

| Upper tier three | (O) | ||

| Short term subordinated debt | GENPRU 2.2.241 R to GENPRU 2.2.245 R | ||

| Lower tier three | (P) | ||

| Net interim trading book profit and loss | GENPRU 2.2.246 R to GENPRU 2.2.249 R | ||

| Total tier three capital=O+P | (Q) | ||

| Total capital before deductions = N+Q | (R) | ||

| Deductions from total capital | (S) | ||

| Free deliveries | BIPRU 14.4 | ||

| Total capital after deductions (R - S) | (T) | ||

| In calculating whether a firm'scapital resources exceed its capital resources requirement, the market risk capital requirement, the concentration risk capital componentand (if applicable)the fixed overheads requirement must be deducted here. | |||

| Note (1): Where the table refers to related text, it is necessary to refer to that text in order to understand fully what is included in the descriptions of capital items and deductions set out in the table. |

| Note (2): If the amount calculated at: (a)stage N less the deductions in respect of the capital resources requirement made immediately following stage N; or(b)stage T less the deductions in respect of the capital resources requirement made immediately following stages N and T; is a negative number the firm'scapital resources are less than its capital resources requirement. |

- 01/04/2013

- Past version of Capital before 01/04/2013

GENPRU 2 Annex 5

Capital resources table for a BIPRU investment firm deducting illiquid assets

- 31/12/2006

See Notes

| The capital resources calculation for an investment firm that deducts illiquid assets | |||

| Type of capital | Related text | Stage | |

| Core tier one capital | (A) | ||

| Permanent share capital | GENPRU 2.2.83 R | ||

| Profit and loss account and other reserves (taking into account material interim net losses) | GENPRU 2.2.85 R to GENPRU 2.2.90 R | ||

| Eligible partnership capital | GENPRU 2.2.93 R; GENPRU 2.2.95 R | ||

| Eligible LLP members' capital | GENPRU 2.2.94 R; GENPRU 2.2.95 R | ||

| Sole trader capital | None | ||

| Share premium account | GENPRU 2.2.101 R | ||

| Externally verified interim net profits | GENPRU 2.2.102 R | ||

| Hybrid capital | |||

| Stage B1 | GENPRU 2.2.115A R to GENPRU 2.2.117B R | (B1) | |

| Stage B2 | GENPRU 2.2.115D R to GENPRU 2.2.117B R | (B2) | |

| Stage C | GENPRU 2.2.115F R to GENPRU 2.2.117B R | (C) | |

| Total tier one capital before deductions = A + B1 + B2 + C | (D) | ||

| Deductions from tier one capital | (E) | ||

| Investments in own shares | None | ||

| Intangible assets | GENPRU 2.2.155 R | ||

| Excess of drawings over profits for partnerships, limited liability partnerships and sole traders | GENPRU 2.2.100 R; there is no related text for sole traders | ||

| Net losses on equities held in the available-for-sale financial asset category | GENPRU 2.2.185 R | ||

| (For certain limited purposes only certain additional deductions are made here) | GENPRU 2.2.239R (2) to GENPRU 2.2.239R (4) | ||

| Total tier one capital after deductions = D-E | (F) | ||

| Upper tier two capital | (G) | ||

| Perpetual cumulative preference shares | GENPRU 2.2.159 R to GENPRU 2.2.181 R | ||

| Perpetual subordinated debt | See previous entry | ||

| Perpetual subordinated securities | See previous entry | ||

| Revaluation reserves | GENPRU 2.2.185 R | ||

| General/collective provisions | GENPRU 2.2.187 R to GENPRU 2.2.189 R | ||

| Surplus provisions | GENPRU 2.2.190 R to GENPRU 2.2.193 R | ||

| Lower tier two capital | (H) | ||

| Fixed term preference shares | GENPRU 2.2.159 R to GENPRU 2.2.174 R; GENPRU 2.2.194 R to GENPRU 2.2.196 R | ||

| Long term subordinated debt | See previous entry | ||

| Fixed term subordinated securities | See previous entry | ||

| Total tier two capital = G+H | (I) | ||

| Deductions from tier two capital | (J) | ||

| (For certain limited purposes only certain additional deductions are made here) | GENPRU 2.2.239R (2) to GENPRU 2.2.239R (4) | ||

| Total tier two capital after deductions = I - J | (K) | ||

| Total tier one capital plus tier two capital = F+K | (L) | ||

| Deductions from the totals of tier one and two | (M) | ||

| Expected loss amounts and other negative amounts | GENPRU 2.2.236 R | (Part 1 of stage M) | |

| Securitisation positions | GENPRU 2.2.237 R | ||

| Reciprocal cross-holdings | GENPRU 2.2.217 R to GENPRU 2.2.220 R | (Part 2 of stage M) | |

| Total tier one capital plus tier two capital after deductions = L-M | (N) | ||

| In calculating whether a firm'scapital resources exceed its capital resources requirement: (1)the credit risk capital component, the operational risk capital requirement (if applicable) and the counterparty risk capital component; or(2)the base capital resources requirement; as the case may be, must be deducted here. | |||

| Upper tier three | (O) | ||

| Short term subordinated debt | GENPRU 2.2.241 R to GENPRU 2.2.245 R | ||

| Lower tier three | (P) | ||

| Net interim trading book profit and loss | GENPRU 2.2.246 R to GENPRU 2.2.249 R | ||

| Total tier three capital=O+P | (Q) | ||

| Total capital before deductions = N+Q | (R) | ||

| Deductions from total capital | (S) | ||

| Illiquid assets | GENPRU 2.2.259 R to GENPRU 2.2.260 R | ||

| Free deliveries | BIPRU 14.4 | ||

| Total capital after deductions = R-S | (T) | ||

| In calculating whether a firm'scapital resources exceed its capital resources requirement, the market risk capital requirement, the concentration risk capital component and (if applicable) the fixed overheads requirement must be deducted here. | |||

| Note (1): Where the table refers to related text, it is necessary to refer to that text in order to understand fully what is included in the descriptions of capital items and deductions set out in the table. |

| Note (2): If the amount calculated at: (a)stage N less the deductions in respect of the capital resources requirement made immediately following stage N; or(b)stage T less the deductions in respect of the capital resources requirement made immediately following stages N and T; is a negative number the firm'scapital resources are less than its capital resources requirement. |

- 01/04/2013

- Past version of Capital before 01/04/2013

GENPRU 2 Annex 7

Admissible assets in insurance

- 31/12/2006

See Notes

| (1) | (A) | Investments that are, or amounts owed arising from the disposal of: | ||

| (a) | debt securities, bonds and other money and capital market instruments; | |||

| (b) | loans; | |||

| (c) | shares and other variable yield participations; | |||

| (d) | units in: | |||

| (i) | collective investment schemes falling within the UCITS Directive; | |||

| (ii) | non-UCITS retail schemes; | |||

| (iii) | recognised schemes; and | |||

| (iv) | any other collective investment scheme where the insurer's investment in the scheme is sufficiently small to be consistent with a prudent overall investment strategy, having regard to the investment policy of the scheme and the information available to the insurer to enable it to monitor the investment risk being taken by the scheme | |||

| (e) | land, buildings and immovable property rights; | |||

| (f) | an approved derivative or quasi-derivative transaction that satisfies the conditions in INSPRU 3.2.5 R or an approved stock lending transaction that satisfies the conditions in INSPRU 3.2.36 R. | |||

| (B) | Debts and claims | |||

| (a) | debts owed by reinsurers, including reinsurers' shares of technical provisions (but excluding amounts recoverable from an ISPV*); | |||

| (b) | deposits with and debts owed by ceding undertakings; | |||

| (c) | debts owed by policyholders and intermediaries arising out of direct and reinsurance operations (except where overdue for more than 3 months and other than commission prepaid to agents or intermediaries); | |||

| (d) | for general insurance business only, claims arising out of salvage and subrogation; | |||

| (e) | for long-term insurance business only, advances secured on, and not exceeding the surrender value of, long-term insurance contracts issued by the insurer; | |||

| (f) | tax recoveries; | |||

| (g) | claims against compensation funds. | |||

| (C) | Other assets | |||

| (a) | tangible fixed assets, other than land and buildings; | |||

| (b) | cash at bank and in hand, deposits with credit institutions and any other bodies authorised to receive deposits; | |||

| (c) | for general insurance business only, deferred acquisition costs; | |||

| (d) | accrued interest and rent, other accrued income and prepayments; | |||

| (e) | for long-term insurance business only, reversionary interests. | |||

| * | An insurer may treat amounts recoverable from an ISPV as an admissible asset if it obtains a waiver under section 138A of the Act. The conditions that will need to be met, in addition to the statutory tests under section 138A(4) of the Act, before the appropriate regulator will consider granting such a waiver are set out in INSPRU 1.6.13 G to INSPRU 1.6.18 G. | |||

| (2) | Subject to paragraph (3) belowa unit in a collective investment scheme is only admissible for the purposes of paragraph (1) above if it falls within paragraph (1)(A)(d), notwithstanding that it may also fall into one or more other categories in paragraph (1). | |||

| (3) | A derivative, quasi-derivative or stock lending transaction is only admissible for the purposes of paragraph (1) above if it falls within paragraph (1)(A)(f), notwithstanding that it may also fall into one or more other categories in paragraph (1). | |||

- 01/04/2013

- Past version of Capital before 01/04/2013

GENPRU 2 Annex 8

Guidance on applications for waivers relating to Implicit items

- 31/12/2006

GENPRU 3

Cross sector groups

GENPRU 3.1

Application

- 01/01/2007

GENPRU 3.1.1

See Notes

Purpose

GENPRU 3.1.2

See Notes

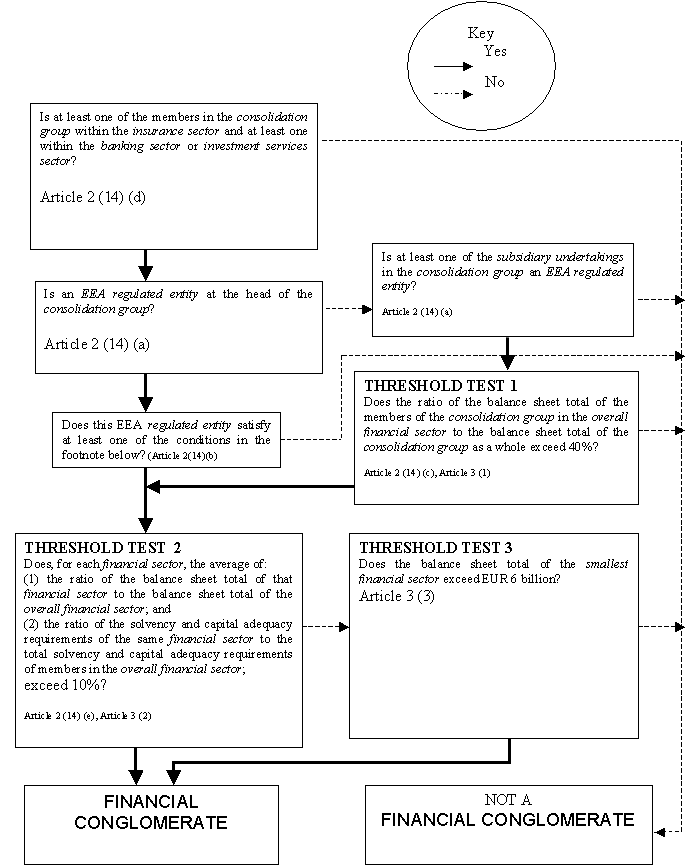

Introduction: identifying a financial conglomerate

GENPRU 3.1.3

See Notes

Introduction: The role of other competent authorities

GENPRU 3.1.4

See Notes

Definition of financial conglomerate: basic definition

GENPRU 3.1.5

See Notes

Definition of financial conglomerate: sub-groups

GENPRU 3.1.6

See Notes

Definition of financial conglomerate: the financial sectors: general

GENPRU 3.1.7

See Notes

GENPRU 3.1.8

See Notes

Definition of financial conglomerate: adjustment of the percentages

GENPRU 3.1.9

See Notes

GENPRU 3.1.10

See Notes

Definition of financial conglomerate: balance sheet totals

GENPRU 3.1.11

See Notes

Definition of financial conglomerate: solvency requirement

GENPRU 3.1.12

See Notes

Definition of financial conglomerate: discretionary changes to the definition

GENPRU 3.1.13

See Notes

Capital adequacy requirements: introduction

GENPRU 3.1.14

See Notes

GENPRU 3.1.15

See Notes

GENPRU 3.1.16

See Notes

GENPRU 3.1.17

See Notes

GENPRU 3.1.19

See Notes

GENPRU 3.1.20

See Notes

GENPRU 3.1.21

See Notes

Capital adequacy requirements: high level requirement

GENPRU 3.1.25

See Notes

GENPRU 3.1.28

See Notes

Capital adequacy requirements: application of Method 1 or 2 from Annex I of the Financial Groups Directive

GENPRU 3.1.29

See Notes

GENPRU 3.1.29A

See Notes

- 10/06/2013

Capital adequacy requirements: use of requirement to apply Annex I of the Financial Groups Directive

GENPRU 3.1.30

See Notes

GENPRU 3.1.31

See Notes

Risk concentration and intra-group transactions: introduction

GENPRU 3.1.32

See Notes

GENPRU 3.1.33

See Notes

Risk concentration and intra-group transactions: application

GENPRU 3.1.34

See Notes

Risk concentration and intra group transactions: the main rule

GENPRU 3.1.35

See Notes

Risk concentration and intra-group transactions: Table of applicable sectoral rules

GENPRU 3.1.36

See Notes

This table belongs to GENPRU 3.1.35 R

| The most important financial sector | Applicable sectoral rules | |

| Risk concentration | Intra-group transactions | |

| Banking and investment services sector | BIPRU 8.9A (Consolidated large exposure requirements) including BIPRU TP as it applies to a UK consolidation group. | BIPRU 10 (Large exposures requirements) including BIPRU TP as it applies on a solo basis and relates to BIPRU 10. |

| Insurance sector | None | Rule 9.39 of IPRU(INS) |

| Note | Any waiver granted to a member of the financial conglomerate, on a solo or consolidated basis, shall not apply in respect of the financial conglomerate for the purposes of GENPRU 3.1.36 R. | |

GENPRU 3.1.37

See Notes

GENPRU 3.1.38

See Notes

The financial sectors: asset management companies and alternative investment fund managers

GENPRU 3.1.39

See Notes

GENPRU 3.2

Third-country groups

- 01/01/2007

Application

GENPRU 3.2.1

See Notes

Purpose

GENPRU 3.2.2

See Notes

Equivalence

GENPRU 3.2.3

See Notes

Other methods: General

GENPRU 3.2.4

See Notes

Supervision by analogy: introduction

GENPRU 3.2.5

See Notes

GENPRU 3.2.6

See Notes

GENPRU 3.2.7

See Notes

Supervision by analogy: rules for third-country conglomerates

GENPRU 3.2.8

See Notes

Supervision by analogy: rules for third-country banking and investment groups

GENPRU 3.2.9

See Notes

GENPRU 3 Annex 1

Capital adequacy calculations for financial conglomerates (GENPRU 3.1.29R)

See Notes

| Capital resources | 1.1 | The conglomerate capital resources of a financial conglomerate calculated in accordance with this Part are the capital of that financial conglomerate, calculated on an accounting consolidation basis, that qualifies under paragraph 1.2. | |

| 1.2 | The elements of capital that qualify for the purposes of paragraph 1.1 are those that qualify in accordance with the applicable sectoral rules, in accordance with the following: | ||

| (1) | the conglomerate capital resources requirement is divided up in accordance with the contribution of each financial sector to it; and | ||

| (2) | the portion of the conglomerate capital resources requirement attributable to a particular financial sector must be met by capital resources that are eligible in accordance with the applicable sectoral rules for that financial sector. | ||

| Capital resources requirement | 1.3 | The conglomerate capital resources requirement of a financial conglomerate calculated in accordance with this Part is equal to the sum of the capital adequacy and solvency requirements for each financial sector calculated in accordance with the applicable sectoral rules for that financial sector. | |

| Consolidation | 1.4 | The information required for the purpose of establishing whether or not a firm is complying with GENPRU 3.1.29 R (insofar as the definitions in this Part are applied for the purpose of that rule) must be based on the consolidated accounts of the financial conglomerate, together with such other sources of information as appropriate. | |

| 1.5 | The applicable sectoral rules that are applied under this Part are the applicable sectoral consolidation rules. Other applicable sectoral rules must be applied if required. | ||

| Capital resources | 2.1 | The conglomerate capital resources of a financial conglomerate calculated in accordance with this Part are equal to the sum of the following amounts (so far as they qualify under paragraph 2.3) for each member of the overall financial sector: (1)(for the person at the head of the financial conglomerate) its solo capital resources;(2)(for any other member):

(a)its solo capital resources; less(b)the book value of the financial conglomerate's investment in that member, to the extent not already deducted in the calculation of the solo capital resources for:(i)the person at the head of the financial conglomerate; or (ii)any other member. |

| 2.2 | The deduction in paragraph 2.1(2) must be carried out separately for each type of capital represented by the financial conglomerate's investment in the member concerned. | |

| 2.3 | The elements of capital that qualify for the purposes of paragraph 2.1 are those that qualify in accordance with the applicable sectoral rules. In particular, the portion of the conglomerate capital resources requirement attributable to a particular member of a financial sector must be met by capital resources that would be eligible under the sectoral rules that apply to the calculation of its solo capital resources. | |